Question: . Calculate Equivalent Units, Unit Costs, and Transferred CostsFIFO Method Commodore Company processes a food seasoning powder through its Compounding and Packaging departments. In the

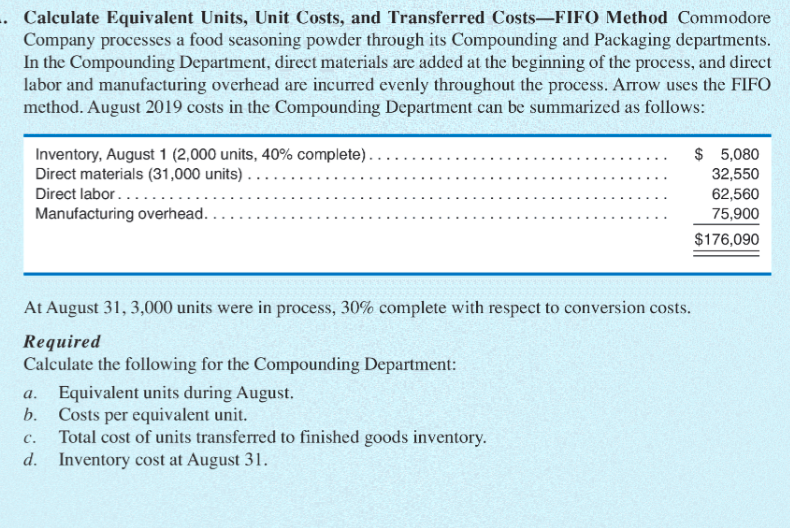

. Calculate Equivalent Units, Unit Costs, and Transferred CostsFIFO Method Commodore Company processes a food seasoning powder through its Compounding and Packaging departments. In the Compounding Department, direct materials are added at the beginning of the process, and direct labor and manufacturing overhead are incurred evenly throughout the process. Arrow uses the FIFO method. August 2019 costs in the Compounding Department can be summarized as follows: Inventory, August 1 (2,000 units, 40% complete). Direct materials (31,000 units) .... Direct labor... Manufacturing overhead... $ 5,080 32,550 62,560 75,900 $176,090 At August 31, 3,000 units were in process, 30% complete with respect to conversion costs. Required Calculate the following for the Compounding Department: Equivalent units during August b. Costs per equivalent unit. Total cost of units transferred to finished goods inventory. d. Inventory cost at August 31. a. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts