Question: The following payoff table shows the profit for a decision problem with two states of nature and two decision alternatives: a. Suppose P(s1) = 0.2

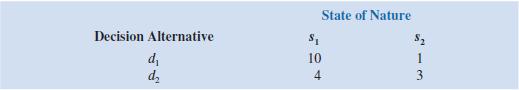

The following payoff table shows the profit for a decision problem with two states of nature and two decision alternatives:

a. Suppose P(s1) = 0.2 and P(s2) = 0.8. What is the best decision using the expected value approach?

b. Perform sensitivity analysis on the payoffs for decision alternative d1. Assume the probabilities are as given in part a, and find the range of payoffs under states of nature s1 and s2 that will keep the solution found in part a optimal. Is the solution more sensitive to the payoff under state of nature s1 or s2?

State of Nature Decision Alternative di dz 10 1 4 3

Step by Step Solution

3.27 Rating (159 Votes )

There are 3 Steps involved in it

Decision alternative s1 s2 Ps1 02 d1 10 1 Ps2 08 d2 9 3 a expected value for decision 1 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635e18295b94f_181403.pdf

180 KBs PDF File

635e18295b94f_181403.docx

120 KBs Word File