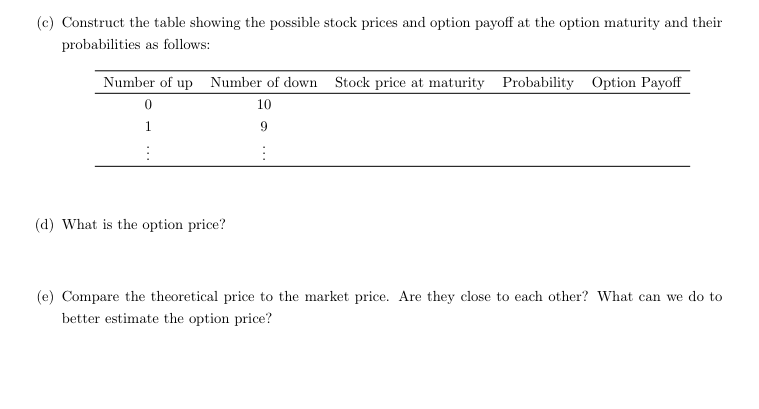

Question: (c) Construct the table showing the possible stock prices and option payoff at the option maturity and their probabilities as follows: Number of up Number

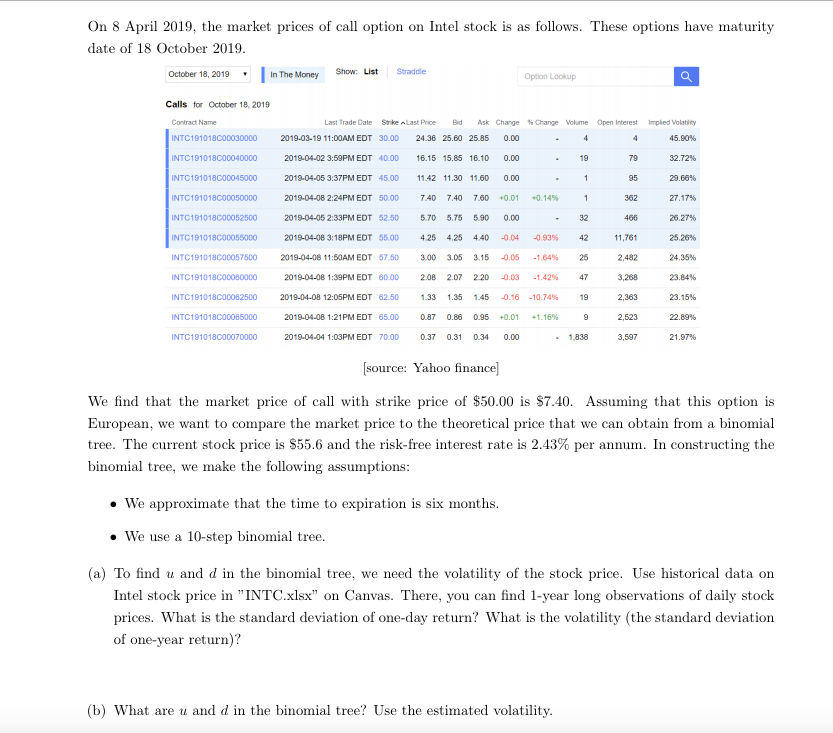

(c) Construct the table showing the possible stock prices and option payoff at the option maturity and their probabilities as follows: Number of up Number of down Stock price at maturity Probability Option Payoff 10 (d) What is the option price? (e) Compare the theoretical price to the market price. Are they close to each other? What can we do to better estimate the option price? I On 8 April 2019, the market prices of call option on Intel stock is as follows. These options have maturity date of 18 October 2019 October 18, 2019 In The Money Sho List Straddle Option Lookup Calls for October 18, 2019 Contract Name INTC191018000030000 INTC191018000040000 INTC191018000045000 INTC191018000050000 INTC191018000052500 INTC191018000055000 INTC191018000057500 INTC191018000080000 Last Trade Date Stie ^Last Proe Bid Ask Charge %Change Volume Open Interest Impled Volatny 45.00% 32.72% 29.66% 27.17% 26.27% 25.26% 24.35% 23.84% 23.15% 22.89% 21.97% 2019-03-19 11:00AM EDT 30.00 24.36 25.60 2585 0.00 2019-04-02 3:59PM EDT 40.00 16.15 15.85 16.10 0.00 2019-04-05 3:37PM EDT 45.00 11.42 11.30 11.60 0.00 2019-04-08 2:24PM EDT 50.00 740 740 7.60 +0,01 40,14% 2019-04-05 2:33PM EDT 52.50 5.70 5.75 5.90 0.00 2019-04-08 3:18PM EDT 55.00 425 425 440-004-093% 19 79 95 362 466 11,761 2.482 3,268 2,363 2,523 3,597 32 42 25 47 1.33 1.35 1.45-0.16-10.74% 19 2019-04-08 11:50AM EDT 57.50 3.00 3.05 3.15-005-1.64% 2019-04-08 1:39PM EDT 60.00 2.08 2.07 2.20-0.03-1.42% 2019-04-08 12:05PM EDT 6250 INTC191018000065000 2019-04-08 1:21 PM EDT 65.00 0.87 0.86 0.95 +0.01 +1.16% INTC191018000070000 2019-04-04 1:03PM EDT 70.00 0.37 0.31 034 0.00 1.838 source: Yahoo finance We find that the market price of call with strike price of $50.00 is S7.40. Assuming that this option is European, we want to compare the market price to the theoretical price that we can obtain from a binomial tree. The current stock price is $55.6 and the risk-free interest rate is 2.43% per annum. In constructing the binomial tree, we make the following assumptions . We approximate that the time to expiration is six months . We use a 10-step binomial tree. (a) To find u and d in the binomial tree, we need the volatility of the stock price. Use historical data on 1-year long observations of daily stocl Intel stock price in "INTC.xlsx" on Canvas. There, you can find prices. What is the standard deviation of one-day return? What is the volatility (the standard deviation of one-year return)? (b) What are u and d in the binomial tree? Use the estimated volatility (c) Construct the table showing the possible stock prices and option payoff at the option maturity and their probabilities as follows: Number of up Number of down Stock price at maturity Probability Option Payoff 10 (d) What is the option price? (e) Compare the theoretical price to the market price. Are they close to each other? What can we do to better estimate the option price? I On 8 April 2019, the market prices of call option on Intel stock is as follows. These options have maturity date of 18 October 2019 October 18, 2019 In The Money Sho List Straddle Option Lookup Calls for October 18, 2019 Contract Name INTC191018000030000 INTC191018000040000 INTC191018000045000 INTC191018000050000 INTC191018000052500 INTC191018000055000 INTC191018000057500 INTC191018000080000 Last Trade Date Stie ^Last Proe Bid Ask Charge %Change Volume Open Interest Impled Volatny 45.00% 32.72% 29.66% 27.17% 26.27% 25.26% 24.35% 23.84% 23.15% 22.89% 21.97% 2019-03-19 11:00AM EDT 30.00 24.36 25.60 2585 0.00 2019-04-02 3:59PM EDT 40.00 16.15 15.85 16.10 0.00 2019-04-05 3:37PM EDT 45.00 11.42 11.30 11.60 0.00 2019-04-08 2:24PM EDT 50.00 740 740 7.60 +0,01 40,14% 2019-04-05 2:33PM EDT 52.50 5.70 5.75 5.90 0.00 2019-04-08 3:18PM EDT 55.00 425 425 440-004-093% 19 79 95 362 466 11,761 2.482 3,268 2,363 2,523 3,597 32 42 25 47 1.33 1.35 1.45-0.16-10.74% 19 2019-04-08 11:50AM EDT 57.50 3.00 3.05 3.15-005-1.64% 2019-04-08 1:39PM EDT 60.00 2.08 2.07 2.20-0.03-1.42% 2019-04-08 12:05PM EDT 6250 INTC191018000065000 2019-04-08 1:21 PM EDT 65.00 0.87 0.86 0.95 +0.01 +1.16% INTC191018000070000 2019-04-04 1:03PM EDT 70.00 0.37 0.31 034 0.00 1.838 source: Yahoo finance We find that the market price of call with strike price of $50.00 is S7.40. Assuming that this option is European, we want to compare the market price to the theoretical price that we can obtain from a binomial tree. The current stock price is $55.6 and the risk-free interest rate is 2.43% per annum. In constructing the binomial tree, we make the following assumptions . We approximate that the time to expiration is six months . We use a 10-step binomial tree. (a) To find u and d in the binomial tree, we need the volatility of the stock price. Use historical data on 1-year long observations of daily stocl Intel stock price in "INTC.xlsx" on Canvas. There, you can find prices. What is the standard deviation of one-day return? What is the volatility (the standard deviation of one-year return)? (b) What are u and d in the binomial tree? Use the estimated volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts