Question: (c) As a shareholder, do you prefer to work with EBITDA or cash flows statements? GAAP EBITDA Reconciliation YTD '18 ($1,220) (1) 95 YTD '17

(c) As a shareholder, do you prefer to work with EBITDA or cash flows statements?

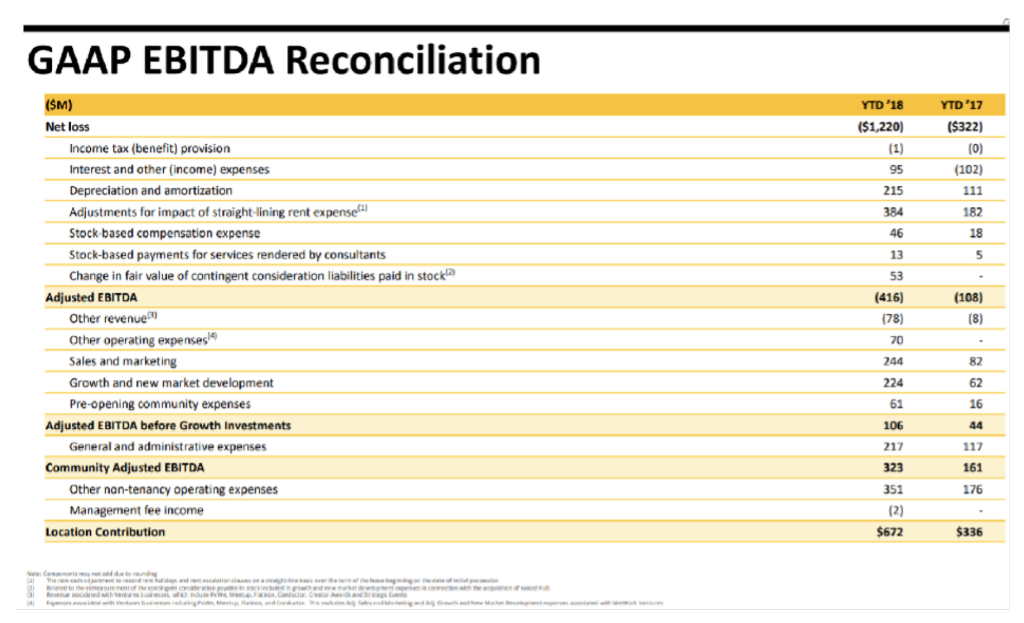

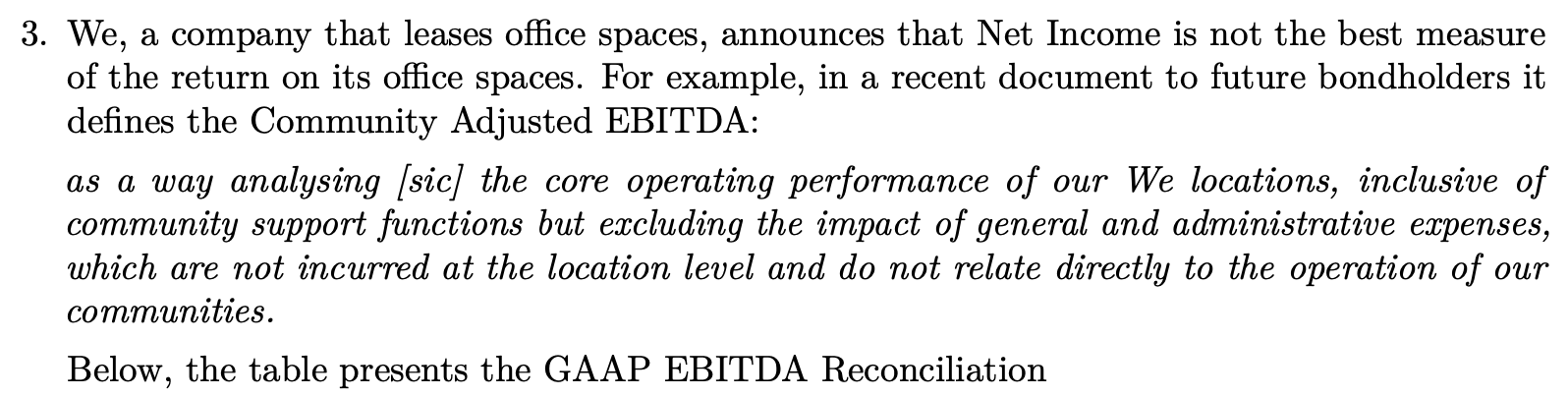

GAAP EBITDA Reconciliation YTD '18 ($1,220) (1) 95 YTD '17 ($322) ) (0) (102) 215 111 182 384 46 18 13 5 53 (SM) Net loss Income tax (benefit) provision Interest and other income) expenses Depreciation and amortization Adjustments for impact of straight-lining rent expense Stock-based compensation expense Stock-based payments for services rendered by consultants Change in fair value of contingent consideration liabilities paid in stock 2 Adjusted EBITDA Other revenue Other operating expenses Sales and marketing Growth and new market development Pre-opening community expenses Adjusted EBITDA before Growth Investments General and administrative expenses Community Adjusted EBITDA Other non-tenancy operating expenses Management fee income Location Contribution (108) (8) (416) (78) 70 244 224 61 82 62 16 106 44 217 117 161 176 323 351 (2) $672 $336 www www 4 3. We, a company that leases office spaces, announces that Net Income is not the best measure of the return on its office spaces. For example, in a recent document to future bondholders it defines the Community Adjusted EBITDA: as a way analysing [sic] the core operating performance of our We locations, inclusive of community support functions but excluding the impact of general and administrative expenses, which are not incurred at the location level and do not relate directly to the operation of our communities. Below, the table presents the GAAP EBITDA Reconciliation GAAP EBITDA Reconciliation YTD '18 ($1,220) (1) 95 YTD '17 ($322) ) (0) (102) 215 111 182 384 46 18 13 5 53 (SM) Net loss Income tax (benefit) provision Interest and other income) expenses Depreciation and amortization Adjustments for impact of straight-lining rent expense Stock-based compensation expense Stock-based payments for services rendered by consultants Change in fair value of contingent consideration liabilities paid in stock 2 Adjusted EBITDA Other revenue Other operating expenses Sales and marketing Growth and new market development Pre-opening community expenses Adjusted EBITDA before Growth Investments General and administrative expenses Community Adjusted EBITDA Other non-tenancy operating expenses Management fee income Location Contribution (108) (8) (416) (78) 70 244 224 61 82 62 16 106 44 217 117 161 176 323 351 (2) $672 $336 www www 4 3. We, a company that leases office spaces, announces that Net Income is not the best measure of the return on its office spaces. For example, in a recent document to future bondholders it defines the Community Adjusted EBITDA: as a way analysing [sic] the core operating performance of our We locations, inclusive of community support functions but excluding the impact of general and administrative expenses, which are not incurred at the location level and do not relate directly to the operation of our communities. Below, the table presents the GAAP EBITDA Reconciliation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts