Question: (c) Assume that O(S) = max( S - K, 0}. After some heavy algebra, the risk-neutral valuation formula in the last question gives you the

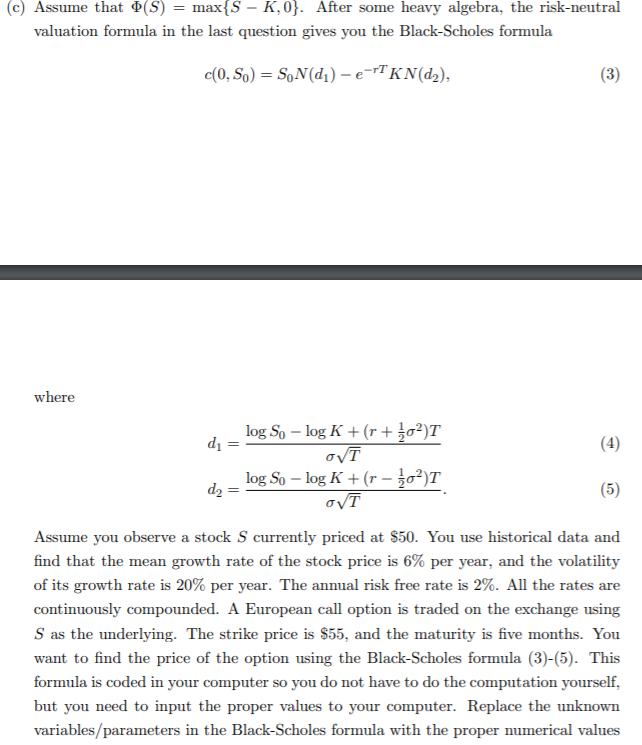

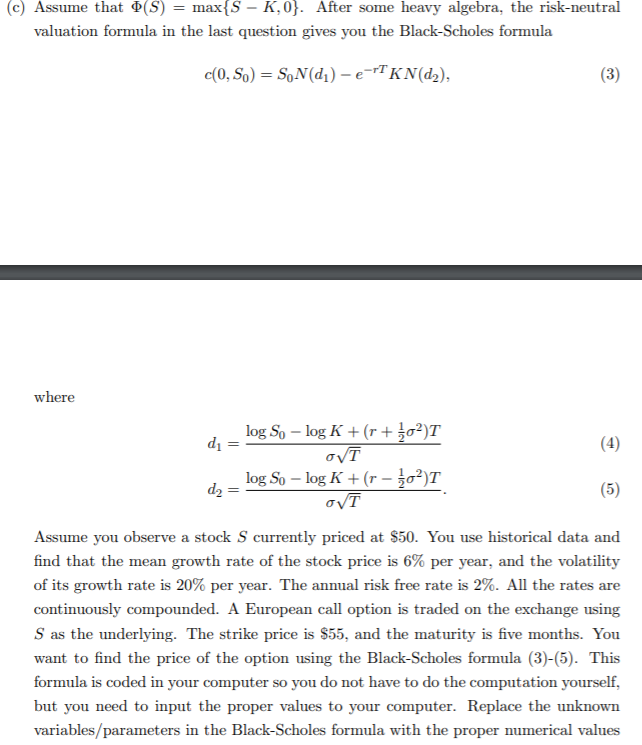

(c) Assume that O(S) = max( S - K, 0}. After some heavy algebra, the risk-neutral valuation formula in the last question gives you the Black-Scholes formula c(0, So) = SON(dj) - e TTKN(d2), (3) where d1 = log So - log K + (r + 403)T (4) OVT d2 = log So - log K + (r - 403)T (5) OVT Assume you observe a stock S currently priced at $50. You use historical data and find that the mean growth rate of the stock price is 6% per year, and the volatility of its growth rate is 20% per year. The annual risk free rate is 2%. All the rates are continuously compounded. A European call option is traded on the exchange using S as the underlying. The strike price is $55, and the maturity is five months. You want to find the price of the option using the Black-Scholes formula (3)-(5). This formula is coded in your computer so you do not have to do the computation yourself, but you need to input the proper values to your computer. Replace the unknown variables/parameters in the Black-Scholes formula with the proper numerical values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts