Question: Develop a decision tree. ( Enter monetary values in thousands and percentages in decimal form. ) Decision Tree Description A decision tree begins at decision

Develop a decision tree. Enter monetary values in thousands and percentages in decimal form.

Decision Tree

Description

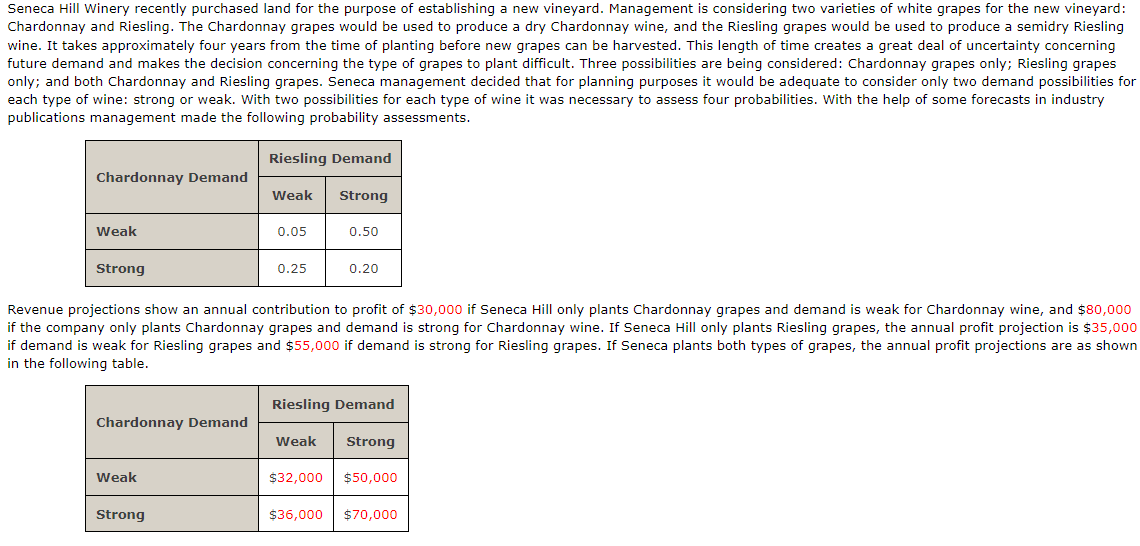

A decision tree begins at decision node and an upper, middle, and lower branch extend from this node to the right. The upper branch, labeled Plant Chardonnay, stops at chance node and an upper and lower branch extend from this node to the right. The middle branch, labeled Plant both grapes, stops at chance node and four branches extend from this node to the right. The lower branch, labeled Plant Riesling, stops at chance node and an upper and lower branch extend from this node to the right.

The branches extending from decision node from top to bottom are labeled Plant Chardonnay, Plant both grapes, and Plant Riesling. The next set of branches from top to bottom are labeled Weak for Chardonnay, Strong for Chardonnay, Weak Chardonnay Weak Riesling, Weak Chardonnay Strong Riesling, Strong Chardonnay Weak Riesling, Strong Chardonnay Strong Riesling, Weak for Riesling, and Strong for Riesling. There is an answer blank at the end of each branch as well as below each branch.

c

Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit.

EVPlant Chardonnay

EVPlant both grapes

EVPlant Riesling

The best decision is to plant

Select

grapes.

d

Suppose management is concerned about the probability assessments when demand for Chardonnay wine is strong. Some believe it is likely for Riesling demand to also be strong in this case. Suppose the probability of strong demand for Chardonnay and weak demand for Riesling is and that the probability of strong demand for Chardonnay and strong demand for Riesling is How does this change the recommended decision? Assume that the probabilities when Chardonnay demand is weak are still and

EVPlant Chardonnay

EVPlant both grapes

EVPlant Riesling

The best decision is to plant

Select

grapes.

e

Other members of the management team expect the Chardonnay market to become saturated at some point in the future, causing a fall in prices. Suppose that the annual profit projections fall to $ when demand for Chardonnay is strong and Chardonnay grapes only are planted. Using the original probability assessments, determine how this change would affect the optimal decision.

EVPlant Chardonnay

EVPlant both grapes

EVPlant Riesling

The best decision is to plant

Select

grapes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock