Question: C D E F G J M N O 1 P4 2 a. (8pts) Bond valuation: Calculate bond value for a semi-annual coupon bond with

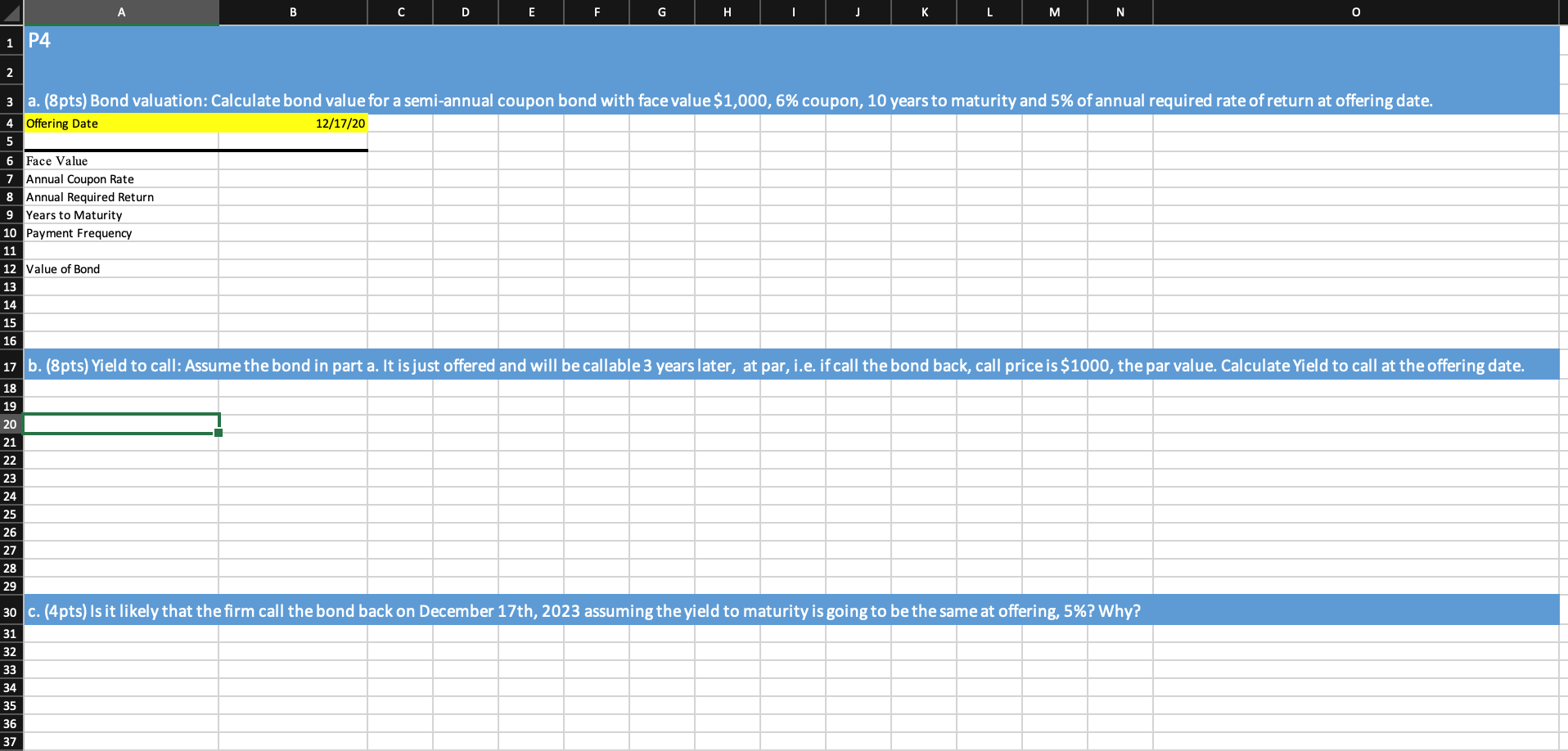

C D E F G J M N O 1 P4 2 a. (8pts) Bond valuation: Calculate bond value for a semi-annual coupon bond with face value $1,000, 6% coupon, 10 years to maturity and 5% of annual required rate of return at offering date. 4 Offering Date 12/17/20 3 5 6 Face Value 7 Annual Coupon Rate 8 Annual Required Return 9 Years to Maturity 10 Payment Frequency 11 12 Value of Bond 13 14 15 16 17 b. (8pts) Yield to call: Assume the bond in part a. It is just offered and will be callable 3 years later, at par, i.e. if call the bond back, call price is $1000, the par value. Calculate Yield to call at the offering date. 18 19 20 21 22 23 24 25 26 27 28 29 30 c. (4pts) Is it likely that the firm call the bond back on December 17th, 2023 assuming the yield to maturity is going to be the same at offering, 5%? Why? 31 32 33 34 35 36 37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts