Question: c. Is the purchase attractive based on these estimates? (Select the best choice below.) A.No, because at a 11.8% discount rate, the NPV is negative.

c. Is the purchase attractive based on these estimates? (Select the best choice below.)

A.No, because at a 11.8% discount rate, the NPV is negative.

B.Yes, because at a 11.8% discount rate, the NPV is positive.

C.No, because at a 11.8% discount rate, the NPV is positive.

D.Yes, because at a 11.8% discount rate, the NPV is negative.

d. How far off could OpenSeas? cost of capital be (to the nearest 1%) before your purchase decision would change? The cost of capital estimate can be off by

______ %. (Round to three decimal places.)

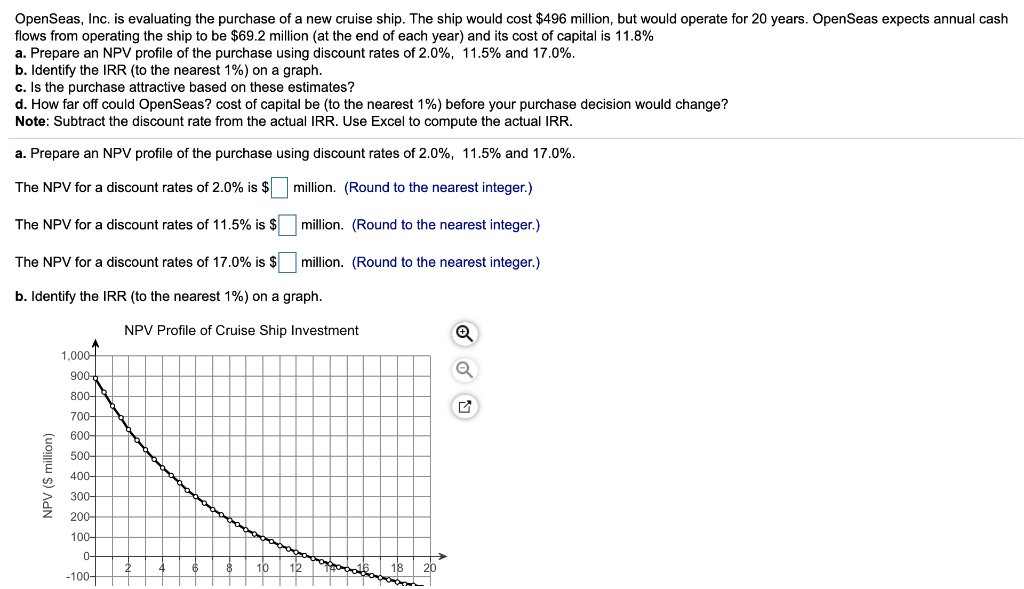

OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship would cost $496 million, but would operate for 20 years. Open Seas expects annual cash flows from operating the ship to be $69.2 million (at the end of each year) and its cost of capital is 11.8% a. Prepare an NPV profile of the purchase using discount rates of 2.0%, 11.5% and 17.0%. b. Identify the IRR (to the nearest 1%) on a graph. c. Is the purchase attractive based on these estimates? d. How far off could OpenSeas? cost of capital be (to the nearest 1%) before your purchase decision would change? Note: Subtract the discount rate from the actual IRR. Use Excel to compute the actual IRR. a. Prepare an NPV profile of the purchase using discount rates of 2.0%, 11.5% and 17.0%. The NPV for a discount rates of 2.0% is $ million. (Round to the nearest integer.) The NPV for a discount rates of 11.5% is $ million. (Round to the nearest integer.) The NPV for a discount rates of 17.0% is $ million. (Round to the nearest integer.) b. Identify the IRR (to the nearest 1%) on a graph. NPV Profile of Cruise Ship Investment 1,000 NPV (S million) 900 800- 700- 600- 500 400- 300 200 100- o- -1004 10 12 18 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts