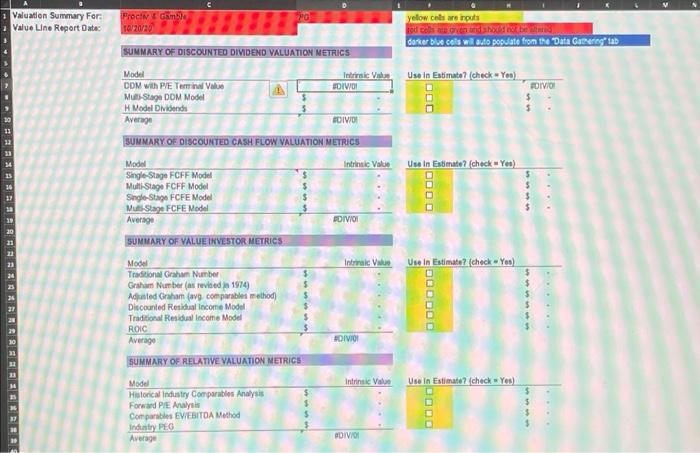

Question: C Valuation Summary For Value Line Report Date: Proin Game 10/20/30 yelow cos are input hoben danser blue cols wil do populate from the Data

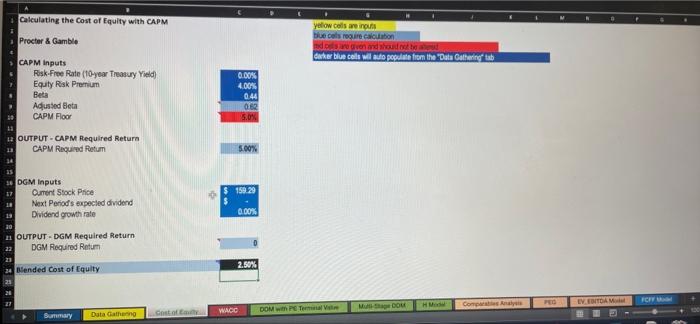

C Valuation Summary For Value Line Report Date: Proin Game 10/20/30 yelow cos are input hoben danser blue cols wil do populate from the Data Gathering a Use in Estimato? (check Yes POIVO! SUMMARY OF DISCOUNTED DIVIDEND VALUATION NETRICS Model latinsic Vi DDM wih PIE Terminal Value IWO Muis Stage DOM Model Model Dividende Average BDIVO SUMMARY OF DISCOUNTED CASH FLOW VALUATION METRICS Model Intrinsic Value Single-Stage FCFF Model $ Multi Stage FCFF Model Single Stage FCFE Model Ms Stage FCFE Model Average BOIVIO Usain Estimate? (check Yes SUMMARY OF VALUE INVESTOR METRICS Internal Value Une In Estimata? (check Yes FOIVIO Model Traditional Graham Number Graham Number (as revised in 1974 Adjusted Graham (avg. comparable method Discounted Real income Model Traditional Residual income Model ROIC Average SUMMARY OF RELATIVE VALUATION METRICS Model Historical industry Comparables Analysis Forward PE Analysis Comparables EWEBITDA Method Industry PEG Average Intrinsic Value Use in Estimato check Yes DIVO Calculating the Cost of Equity with CAPM Procter & Gamble yellow cols are not blue col rogie caution prostore anker blue cols wil so polita from the Duta Galerieofub CAPM Inputs Risk Free Rate (10-year Treasury Yield Equity Risk Premium Beta Adjusted Beta CAPM Floor 0.00% 4.00% 0.44 0.62 5.0% OUTPUT - CAPM Required Return CAPM Required Retum 5.00% $ 150.29 3 DGM Inputs 17 Current Stock Price 12 Next Period's expected dividend 13 Dividend growth rate 0.00% OUTPUT - DGM Required Return DGM Required Retum 2.50% Blended Cost of Equity FCFF HO EVEDAM Company MOU WACC DOM with Pe Tema Summary Duta Gatang Contattauty C Valuation Summary For Value Line Report Date: Proin Game 10/20/30 yelow cos are input hoben danser blue cols wil do populate from the Data Gathering a Use in Estimato? (check Yes POIVO! SUMMARY OF DISCOUNTED DIVIDEND VALUATION NETRICS Model latinsic Vi DDM wih PIE Terminal Value IWO Muis Stage DOM Model Model Dividende Average BDIVO SUMMARY OF DISCOUNTED CASH FLOW VALUATION METRICS Model Intrinsic Value Single-Stage FCFF Model $ Multi Stage FCFF Model Single Stage FCFE Model Ms Stage FCFE Model Average BOIVIO Usain Estimate? (check Yes SUMMARY OF VALUE INVESTOR METRICS Internal Value Une In Estimata? (check Yes FOIVIO Model Traditional Graham Number Graham Number (as revised in 1974 Adjusted Graham (avg. comparable method Discounted Real income Model Traditional Residual income Model ROIC Average SUMMARY OF RELATIVE VALUATION METRICS Model Historical industry Comparables Analysis Forward PE Analysis Comparables EWEBITDA Method Industry PEG Average Intrinsic Value Use in Estimato check Yes DIVO Calculating the Cost of Equity with CAPM Procter & Gamble yellow cols are not blue col rogie caution prostore anker blue cols wil so polita from the Duta Galerieofub CAPM Inputs Risk Free Rate (10-year Treasury Yield Equity Risk Premium Beta Adjusted Beta CAPM Floor 0.00% 4.00% 0.44 0.62 5.0% OUTPUT - CAPM Required Return CAPM Required Retum 5.00% $ 150.29 3 DGM Inputs 17 Current Stock Price 12 Next Period's expected dividend 13 Dividend growth rate 0.00% OUTPUT - DGM Required Return DGM Required Retum 2.50% Blended Cost of Equity FCFF HO EVEDAM Company MOU WACC DOM with Pe Tema Summary Duta Gatang Contattauty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts