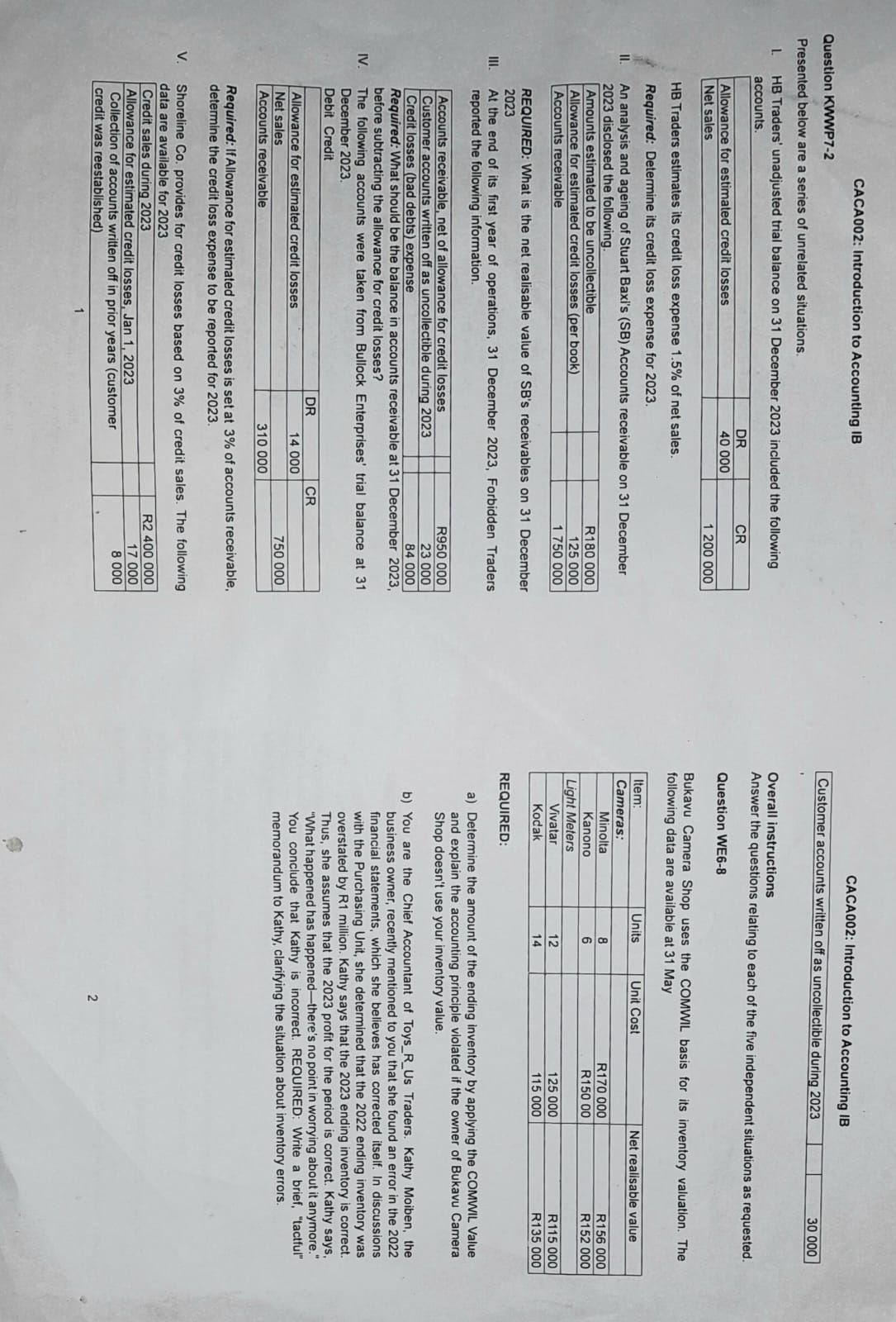

Question: CACA 0 0 2 : Introduction to Accounting IB Question KWWP 7 - 2 Presented below are a series of unrelated situations. HB Traders' unadjusted

CACA: Introduction to Accounting IB

Question KWWP

Presented below are a series of unrelated situations.

HB Traders' unadjusted trial balance on December included the following

accounts.

HB Traders estimates its credit loss expense of net sales.

Required: Determine its credit loss expense for

II An analysis and ageing of Stuart Baxi's SB Accounts receivable on December

disclosed the following.

REQUIRED: What is the net realisable value of SBs receivables on December

III. At the end of its first year of operations, December Forbidden Traders

reported the following information.

Required: What should be the balance in accounts receivable at December

before subtracting the allowance for credit losses?

IV The following accounts were taken from Bullock Enterprises' trial balance at

December

Debit Credit

Required: If Allowance for estimated credit losses is set at of accounts receivable,

determine the credit loss expense to be reported for

V Shoreline Co provides for credit losses based on of credit sales. The following

data are available for

CACA: Introduction to Accounting IB

Overall instructions

Answer the questions relating to each of the five independent situations as requested.

Question WE

Bukavu Camera Shop uses the COMWIL basis for its inventory valuation. The

following data are available at May

REQUIRED:

a Determine the amount of the ending inventory by applying the COMWIL Value

and explain the accounting principle violated if the owner of Bukavu Camera

Shop doesn't use your inventory value.

b You are the Chief Accountant of ToysRUs Traders. Kathy Moiben, the

business owner, recently mentioned to you that she found an error in the

financial statements, which she belleves has corrected itself. In discussions

with the Purchasing Unit, she determined that the ending inventory was

overstated by R million. Kathy says that the ending inventory is correct.

Thus, she assumes that the profit for the period is correct. Kathy says,

"What happened has happenedthere's no point in worrying about it anymore."

You conclude that Kathy is incorrect. REQUIRED: Write a brief, "tactful"

memorandum to Kathy, clarifying the situation about inventory errors.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock