Question: c . Now assume that the project cannot be shut down. However, expertise gained by taking it on will lead to an opportunity at the

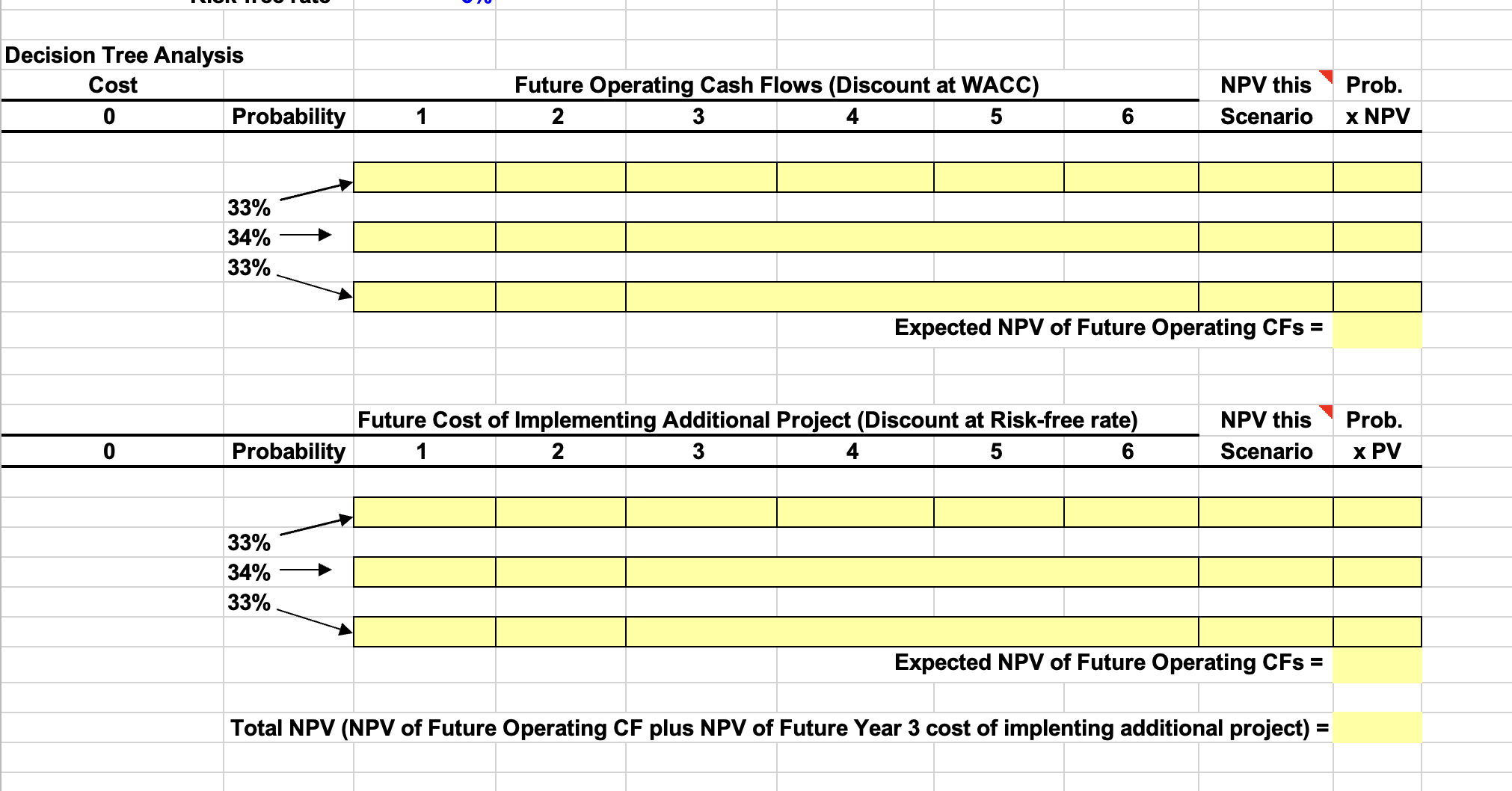

c Now assume that the project cannot be shut down. However, expertise gained by taking it on will lead to an opportunity at the end of Year to undertake a venture that would have the same cost as the original project, and the new project's cash flows would follow whichever branch resulted for the original project. In other words, there would be a second $ million cost at the end of Year and then cash flows of either $ million, $ million, or $ million for the following years. Use decision tree analysis to estimate the value of the project, including the opportunity to implement the new project in Year Assume the $ million cost at Year is known with certainty and should be discounted at the riskfree rate of percent. Hint: do one decision tree for the operating cash flows and one for the cost of the project, then sum their NPVs Expected NPV of Future Operating CFs

Total NPV NPV of Future Operating CF plus NPV of Future Year cost of implenting additional project

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock