Question: C. JTM has S755M in bonds - maturing in 7 years and paying a fixed 3.9% - for the same amount paying a floating

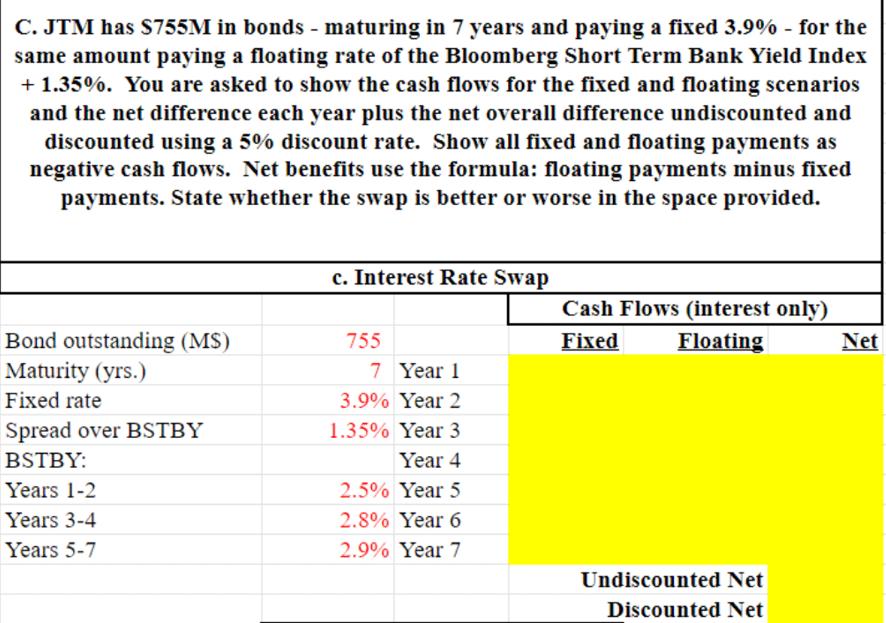

C. JTM has S755M in bonds - maturing in 7 years and paying a fixed 3.9% - for the same amount paying a floating rate of the Bloomberg Short Term Bank Yield Index + 1.35%. You are asked to show the cash flows for the fixed and floating scenarios and the net difference each year plus the net overall difference undiscounted and discounted using a 5% discount rate. Show all fixed and floating payments as negative cash flows. Net benefits use the formula: floating payments minus fixed payments. State whether the swap is better or worse in the space provided. Bond outstanding (MS) Maturity (yrs.) Fixed rate Spread over BSTBY BSTBY: Years 1-2 Years 3-4 Years 5-7 c. Interest Rate Swap 755 7 Year 1 3.9% Year 2 1.35% Year 3 Year 4 2.5% Year 5 2.8% Year 6 2.9% Year 7 Cash Flows (interest only) Fixed Floating Undiscounted Net Discounted Net Net

Step by Step Solution

3.55 Rating (145 Votes )

There are 3 Steps involved in it

To answer the question we need to calculate the fixed and floating interest payments for each year then find the net cash flows by subtracting the fixed payments from the floating payments We will als... View full answer

Get step-by-step solutions from verified subject matter experts