Question: Calculate OCF NCS changes in NWC Is the Net working capital negative or positive? Does this indicate any potential difficulty for the company? Why? CFA

Calculate

- OCF

- NCS

- changes in NWC

- Is the Net working capital negative or positive?

- Does this indicate any potential difficulty for the company? Why?

- CFA

- CFC

- Is the Cash Flow to Creditors Negative?

- Explain how this might come about?

- What is the last total dividend paid? refer to the Statement of Changes in Equity

- Did the company issue new shares? Yes or no. What is the total dollar value? refer to the Statement of Changes in Equity

- Did the company repurchase shares? Yes or no. What is the total dollar value? refer to the Statement of Changes in Equity

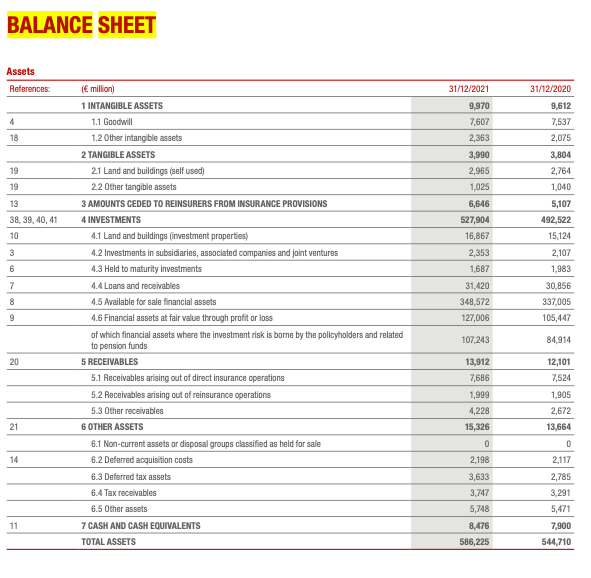

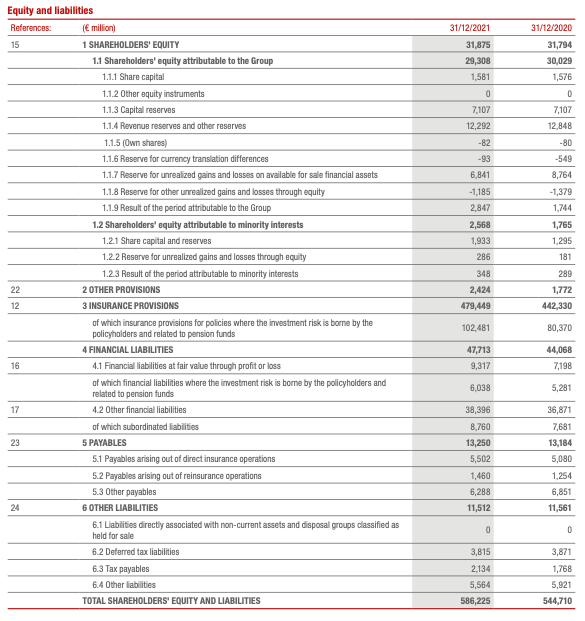

BALANCE SHEET Assets References: 31/12/2021 9,970 7,607 4 18 19 31/12/2020 9,612 7,537 2,075 3,804 2,764 1,040 5,107 492,522 15,124 2,107 1,983 19 2,363 3,990 2,965 1,025 6,646 527,904 16,867 2,353 1,687 13 38, 39, 40, 41 10 3 6 7 8 ( million) 1 INTANGIBLE ASSETS 1.1 Goodwill 1.2 Other intangible assets 2 TANGIBLE ASSETS 2.1 Land and buildings (self used 2.2 Other tangible assets 3 AMOUNTS CEDED TO REINSURERS FROM INSURANCE PROVISIONS 4 INVESTMENTS 4.1 Land and buildings (investment properties) 4.2 Investments in subsidiaries, associated companies and joint ventures 4.3 Held to maturity investments 4.4 Loans and receivables 4.5 Available for sale financial assets 4.6 Financial assets at fair value through profit or loss of which financial assets where the investment risk is borne by the policyholders and related to pension funds 5 RECEIVABLES 5.1 Receivables arising out of direct insurance operations 5.2 Receivables arising out of roinsurance operations 5.3 Other receivables 6 OTHER ASSETS 6.1 Non-current assets or disposal groups classified as held for sale 6.2 Deferred acquisition costs 6.3 Deferred tax assets 6.4 Tax receivables 6.5 Other assets 7 CASH AND CASH EQUIVALENTS TOTAL ASSETS 31,420 348,572 127,006 30,856 337,005 105,447 9 107,243 84,914 20 13,912 7,686 1,999 4,228 15,326 0 2,198 3,633 3,747 12,101 7,524 1,905 2,672 13,664 0 21 14 2.117 2,785 3.291 5,471 7,900 544,710 5,748 8,476 586,225 11 31/12/2020 31,794 30,029 1,576 31/12/2021 31,875 29,308 1,581 0 7,107 12,292 -82 0 7,107 12,848 -93 -80 -549 8,764 6,841 -1,379 1,744 -1,185 2,847 2,568 1,933 286 1,765 1.295 181 348 Equity and liabilities References: ( million) 15 1 SHAREHOLDERS' EQUITY 1.1 Shareholders' equity attributable to the Group 1.1.1 Share capital 1.1.2 Other equity instruments 1.1.3 Capital reserves 1.1.4 Revenue reserves and other reserves 1.1.5 (Own shares) 1.1.6 Reserve for currency translation differences 1.1.7 Reserve for unrealized gains and losses on available for sale financial assets 1.1.8 Reserve for other unrealized gains and losses through equity 1.1.9 Result of the period attributable to the Group 1.2 Shareholders' equity attributable to minority interests 1.21 Share capital and reserves 1.2.2 Reserve for unrealized gains and losses through equity 1.2.3 Result of the period attributable to minority interests 22 2 OTHER PROVISIONS 12 3 INSURANCE PROVISIONS of which insurance provisions for policies where the investment risk is borne by the policyholders and related to pension funds 4 FINANCIAL LIABILITIES 16 4.1 Financial liabilities at fair value through profit or loss of which financial liabilities where the investment risk is borne by the policyholders and related to pension funds 17 4.2 Other financial liabilities of which subordinated liabilities 23 5 PAYABLES 5.1 Payables arising out of direct insurance operations 5.2 Payables arising out of reinsurance operations 5.3 Other payables 24 6 OTHER LIABILITIES 6.1 Liabilities directly associated with non-current assets and disposal groups classified as held for sale 6.2 Deferred tax liabilities 6.3 Tax payables 6.4 Other liabilities TOTAL SHAREHOLDERS' EQUITY AND LIABILITIES 2,424 479,449 289 1,772 442,330 102,481 80,370 47,713 9,317 44,068 7,198 6,038 5,281 38,396 8,760 13,250 5,502 1,460 6,288 11,512 36,871 7,681 13,184 5,080 1,254 6,851 11,561 0 0 3,871 3,815 2,134 5,564 586,225 1,768 5,921 544,710 BALANCE SHEET Assets References: 31/12/2021 9,970 7,607 4 18 19 31/12/2020 9,612 7,537 2,075 3,804 2,764 1,040 5,107 492,522 15,124 2,107 1,983 19 2,363 3,990 2,965 1,025 6,646 527,904 16,867 2,353 1,687 13 38, 39, 40, 41 10 3 6 7 8 ( million) 1 INTANGIBLE ASSETS 1.1 Goodwill 1.2 Other intangible assets 2 TANGIBLE ASSETS 2.1 Land and buildings (self used 2.2 Other tangible assets 3 AMOUNTS CEDED TO REINSURERS FROM INSURANCE PROVISIONS 4 INVESTMENTS 4.1 Land and buildings (investment properties) 4.2 Investments in subsidiaries, associated companies and joint ventures 4.3 Held to maturity investments 4.4 Loans and receivables 4.5 Available for sale financial assets 4.6 Financial assets at fair value through profit or loss of which financial assets where the investment risk is borne by the policyholders and related to pension funds 5 RECEIVABLES 5.1 Receivables arising out of direct insurance operations 5.2 Receivables arising out of roinsurance operations 5.3 Other receivables 6 OTHER ASSETS 6.1 Non-current assets or disposal groups classified as held for sale 6.2 Deferred acquisition costs 6.3 Deferred tax assets 6.4 Tax receivables 6.5 Other assets 7 CASH AND CASH EQUIVALENTS TOTAL ASSETS 31,420 348,572 127,006 30,856 337,005 105,447 9 107,243 84,914 20 13,912 7,686 1,999 4,228 15,326 0 2,198 3,633 3,747 12,101 7,524 1,905 2,672 13,664 0 21 14 2.117 2,785 3.291 5,471 7,900 544,710 5,748 8,476 586,225 11 31/12/2020 31,794 30,029 1,576 31/12/2021 31,875 29,308 1,581 0 7,107 12,292 -82 0 7,107 12,848 -93 -80 -549 8,764 6,841 -1,379 1,744 -1,185 2,847 2,568 1,933 286 1,765 1.295 181 348 Equity and liabilities References: ( million) 15 1 SHAREHOLDERS' EQUITY 1.1 Shareholders' equity attributable to the Group 1.1.1 Share capital 1.1.2 Other equity instruments 1.1.3 Capital reserves 1.1.4 Revenue reserves and other reserves 1.1.5 (Own shares) 1.1.6 Reserve for currency translation differences 1.1.7 Reserve for unrealized gains and losses on available for sale financial assets 1.1.8 Reserve for other unrealized gains and losses through equity 1.1.9 Result of the period attributable to the Group 1.2 Shareholders' equity attributable to minority interests 1.21 Share capital and reserves 1.2.2 Reserve for unrealized gains and losses through equity 1.2.3 Result of the period attributable to minority interests 22 2 OTHER PROVISIONS 12 3 INSURANCE PROVISIONS of which insurance provisions for policies where the investment risk is borne by the policyholders and related to pension funds 4 FINANCIAL LIABILITIES 16 4.1 Financial liabilities at fair value through profit or loss of which financial liabilities where the investment risk is borne by the policyholders and related to pension funds 17 4.2 Other financial liabilities of which subordinated liabilities 23 5 PAYABLES 5.1 Payables arising out of direct insurance operations 5.2 Payables arising out of reinsurance operations 5.3 Other payables 24 6 OTHER LIABILITIES 6.1 Liabilities directly associated with non-current assets and disposal groups classified as held for sale 6.2 Deferred tax liabilities 6.3 Tax payables 6.4 Other liabilities TOTAL SHAREHOLDERS' EQUITY AND LIABILITIES 2,424 479,449 289 1,772 442,330 102,481 80,370 47,713 9,317 44,068 7,198 6,038 5,281 38,396 8,760 13,250 5,502 1,460 6,288 11,512 36,871 7,681 13,184 5,080 1,254 6,851 11,561 0 0 3,871 3,815 2,134 5,564 586,225 1,768 5,921 544,710

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts