Question: C. Matching (50 points) 1 2 3 4 A cost to the seller of extending credit A method of recording collection losses based on estimates

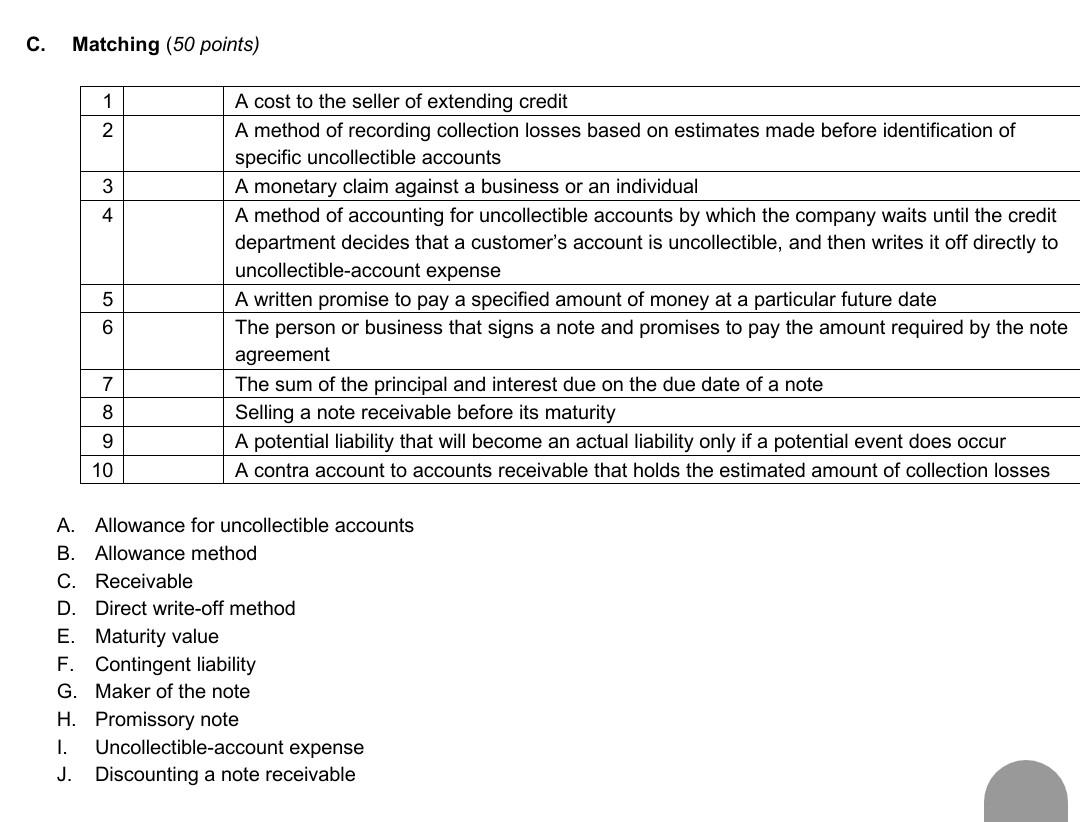

C. Matching (50 points) 1 2 3 4 A cost to the seller of extending credit A method of recording collection losses based on estimates made before identification of specific uncollectible accounts A monetary claim against a business or an individual A method of accounting for uncollectible accounts by which the company waits until the credit department decides that a customer's account is uncollectible, and then writes it off directly to uncollectible-account expense A written promise to pay a specified amount of money at a particular future date The person or business that signs a note and promises to pay the amount required by the note agreement The sum of the principal and interest due on the due date of a note Selling a note receivable before its maturity A potential liability that will become an actual liability only if a potential event does occur A contra account to accounts receivable that holds the estimated amount of collection losses 5 6 7 8 9 10 A. Allowance for uncollectible accounts B. Allowance method C. Receivable D. Direct write-off method E. Maturity value F. Contingent liability G. Maker of the note H. Promissory note 1. Uncollectible-account expense J. Discounting a note receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts