Question: Calculate Question: a) How does a commodity exchange ensure that trade volatility does not go beyond an acceptable level? b) What is basis risk and

Calculate

Question:

a) How does a commodity exchange ensure that trade volatility does not go beyond an acceptable level?

b) What is basis risk and why does it arise?

c) On September 1, an investor holds 10,000 shares of a certain stock. The market price is $62.50 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September S&P 500 futures contract. The futures price on the index is currently 1,000 and one contract is for delivery of $250 times the index. The beta of the stock is 0.8. Using the information above, answer the following questions:

i) With a hedging motive, which position should the investor take in S&P500 futures and in how many contracts?

ii) If the market goes down and the index settles at 750 next month, what will be the gain/loss on the investor's stock portfolio? Will her futures position help her recover the loss? Explain through relevant computations.

d) The spot price for a dividend paying stock is selling for $50 today. The stock will pay a $0.50 dividend in 2 months from now. The 2-month risk-fr

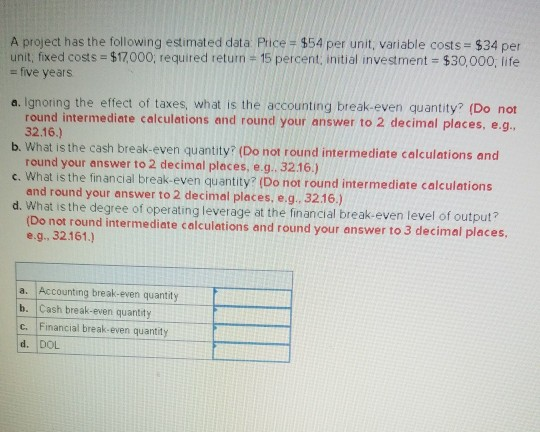

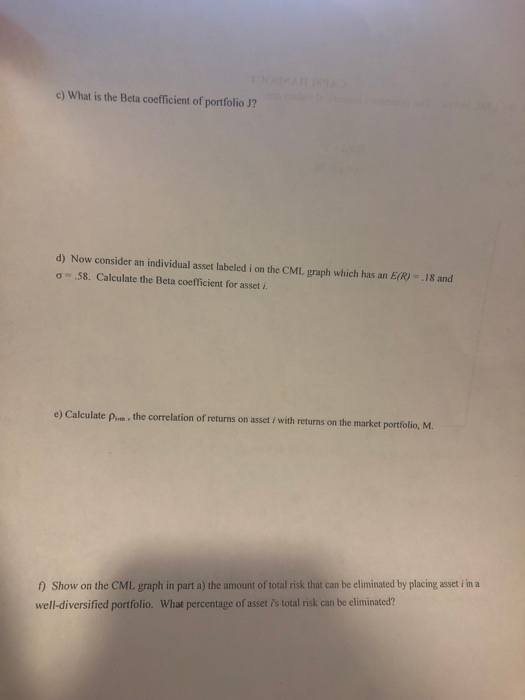

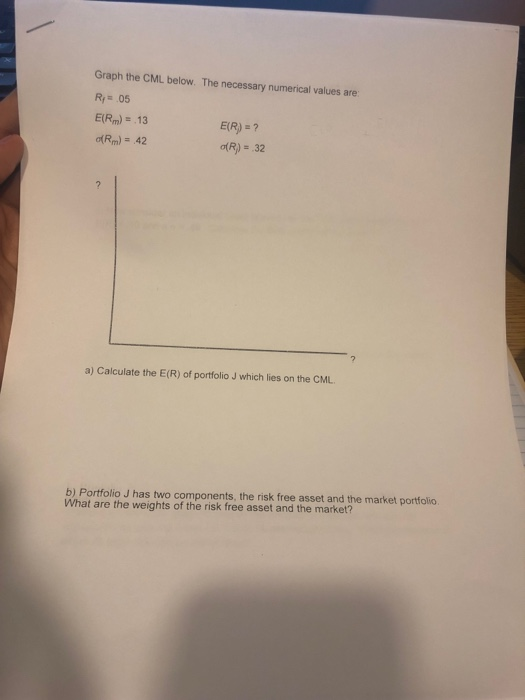

A project has the following estimated data: Price = $54 per unit, variable costs = $34 per unit, fixed costs = $17,000; required return = 15 percent, initial investment = $30,000, life = five years a. Ignoring the effect of taxes, what is the accounting break-even quantity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the cash break-even quantity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g.. 32.16.) c. What is the financial break-even quantity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 3216.) d. What is the degree of operating leverage at the financial break-even level of output? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32161.] a. Accounting break-even quantity Cash break-even quantity C. Financial break-even quantity d. DOLc) What is the Beta coefficient of portfolio J? d) Now consider an individual asset labeled i on the CML graph which has an E(R) = .18 and o= .58. Calculate the Beta coefficient for asset . e) Calculate pam . the correlation of returns on asset / with returns on the market portfolio, M. () Show on the CML graph in part a) the amount of total risk that can be eliminated by placing asset i in a well-diversified portfolio. What percentage of asset i's total risk can be eliminated?Graph the CML below. The necessary numerical values are: Ry = 05 E(Rm) = . 13 E(R) = ? (Rm) = 42 O(R) = 32 7 a) Calculate the E(R) of portfolio J which lies on the CML. b) Portfolio J has two components, the risk free asset and the market portfolio What are the weights of the risk free asset and the market