Question: Calculate cash flow from operating activities using Indirect method. I. Cost of Materials Consumed Employee benefit expenses Depreciation expenses Other expenses Total expenses III.

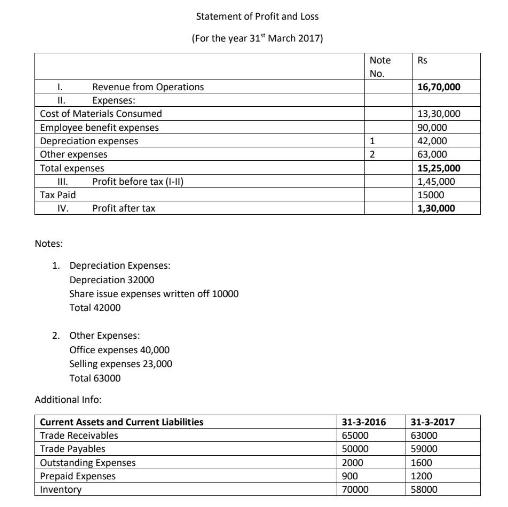

Calculate cash flow from operating activities using Indirect method. I. Cost of Materials Consumed Employee benefit expenses Depreciation expenses Other expenses Total expenses III. Tax Paid IV. Revenue from Operations Expenses: Notes: Profit before tax (1-11) Profit after tax 1. Depreciation Expenses: Depreciation 32000 Share issue expenses written off 10000 Total 42000 2. Other Expenses: Statement of Profit and Loss (For the year 31" March 2017) Office expenses 40,000 Selling expenses 23,000 Total 63000 Additional Info: Current Assets and Current Liabilities Trade Receivables Trade Payables Outstanding Expenses Prepaid Expenses Inventory Note No. 2000 900 70000 1 2 Rs 16,70,000 13,30,000 90,000 42,000 63,000 15,25,000 1,45,000 15000 1,30,000 31-3-2016 31-3-2017 65000 63000 50000 59000 1600 1200 58000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

To calculate cash flow from operating activities using the indirect method we start with the net pro... View full answer

Get step-by-step solutions from verified subject matter experts