Question: C. Problem - LO 3: (10 marks) XYZ company expects in the coming year: sales of 40000 units at $10 per unit, variable operating costs

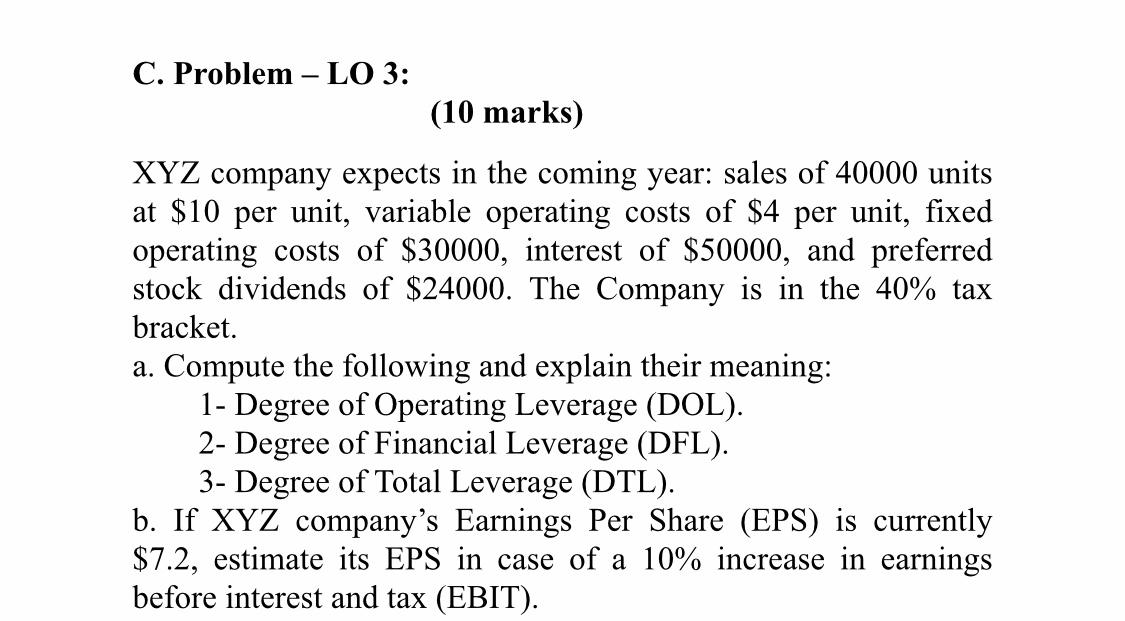

C. Problem - LO 3: (10 marks) XYZ company expects in the coming year: sales of 40000 units at $10 per unit, variable operating costs of $4 per unit, fixed operating costs of $30000, interest of $50000, and preferred stock dividends of $24000. The Company is in the 40% tax bracket. a. Compute the following and explain their meaning: 1- Degree of Operating Leverage (DOL). 2- Degree of Financial Leverage (DFL). 3- Degree of Total Leverage (DTL). b. If XYZ company's Earnings Per Share (EPS) is currently $7.2, estimate its EPS in case of a 10% increase in earnings before interest and tax (EBIT). C. Problem - LO 3: (10 marks) XYZ company expects in the coming year: sales of 40000 units at $10 per unit, variable operating costs of $4 per unit, fixed operating costs of $30000, interest of $50000, and preferred stock dividends of $24000. The Company is in the 40% tax bracket. a. Compute the following and explain their meaning: 1- Degree of Operating Leverage (DOL). 2- Degree of Financial Leverage (DFL). 3- Degree of Total Leverage (DTL). b. If XYZ company's Earnings Per Share (EPS) is currently $7.2, estimate its EPS in case of a 10% increase in earnings before interest and tax (EBIT)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts