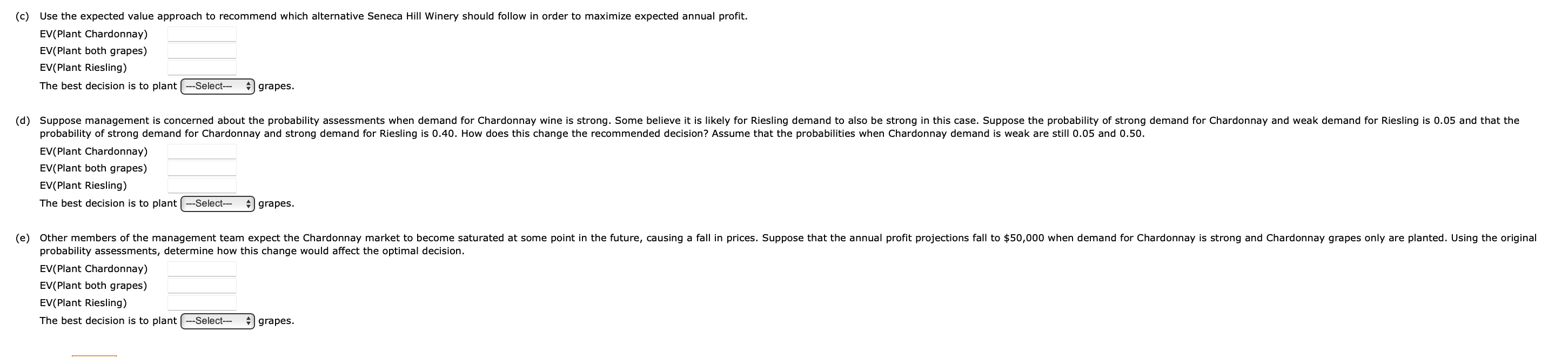

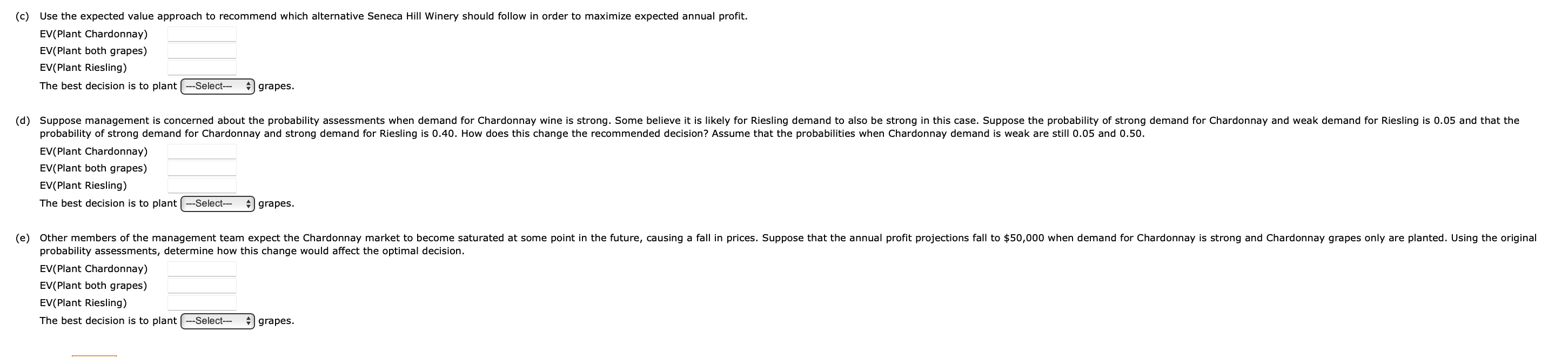

Question: (c) Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit. EV(Plant Chardonnay) EV(Plant

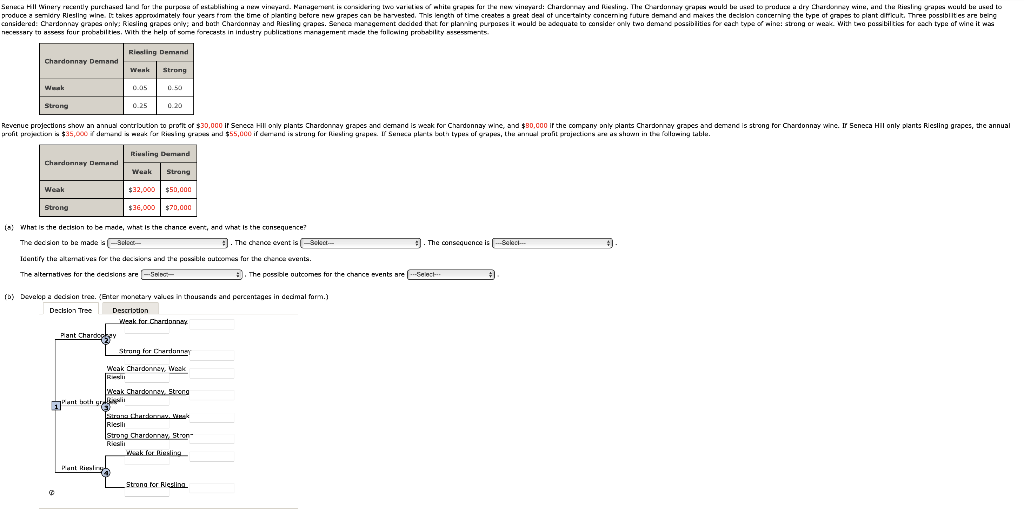

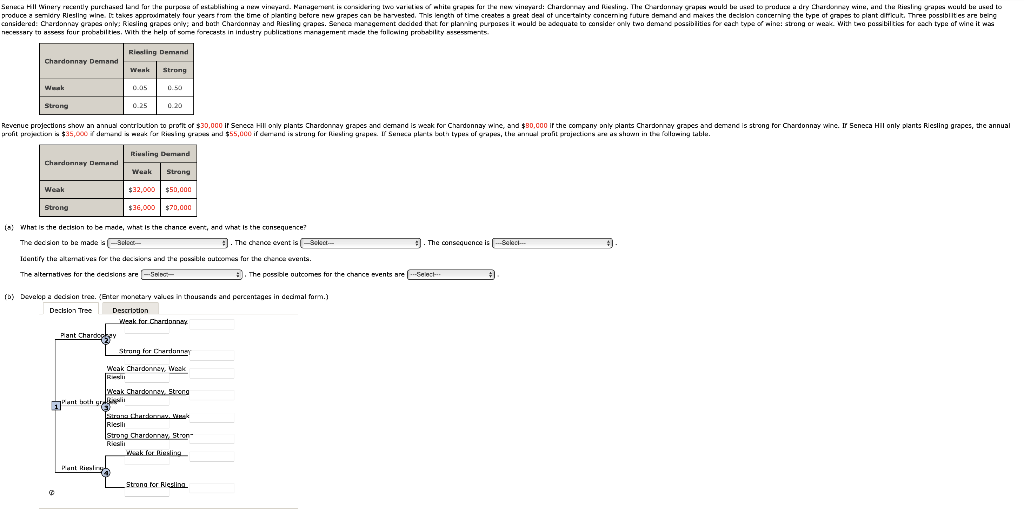

(c) Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant ( ---Select--- grapes. (d) Suppose management is concerned about the probability assessments when demand for Chardonnay wine is strong. Some believe it is likely for Riesling demand to also be strong in this case. Suppose the probability of strong demand for Chardonnay and weak demand for Riesling is 0.05 and that the probability of strong demand for Chardonnay and strong demand for Riesling is 0.40. How does this change the recommended decision? Assume that the probabilities when Chardonnay demand is weak are still 0.05 and 0.50. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant --Select--- grapes. (e) Other members of the management team expect the Chardonnay market to become saturated at some point in the future, causing a fall in prices. Suppose that the annual profit projections fall to $50,000 when demand for Chardonnay is strong and Chardonnay grapes only are planted. Using the original probability assessments, determine how this change would affect the optimal decision. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant --Select--- grapes. Sen Hill Winery recently purchased and for the purpose of establishing a nem virard. Management is considering two warto white grups ur le new vineyard: Chardonnay und Riesling. The Cerdany grupi wuld be used to produce a dry chardonnay wine, and the Riscaling gapi wuld be used to produce a semicry Riesling wine. It takes approxmately four years from the time ctplanting before new grepes can be ha vested. This length of time creates a great deal of uncetainty concern ng future demand arc maces the decision concerning the type of grapes to plant difficult. Three possiblites are being considered. Chardonnay grapes anly: Ricsling grapes only, and both Chardonnay and Riesling gaps. Secca management decided that for planning purpares it would be adequate to consider only two demand possibilities for cada type of wine! Strong or weak with the possibilities for each type of wine it was necessary to assess four probabilties, with the help of some forecasts in industry publications muragement made the following probability extent Riesling Demand Chardonnay Demand Wun Strong Wuak 0.05 0.50 Strong 0.25 0.20 Revenuc projections show an annual contribution to profit or $30,000 ir Sencce Hill only plants Chardonnay grapes and demand is week for Chardonnay wine, and $30.000 if the company only plants Chardonnay grapes and demand is strong for Chardonnay winc. Ir Scneca Hll only plants Riesling grapes, the annual profil propi $35,000 denak lor Rising $55,000 if car and is strong for Rising grapes. If Seaplars beltypes of grapes, the prali prior was in the following labels Chardonnay Demand tiusling Demand Weak Strong Weak $32,000 $50,000 $36,000 $70.000 Strong Skagi- 1 (8 What is the decision to be mede, what is the chance event, and what is the consequence? The desilon to be made 3 ). The drence event is kit- 2 Boked- 2. . The consequence is Identify the alternatives for the desirs and the possible outcomes for the chance events The alternatives for the cedsions are -Sel The possible outcomes for the chance events are Beach b) Develop a dedsion tree. Enter monday values in thousands and percentages in decimal form.) Decision Tree Descriton Weak for Chardonnay Pant Charley Struny for Curtonnn Weak Chardonnay, Wook Reki Alcak Chardonnay. Sting Punt toch Straw. Wat Riesli Strong Chardonnay Stron- Riesli ak fairline Punt Harry Strona for Retina (c) Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant ( ---Select--- grapes. (d) Suppose management is concerned about the probability assessments when demand for Chardonnay wine is strong. Some believe it is likely for Riesling demand to also be strong in this case. Suppose the probability of strong demand for Chardonnay and weak demand for Riesling is 0.05 and that the probability of strong demand for Chardonnay and strong demand for Riesling is 0.40. How does this change the recommended decision? Assume that the probabilities when Chardonnay demand is weak are still 0.05 and 0.50. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant --Select--- grapes. (e) Other members of the management team expect the Chardonnay market to become saturated at some point in the future, causing a fall in prices. Suppose that the annual profit projections fall to $50,000 when demand for Chardonnay is strong and Chardonnay grapes only are planted. Using the original probability assessments, determine how this change would affect the optimal decision. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant --Select--- grapes. Sen Hill Winery recently purchased and for the purpose of establishing a nem virard. Management is considering two warto white grups ur le new vineyard: Chardonnay und Riesling. The Cerdany grupi wuld be used to produce a dry chardonnay wine, and the Riscaling gapi wuld be used to produce a semicry Riesling wine. It takes approxmately four years from the time ctplanting before new grepes can be ha vested. This length of time creates a great deal of uncetainty concern ng future demand arc maces the decision concerning the type of grapes to plant difficult. Three possiblites are being considered. Chardonnay grapes anly: Ricsling grapes only, and both Chardonnay and Riesling gaps. Secca management decided that for planning purpares it would be adequate to consider only two demand possibilities for cada type of wine! Strong or weak with the possibilities for each type of wine it was necessary to assess four probabilties, with the help of some forecasts in industry publications muragement made the following probability extent Riesling Demand Chardonnay Demand Wun Strong Wuak 0.05 0.50 Strong 0.25 0.20 Revenuc projections show an annual contribution to profit or $30,000 ir Sencce Hill only plants Chardonnay grapes and demand is week for Chardonnay wine, and $30.000 if the company only plants Chardonnay grapes and demand is strong for Chardonnay winc. Ir Scneca Hll only plants Riesling grapes, the annual profil propi $35,000 denak lor Rising $55,000 if car and is strong for Rising grapes. If Seaplars beltypes of grapes, the prali prior was in the following labels Chardonnay Demand tiusling Demand Weak Strong Weak $32,000 $50,000 $36,000 $70.000 Strong Skagi- 1 (8 What is the decision to be mede, what is the chance event, and what is the consequence? The desilon to be made 3 ). The drence event is kit- 2 Boked- 2. . The consequence is Identify the alternatives for the desirs and the possible outcomes for the chance events The alternatives for the cedsions are -Sel The possible outcomes for the chance events are Beach b) Develop a dedsion tree. Enter monday values in thousands and percentages in decimal form.) Decision Tree Descriton Weak for Chardonnay Pant Charley Struny for Curtonnn Weak Chardonnay, Wook Reki Alcak Chardonnay. Sting Punt toch Straw. Wat Riesli Strong Chardonnay Stron- Riesli ak fairline Punt Harry Strona for Retina