Question: c) Dividend valuation method (10 marks) pls answer only the question c) thank you I needed an answer to the question C) you answer the

c) Dividend valuation method (10 marks)

pls answer only the question c) thank you

I needed an answer to the question C) you answer the 3a &b but question c) wasn't answered

pls read the Mergers and the take overs... number 3) u will get the data n numerical data to solve the question thank you

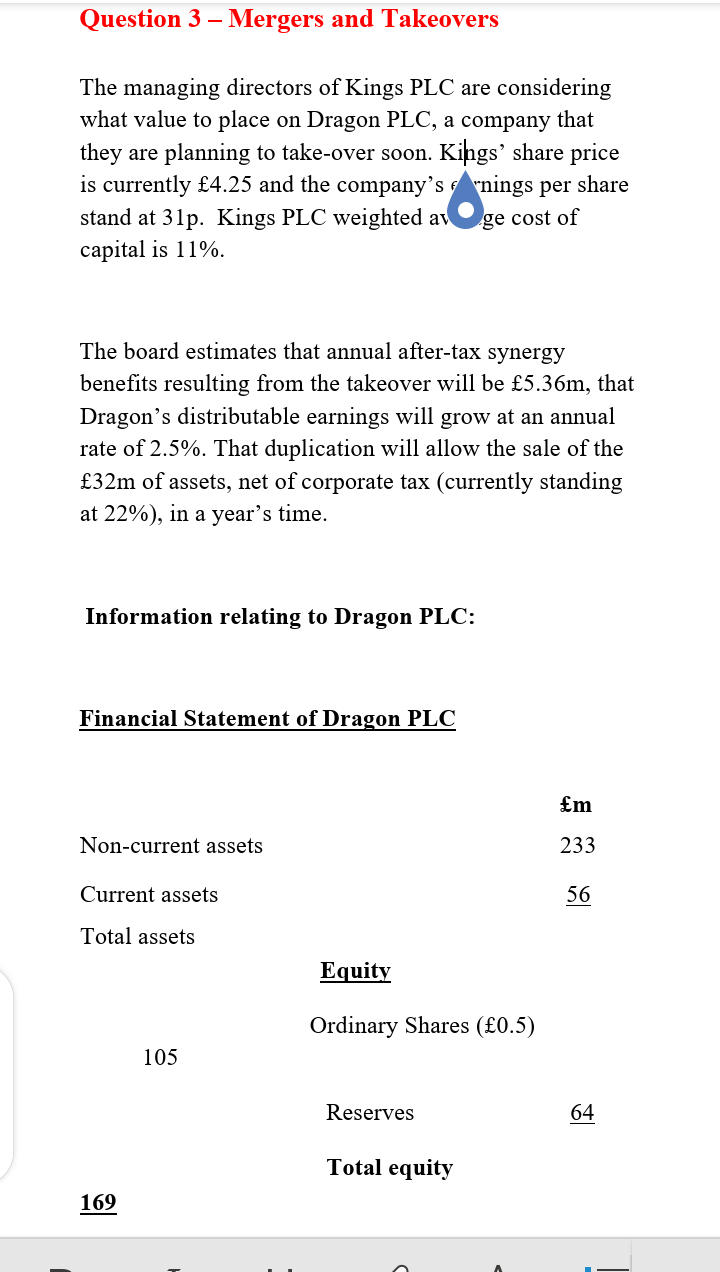

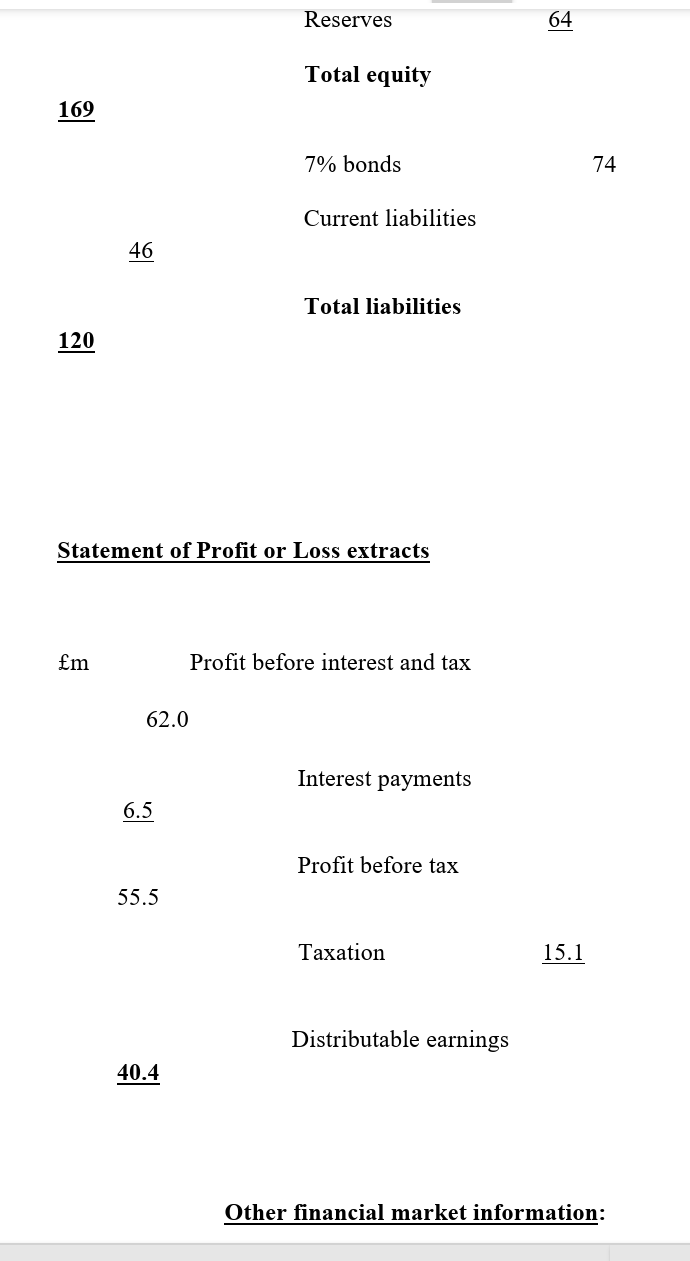

Given the above information calculate the value of Dragon PLC using the following valuation methods: a) Price/earnings ratio (10 marks) b) Discounted cash flow method (10 marks) c) Dividend valuation method (10 marks) Question 3 - Mergers and Takeovers The managing directors of Kings PLC are considering what value to place on Dragon PLC, a company that they are planning to take-over soon. Kings' share price is currently 4.25 and the company's nings per share stand at 31p. Kings PLC weighted av capital is 11%. ge cost of The board estimates that annual after-tax synergy benefits resulting from the takeover will be 5.36m, that Dragon's distributable earnings will grow at an annual rate of 2.5%. That duplication will allow the sale of the 32m of assets, net of corporate tax (currently standing at 22%), in a year's time. Information relating to Dragon PLC: Financial Statement of Dragon PLC Non-current assets Current assets Total assets Equity Ordinary Shares (0.5) 105 Reserves Total equity 169 m 233 56 64 Reserves Total equity 7% bonds Current liabilities Total liabilities 120 Statement of Profit or Loss extracts m 169 46 62.0 6.5 55.5 40.4 64 Profit before interest and tax Interest payments Profit before tax Taxation Distributable earnings Other financial market information: 74 15.1 Other financial market information: 2.45 14p 9p, 10.5p, 11p, 5.5% Current ex-div share price Latest dividend payment Past four years dividends payment 12p Dragon's equity beta Treasury bills yield Market risk rate 11% Given the above information calculate the value of Dragon PLC using the following valuation methods: a) Price/earnings ratio (10 marks) b) Discounted cash flow method (10 marks) c) Dividend valuation method (10 marks) 1.05 Given the above information calculate the value of Dragon PLC using the following valuation methods: a) Price/earnings ratio (10 marks) b) Discounted cash flow method (10 marks) c) Dividend valuation method (10 marks) Question 3 - Mergers and Takeovers The managing directors of Kings PLC are considering what value to place on Dragon PLC, a company that they are planning to take-over soon. Kings' share price is currently 4.25 and the company's nings per share stand at 31p. Kings PLC weighted av capital is 11%. ge cost of The board estimates that annual after-tax synergy benefits resulting from the takeover will be 5.36m, that Dragon's distributable earnings will grow at an annual rate of 2.5%. That duplication will allow the sale of the 32m of assets, net of corporate tax (currently standing at 22%), in a year's time. Information relating to Dragon PLC: Financial Statement of Dragon PLC Non-current assets Current assets Total assets Equity Ordinary Shares (0.5) 105 Reserves Total equity 169 m 233 56 64 Reserves Total equity 7% bonds Current liabilities Total liabilities 120 Statement of Profit or Loss extracts m 169 46 62.0 6.5 55.5 40.4 64 Profit before interest and tax Interest payments Profit before tax Taxation Distributable earnings Other financial market information: 74 15.1 Other financial market information: 2.45 14p 9p, 10.5p, 11p, 5.5% Current ex-div share price Latest dividend payment Past four years dividends payment 12p Dragon's equity beta Treasury bills yield Market risk rate 11% Given the above information calculate the value of Dragon PLC using the following valuation methods: a) Price/earnings ratio (10 marks) b) Discounted cash flow method (10 marks) c) Dividend valuation method (10 marks) 1.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts