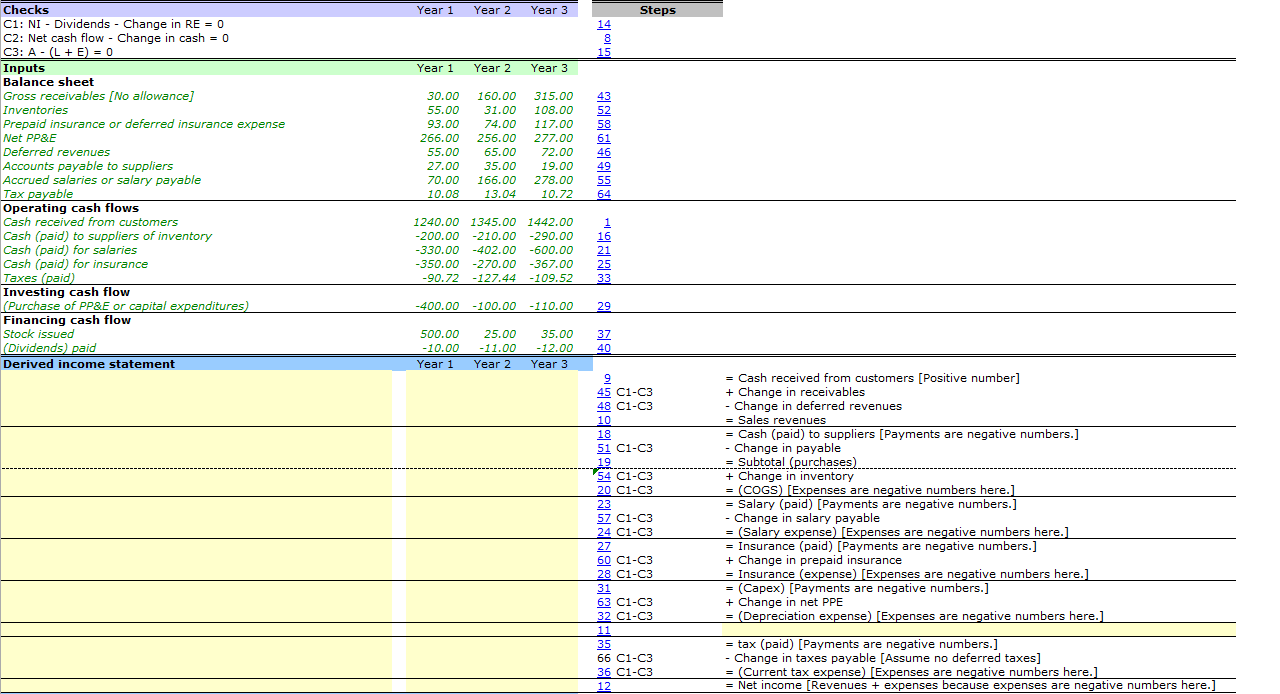

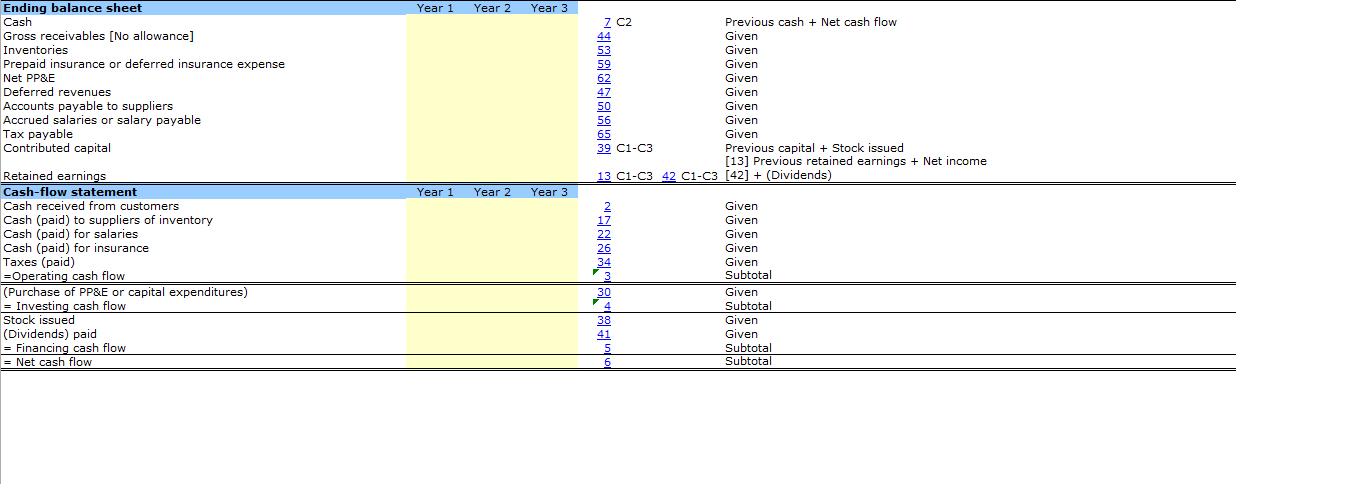

Question: Checks Year 1 Year 2 Year 3 Steps C1: NI - Dividends - Change in RE = 0 14 C2: Net cash flow - Change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts