Question: C. Binomial Trees (45 points) Question 5 We are working with the Black-Derman-Toy binomial tree model. Assume a constant short rate volatility each period at

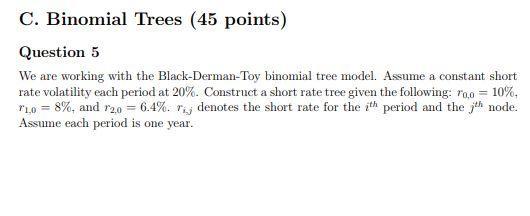

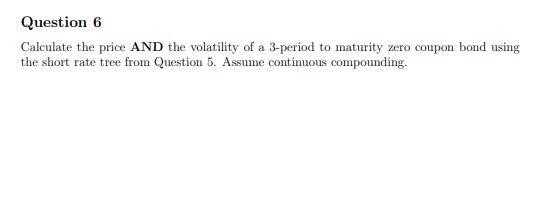

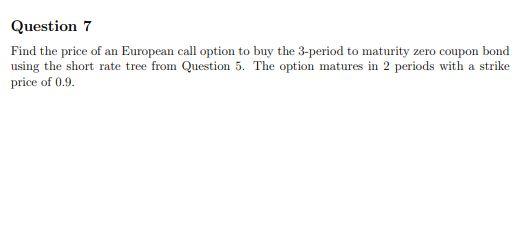

C. Binomial Trees (45 points) Question 5 We are working with the Black-Derman-Toy binomial tree model. Assume a constant short rate volatility each period at 20%. Construct a short rate tree given the following: r0,0 = 10%. TL0 = 8%, and 12,0 = 6.4%. denotes the short rate for the th period and the th node. Assume each period is one year. Question 6 Calculate the price AND the volatility of a 3-period to maturity zero coupon bond using the short rate tree from Question 5. Assume continuous compounding. Question 7 Find the price of an European call option to buy the 3-period to maturity zero coupon bond using the short rate tree from Question 5. The option matures in 2 periods with a strike price of 0.9. C. Binomial Trees (45 points) Question 5 We are working with the Black-Derman-Toy binomial tree model. Assume a constant short rate volatility each period at 20%. Construct a short rate tree given the following: r0,0 = 10%. TL0 = 8%, and 12,0 = 6.4%. denotes the short rate for the th period and the th node. Assume each period is one year. Question 6 Calculate the price AND the volatility of a 3-period to maturity zero coupon bond using the short rate tree from Question 5. Assume continuous compounding. Question 7 Find the price of an European call option to buy the 3-period to maturity zero coupon bond using the short rate tree from Question 5. The option matures in 2 periods with a strike price of 0.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts