Question: could you please help me with the transactions for this i tried doing the first one but no matter what the transactions would not balance

could you please help me with the transactions for this i tried doing the first one but no matter what the transactions would not balance out

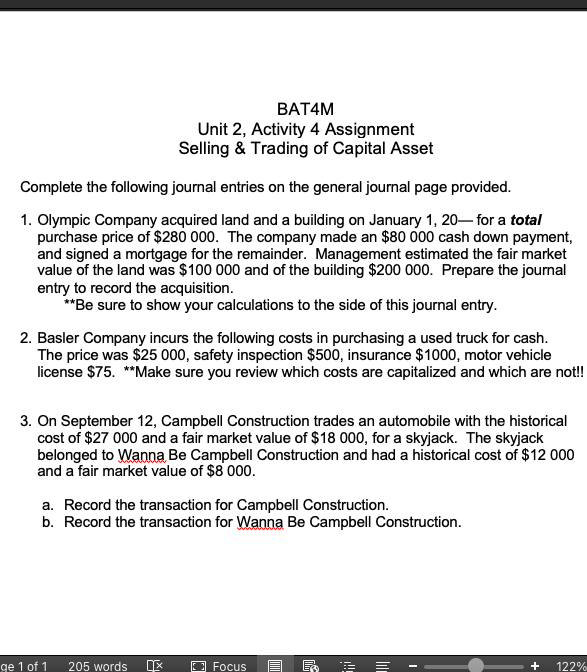

1. Olympic Company acquired land and a building on January 1,20 for a total purchase price of $280000. The company made an $80000 cash down payment, and signed a mortgage for the remainder. Management estimated the fair market value of the land was $100000 and of the building $200000. Prepare the journal entry to record the acquisition. Be sure to show your calculations to the side of this journal entry. 2. Basler Company incurs the following costs in purchasing a used truck for cash. The price was $25000, safety inspection $500, insurance $1000, motor vehicle license $75. Make sure you review which costs are capitalized and which are not!! 3. On September 12, Campbell Construction trades an automobile with the historical cost of $27000 and a fair market value of $18000, for a skyjack. The skyjack belonged to Wanna Be Campbell Construction and had a historical cost of $12000 and a fair market value of $8000. a. Record the transaction for Campbell Construction. b. Record the transaction for Wanna Be Campbell Construction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts