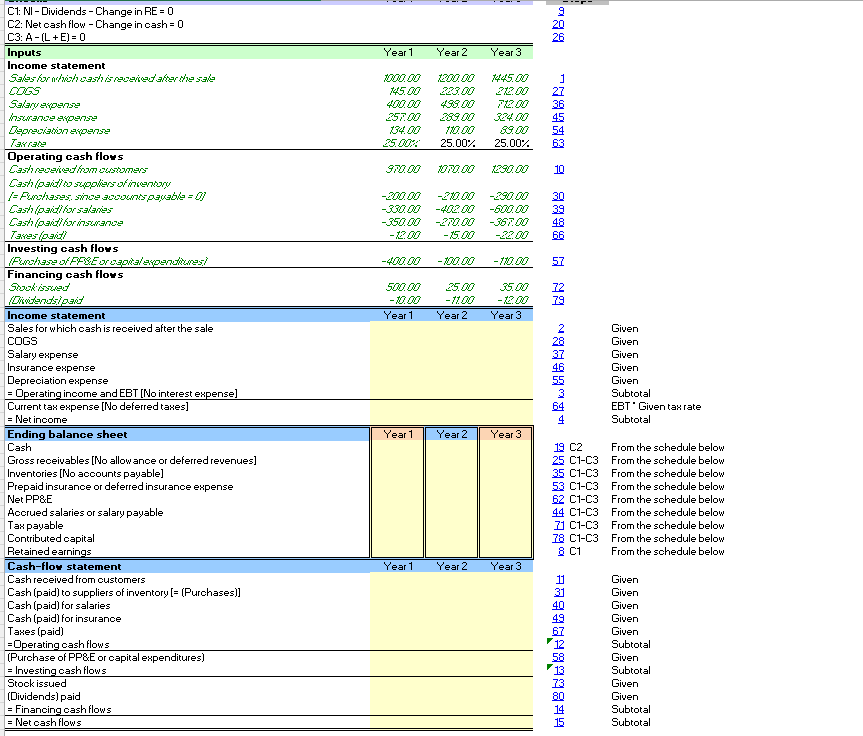

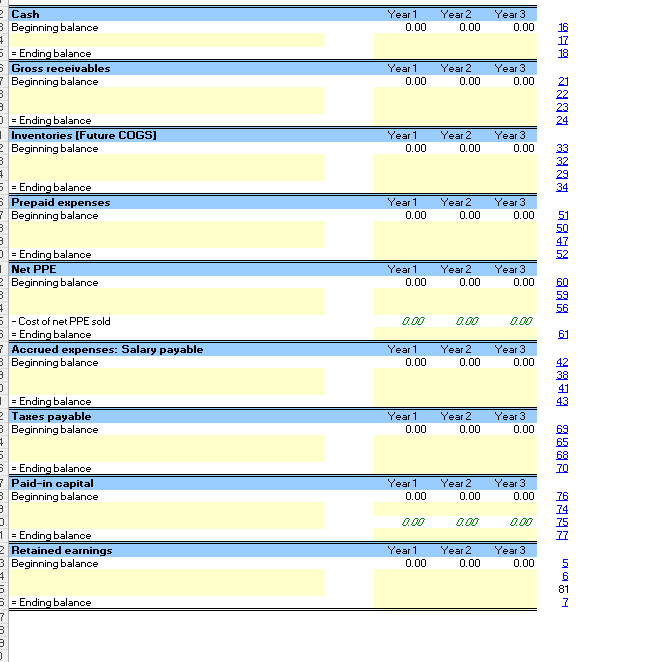

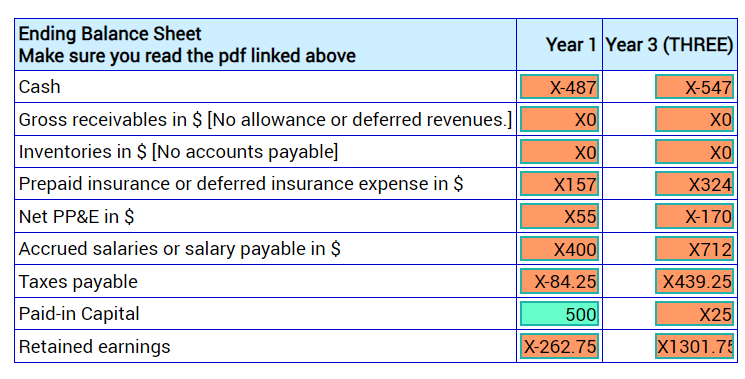

Question: C1: NI - Dividends - Change in RE = 0 C2: Net cash flow - Change in cash = 0 C3: A - (L +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts