Question: c. The company is considering three mutually exclusive projects. Each of which 2 requires a $ 10 million investment. The estimated internal rate of return

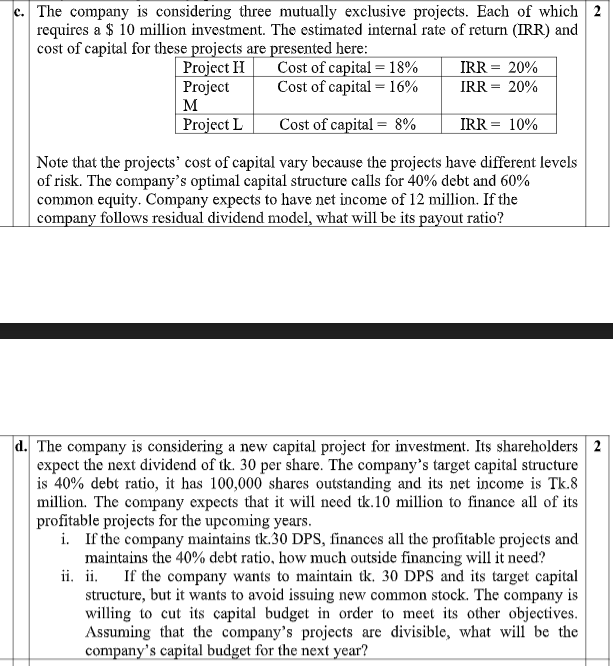

c. The company is considering three mutually exclusive projects. Each of which 2 requires a $ 10 million investment. The estimated internal rate of return (IRR) and cost of capital for these projects are presented here: Project H Cost of capital = 18% IRR = 20% Project Cost of capital = 16% IRR = 20% M Project L Cost of capital = 8% IRR = 10% Note that the projects' cost of capital vary because the projects have different levels of risk. The company's optimal capital structure calls for 40% debt and 60% common equity. Company expects to have net income of 12 million. If the company follows residual dividend model, what will be its payout ratio? d. The company is considering a new capital project for investment. Its shareholders 2 expect the next dividend of tk. 30 per share. The company's target capital structure is 40% debt ratio, it has 100,000 shares outstanding and its net income is Tk.8 million. The company expects that it will need tk. 10 million to finance all of its profitable projects for the upcoming years. i. If the company maintains tk. 30 DPS, finances all the profitable projects and maintains the 40% debt ratio, how much outside financing will it need? ii. ii. If the company wants to maintain tk. 30 DPS and its target capital structure, but it wants to avoid issuing new common stock. The company is willing to cut its capital budget in order to meet its other objectives. Assuming that the company's projects are divisible, what will be the company's capital budget for the next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts