Question: + c) Decrease in income taxes payable d) Increase in Accounts receivable PARTC 40 X 5= 20 marks Answer ALL questions. Each Full Question carries

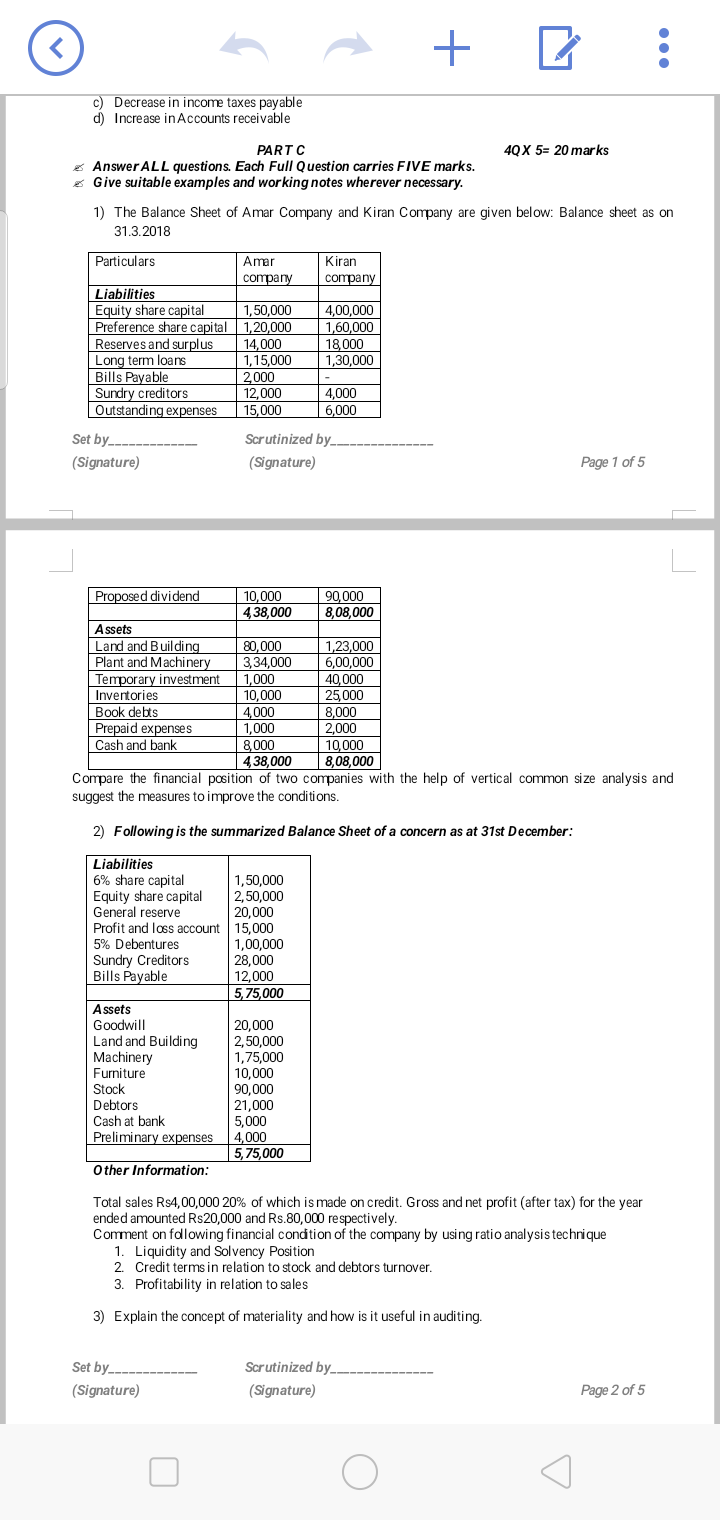

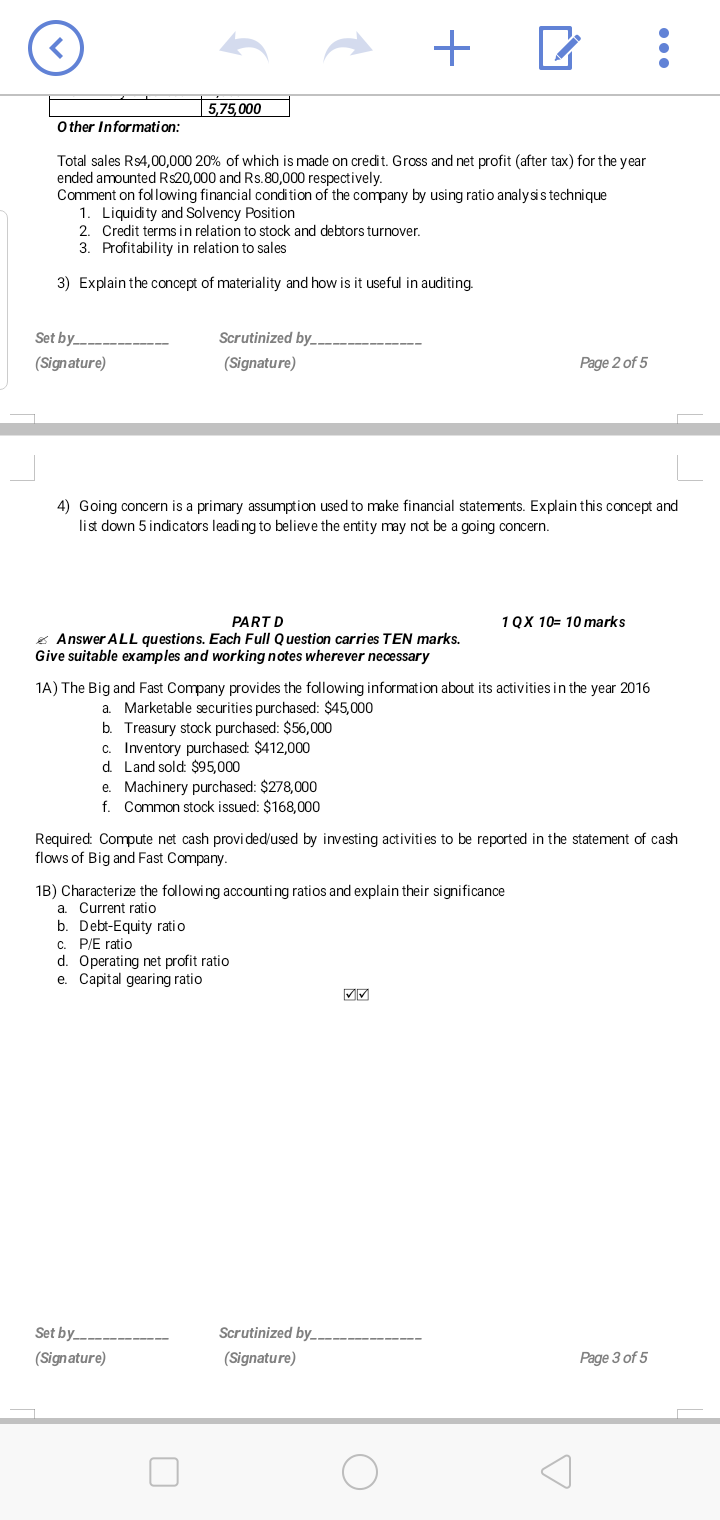

+ c) Decrease in income taxes payable d) Increase in Accounts receivable PARTC 40 X 5= 20 marks Answer ALL questions. Each Full Question carries FIVE marks. Give suitable examples and working notes wherever necessary. 1) The Balance Sheet of Amar Company and Kiran Company are given below: Balance sheet as on 31.3.2018 Particulars Amar Kiran company company Liabilities Equity share capital 1,50,000 4,00,000 Preference share capital 1,20,000 1,60,000 Reserves and surplus 14,000 18.000 Long term loans 1,15,000 1,30,000 Bills Payable 2000 Sundry creditors 12,000 4,000 Outstanding expenses 15,000 6,000 Set by Scrutinized by (Signature) (Signature) Page 1 of 5 80,000 Proposed dividend 10,000 90,000 438,000 8,08,000 Assets Land and Building 1,23,000 Plant and Machinery 3,34,000 6,00,000 Temporary investment 1,000 40,000 Inventories 10,000 25,000 Book debts 4,000 8,000 Prepaid expenses 1,000 2,000 Cash and bank 8,000 10,000 438,000 8,08,000 Compare the financial position of two companies with the help of vertical common size analysis and suggest the measures to improve the conditions. 2) Following is the summarized Balance Sheet of a concern as at 31st December: Liabilities 6% share capital Equity share capital General reserve Profit and loss account 5% Debentures Sundry Creditors Bills Payable 1,50,000 2,50,000 20,000 15,000 1,00,000 28,000 12,000 5.75,000 Assets Goodwill Land and Building Machinery Furniture Stock Debtors Cash at bank Preliminary expenses 20,000 2,50,000 1,75,000 10,000 90,000 21,000 5,000 4,000 5,75,000 Other Information: Total sales Rs4,00,000 20% of which is made on credit. Gross and net profit (after tax) for the year ended amounted Rs20,000 and Rs. 80,000 respectively. Comment on fdlowing financial condition of the company by using ratio analysis technique 1. Liquidity and Solvency Position 2 Credit terms in relation to stock and debtors turnover. 3. Profitability in relation to sales 3) Explain the concept of materiality and how is it useful in auditing. Set by (Signature) Scrutinized by (Signature) Page 2 of 5 a + 5,75,000 Other Information: Total sales R$4,00,000 20% of which is made on credit. Gross and net profit (after tax) for the year ended amounted Rs20,000 and Rs.80,000 respectively. Comment on following financial condition of the company by using ratio analysis technique 1. Liquidity and Solvency Position 2. Credit terms in relation to stock and debtors turnover. 3. Profitability in relation to sales 3) Explain the concept of materiality and how is it useful in auditing. Set by Scrutinized by (Signature) (Signature) Page 2 of 5 4) Going concern is a primary assumption used to make financial statements. Explain this concept and list down 5 indicators leading to believe the entity may not be a going concern. 1 QX 10= 10 marks PARTD & Answer ALL questions. Each Full Question carries TEN marks. Give suitable examples and working notes wherever necessary 1A) The Big and Fast Company provides the following information about its activities in the year 2016 a Marketable securities purchased: $45,000 b. Treasury stock purchased: $56,000 c. Inventory purchased: $412,000 d Land sold: $95,000 e. Machinery purchased: $278,000 f. Common stock issued: $168,000 Required: Compute net cash provided/used by investing activities to be reported in the statement of cash flows of Big and Fast Company. 1B) Characterize the following accounting ratios and explain their significance a. Current ratio b. Debt-Equity ratio C. P/E ratio d. Operating net profit ratio e. Capital gearing ratio Set by --- Scrutinized by (Signature) (Signature) Page 3 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts