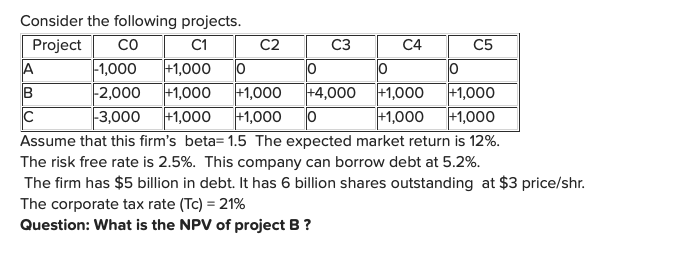

Question: C1 Consider the following projects. Project CO C2 C3 C4 C5 A 1,000 1,000 O o 0 o B -2,000 +1,000 +1,000 +4,000 |+1,000 +1,000

C1 Consider the following projects. Project CO C2 C3 C4 C5 A 1,000 1,000 O o 0 o B -2,000 +1,000 +1,000 +4,000 |+1,000 +1,000 3,000 1,000 +1,000 o +1,000 +1,000 Assume that this firm's beta= 1.5 The expected market return is 12%. The risk free rate is 2.5%. This company can borrow debt at 5.2%. The firm has $5 billion in debt. It has 6 billion shares outstanding at $3 price/shr. The corporate tax rate (TC) = 21% Question: What is the NPV of project B? Multiple Choice The NPV for project B is -$128 The NPV for project B is -$122 The NPV for project B is $3,458 The NPV for project B is $2,158

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock