Question: 3. Compute the annualized Jensen's alpha. What does this value tell you about management's ability at Textron? 4. What proportion of Textron's can be attribute

3. Compute the annualized Jensen's alpha. What does this value tell you about management's ability at Textron?

4. What proportion of Textron's can be attribute to market risk? What proportion of this Textron's risk is diversifiable?

5, What would an investor in Textron require as a rate of return (cost of equity)?

6. What are the three decisions the analyst must make in setting up the regression describe above?

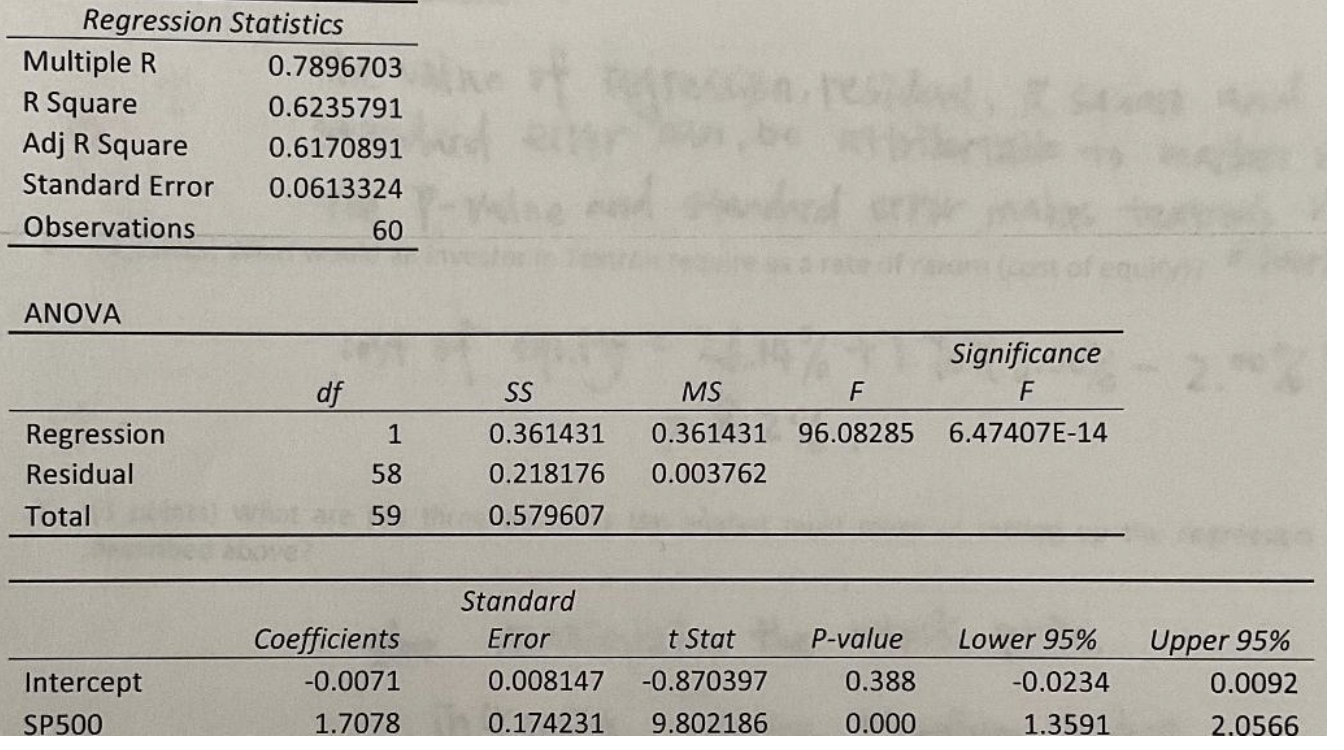

Regression Statistics Multiple R 0.7896703 R Square 0.6235791 Adj R Square 0.6170891 Standard Error 0.0613324 Observations 60 ANOVA df MS Significance F F 96.08285 6.47407E-14 1 Regression Residual Total SS 0.361431 0.218176 0.579607 0.361431 0.003762 58 59 Standard Error 0.008147 0.174231 Coefficients -0.0071 1.7078 Intercept SP500 t Stat -0.870397 9.802186 P-value 0.388 0.000 Lower 95% -0.0234 Upper 95% 0.0092 2.0566 1.3591Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts