Question: c4 q16 need help with all 37 parts Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Challenge

c4 q16 need help with all 37 parts

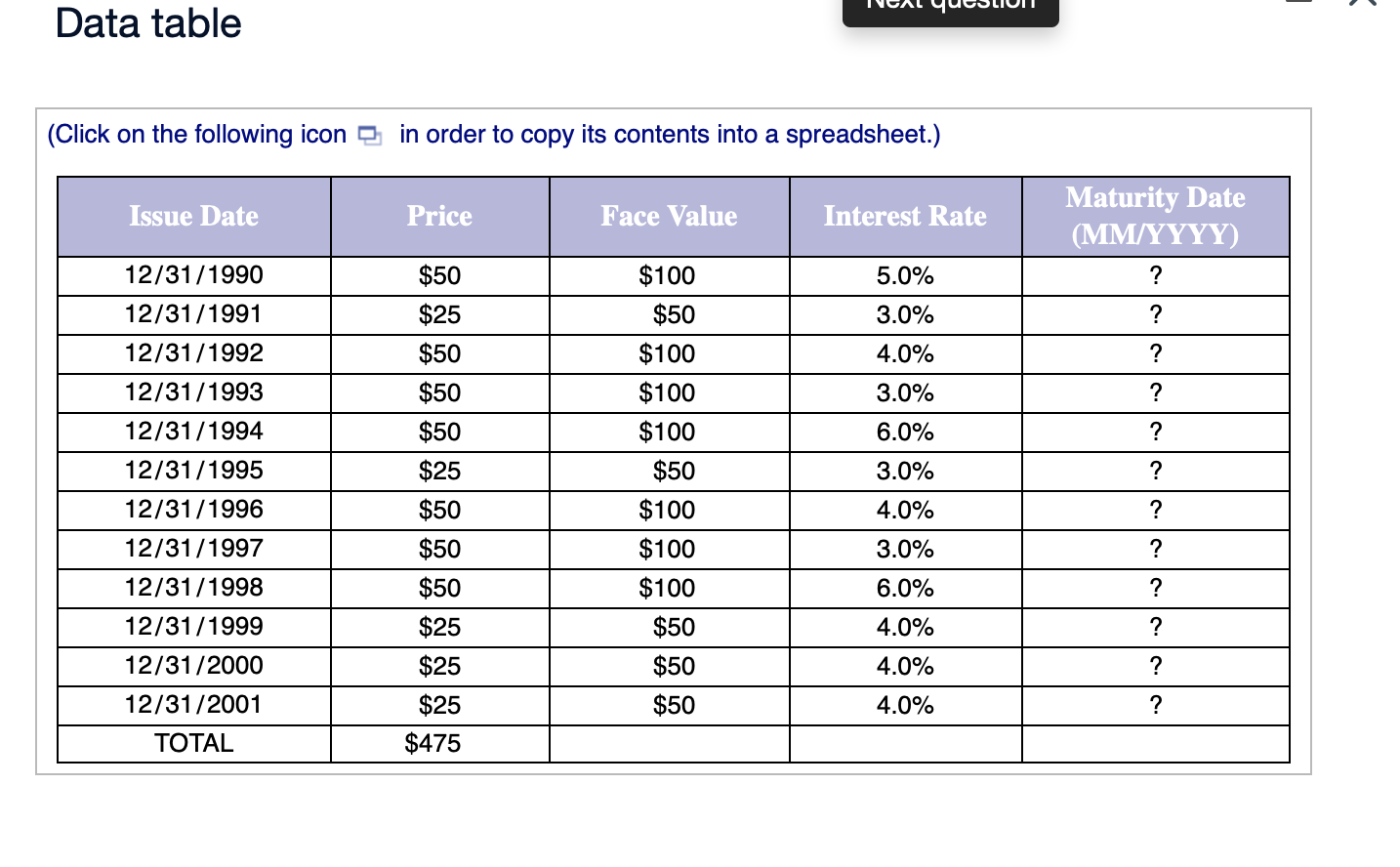

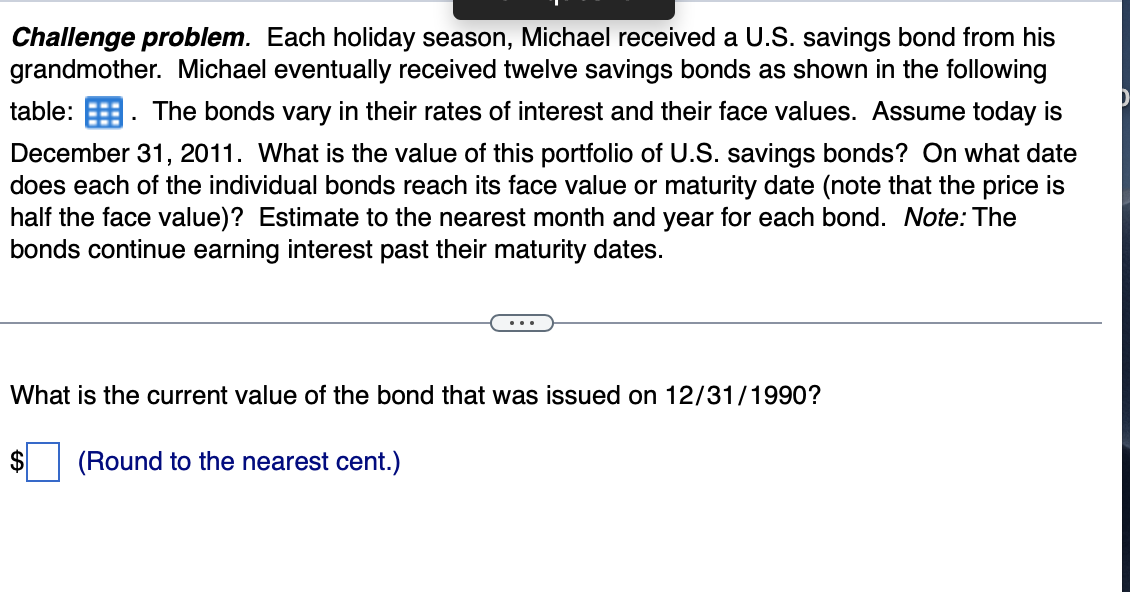

Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Challenge problem. Each holiday season, Michael received a U.S. savings bond from his grandmother. Michael eventually received twelve savings bonds as shown in the following table: . The bonds vary in their rates of interest and their face values. Assume today is December 31,2011 . What is the value of this portfolio of U.S. savings bonds? On what date does each of the individual bonds reach its face value or maturity date (note that the price is half the face value)? Estimate to the nearest month and year for each bond. Note: The bonds continue earning interest past their maturity dates. What is the current value of the bond that was issued on 12/31/1990? $ (Round to the nearest cent.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Challenge problem. Each holiday season, Michael received a U.S. savings bond from his grandmother. Michael eventually received twelve savings bonds as shown in the following table: . The bonds vary in their rates of interest and their face values. Assume today is December 31,2011 . What is the value of this portfolio of U.S. savings bonds? On what date does each of the individual bonds reach its face value or maturity date (note that the price is half the face value)? Estimate to the nearest month and year for each bond. Note: The bonds continue earning interest past their maturity dates. What is the current value of the bond that was issued on 12/31/1990? $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts