Question: (c) Based on Needs Analysis approach, what is the additional amount of life insurance coverage would you recommend? [3 marks] (d) Compare and contrast Human

(c) Based on Needs Analysis approach, what is the additional amount of life insurance coverage would you recommend? [3 marks]

(d) Compare and contrast Human Life Value and Needs Analysis approaches. Which approach would you recommend in Johns situation? [4 marks]

It's one question

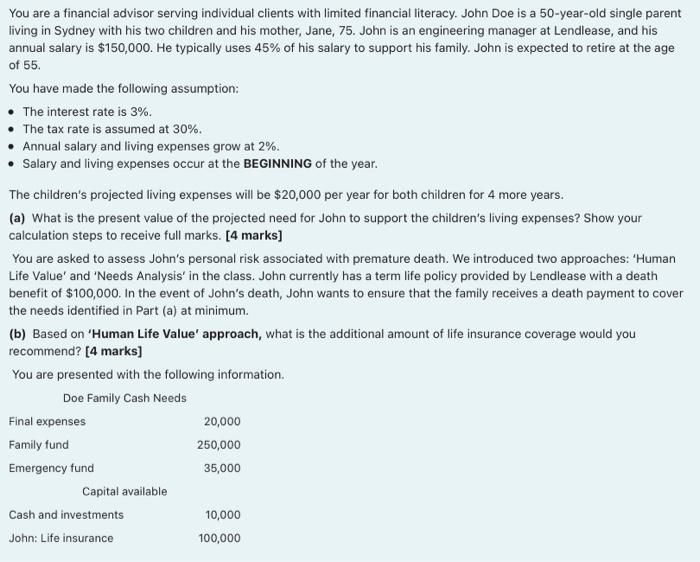

You are a financial advisor serving individual clients with limited financial literacy. John Doe is a 50-year-old single parent living in Sydney with his two children and his mother, Jane, 75. John is an engineering manager at Lendlease, and his annual salary is $150,000. He typically uses 45% of his salary to support his family. John is expected to retire at the age of 55. You have made the following assumption: The interest rate is 3%. The tax rate is assumed at 30%. Annual salary and living expenses grow at 2%. Salary and living expenses occur at the BEGINNING of the year. The children's projected living expenses will be $20,000 per year for both children for 4 more years. (a) What is the present value of the projected need for John to support the children's living expenses? Show your calculation steps to receive full marks. [4 marks] You are asked to assess John's personal risk associated with premature death. We introduced two approaches: 'Human Life Value' and 'Needs Analysis' in the class. John currently has a term life policy provided by Lendlease with a death benefit of $100,000. In the event of John's death, John wants to ensure that the family receives a death payment to cover the needs identified in Part (a) at minimum. (b) Based on 'Human Life Value' approach, what is the additional amount of life insurance coverage would you recommend? [4 marks) You are presented with the following information. Doe Family Cash Needs Final expenses 20,000 Family fund 250,000 Emergency fund 35,000 Capital available Cash and investments 10,000 John: Life insurance 100,000 Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock