Question: Question I (20 points) Suppose that put options on a stock with strike prices $25 and 5 month maturity costs $3. Suppose the current

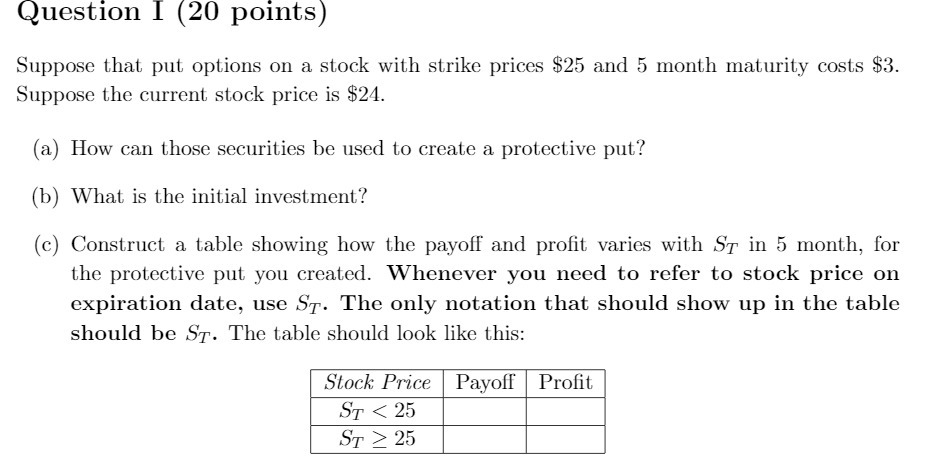

Question I (20 points) Suppose that put options on a stock with strike prices $25 and 5 month maturity costs $3. Suppose the current stock price is $24. (a) How can those securities be used to create a protective put? (b) What is the initial investment? (c) Construct a table showing how the payoff and profit varies with ST in 5 month, for the protective put you created. Whenever you need to refer to stock price on expiration date, use ST. The only notation that should show up in the table should be ST. The table should look like this: Stock Price Payoff Profit ST < 25 ST 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts