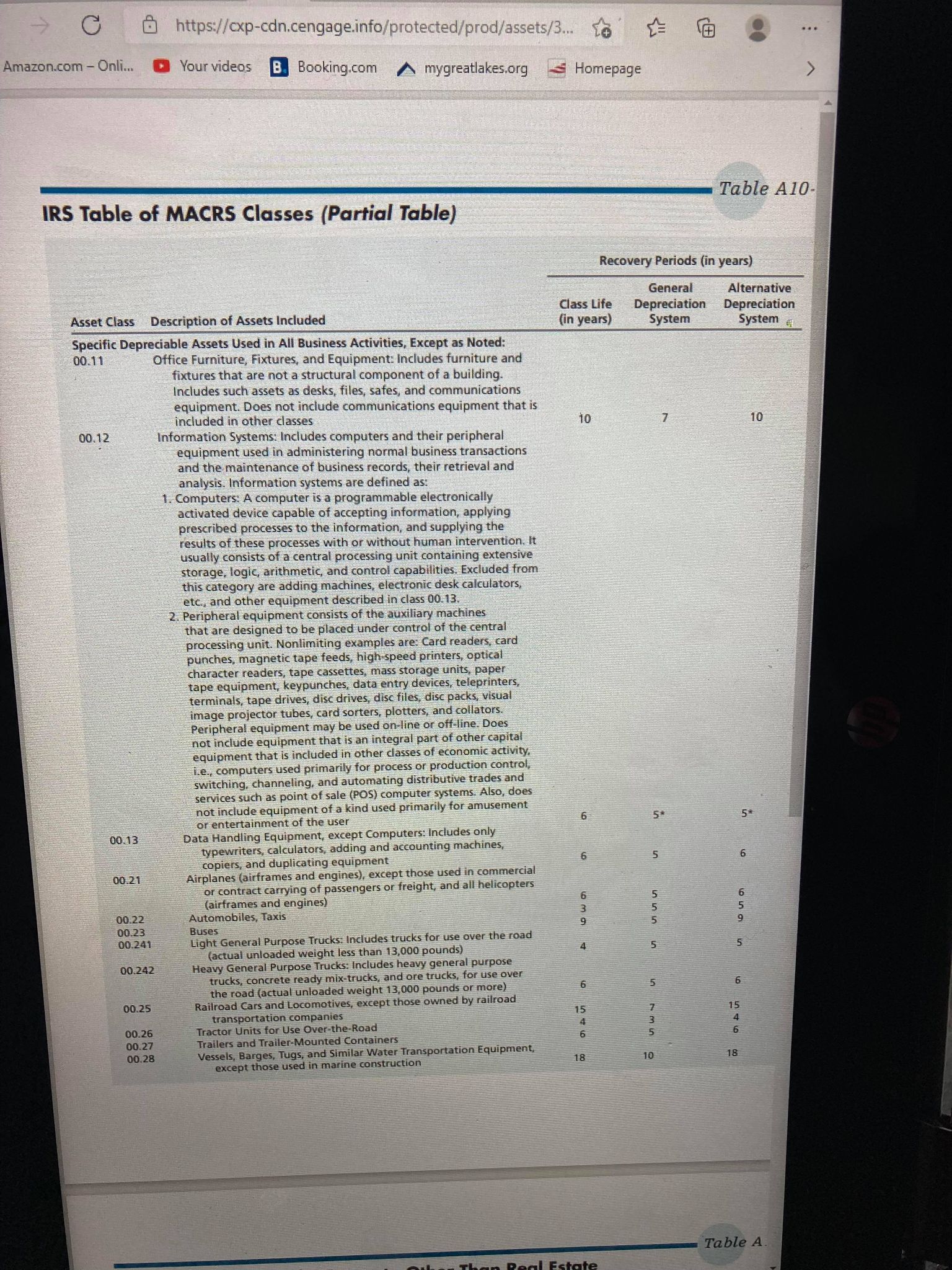

Question: C & https://cxp-cdn.cengage.info/protected/prod/assets/3... Amazon.com - Onli... Your videos B. Booking.com / mygreatlakes.org Homepage Table A10- IRS Table of MACRS Classes (Partial Table) Recovery Periods (in

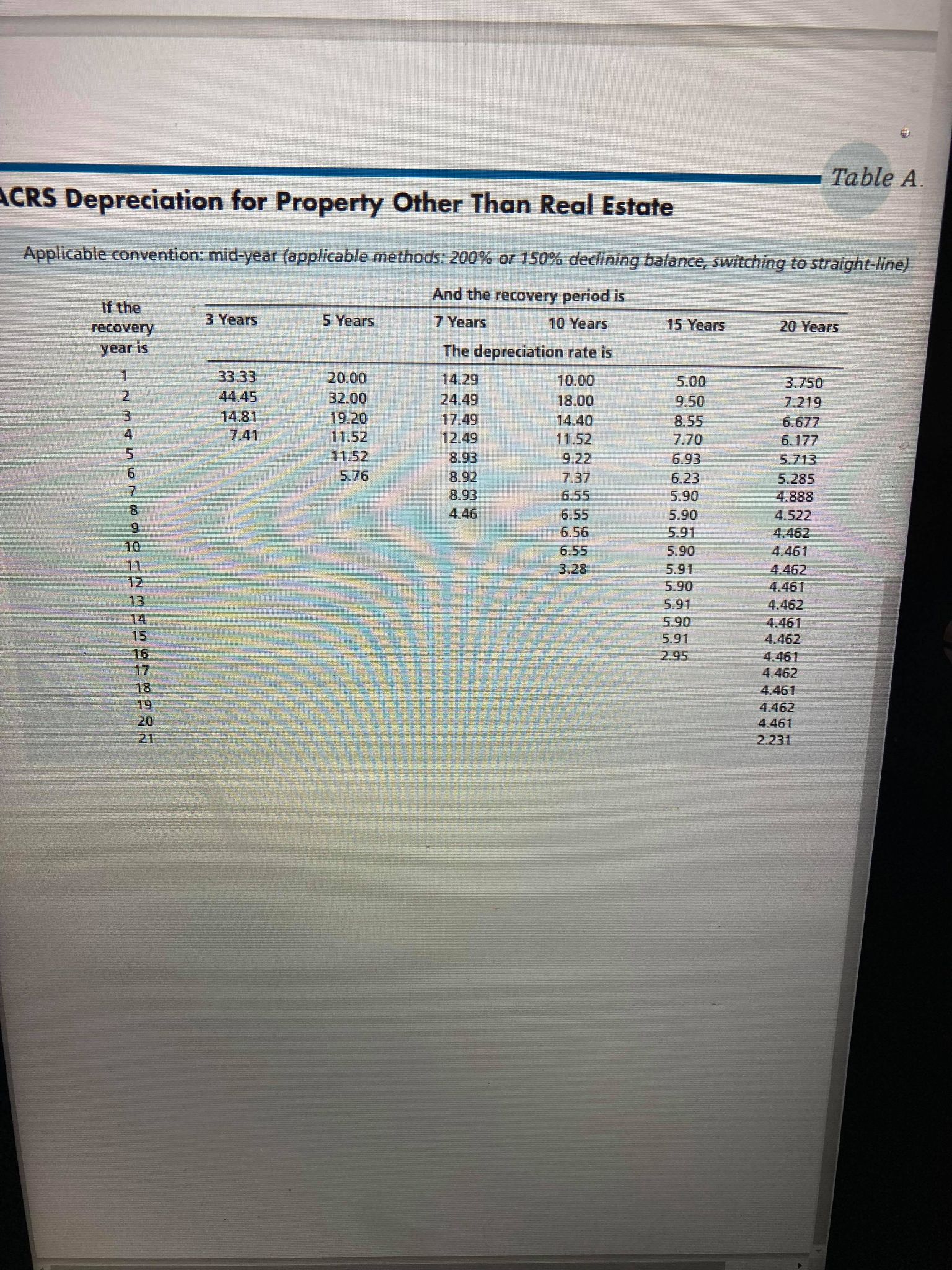

C & https://cxp-cdn.cengage.info/protected/prod/assets/3... Amazon.com - Onli... Your videos B. Booking.com / mygreatlakes.org Homepage Table A10- IRS Table of MACRS Classes (Partial Table) Recovery Periods (in years) General Alternative Class Life Depreciation Asset Class Description of Assets Included Depreciation (in years) System System Specific Depreciable Assets Used in All Business Activities, Except as Noted: 00.11 Office Furniture, Fixtures, and Equipment: Includes furniture and fixtures that are not a structural component of a building. Includes such assets as desks, files, safes, and communications equipment. Does not include communications equipment that is included in other classes 10 00.12 Information Systems: Includes computers and their peripheral equipment used in administering normal business transactions and the maintenance of business records, their retrieval and analysis. Information systems are defined as: 1. Computers: A computer is a programmable electronically activated device capable of accepting information, applying prescribed processes to the information, and supplying the results of these processes with or without human intervention. It usually consists of a central processing unit containing extensive storage, logic, arithmetic, and control capabilities. Excluded from this category are adding machines, electronic desk calculators, etc., and other equipment described in class 00.13. 2. Peripheral equipment consists of the auxiliary machines that are designed to be placed under control of the central processing unit. Nonlimiting examples are: Card readers, card punches, magnetic tape feeds, high-speed printers, optical character readers, tape cassettes, mass storage units, paper tape equipment, keypunches, data entry devices, teleprinters, terminals, tape drives, disc drives, disc files, disc packs, visual image projector tubes, card sorters, plotters, and collators. Peripheral equipment may be used on-line or off-line. Does not include equipment that is an integral part of other capital equipment that is included in other classes of economic activity, ie., computers used primarily for process or production control, switching, channeling, and automating distributive trades and services such as point of sale (POS) computer systems. Also, does not include equipment of a kind used primarily for amusement or entertainment of the user 5* DO. 13 Data Handling Equipment, except Computers: Includes only typewriters, calculators, adding and accounting machines, copiers, and duplicating equipment 00.21 Airplanes (airframes and engines), except those used in commercial or contract carrying of passengers or freight, and all helicopters (airframes and engines) 00.22 Automobiles, Taxis D W O 00.23 Buses 10.241 Light General Purpose Trucks: Includes trucks for use over the road (actual unloaded weight less than 13,000 pounds) 5 00.242 Heavy General Purpose Trucks: Includes heavy general purpose trucks, concrete ready mix-trucks, and ore trucks, for use over the road (actual unloaded weight 13,000 pounds or more) 00.25 Railroad Cars and Locomotives, except those owned by railroad transportation companies 00.26 Tractor Units for Use Over-the-Road 00.27 Trailers and Trailer-Mounted Containers 00.28 Vessels, Barges, Tugs, and Similar Water Transportation Equipment, except those used in marine construction 18 Table ATable A. CRS Depreciation for Property Other Than Real Estate Applicable convention: mid-year (applicable methods: 200% or 150% declining balance, switching to straight-line) And the recovery period is If the 3 Years 5 Years 7 Years 10 Years 15 Years 20 Years recovery year is The depreciation rate is 33.33 20.00 14.29 10.00 5.00 3.750 44.45 32.00 24.49 18.00 9.50 7.219 14.8 19.20 17.49 14.40 8.55 6.677 7.41 11.52 12.49 11.52 7.70 6.177 11.52 8.93 9.22 5.93 5.713 5.76 8.92 7.37 6.23 5.285 8.93 6.55 5.90 4.888 4.46 6.55 5.90 4.522 6.56 5.91 4.462 6.55 5.90 4.461 3.28 5.91 4.462 5.90 4.461 5.91 4.462 5.90 4.461 5.91 4.462 2.95 4.461 4.462 4.461 4.462 4.461 2.231