Question: Calculate the additional initial outlay associated with purchasing the new diesel boat. (In other words, calculate the incremental difference in the cash flows between the

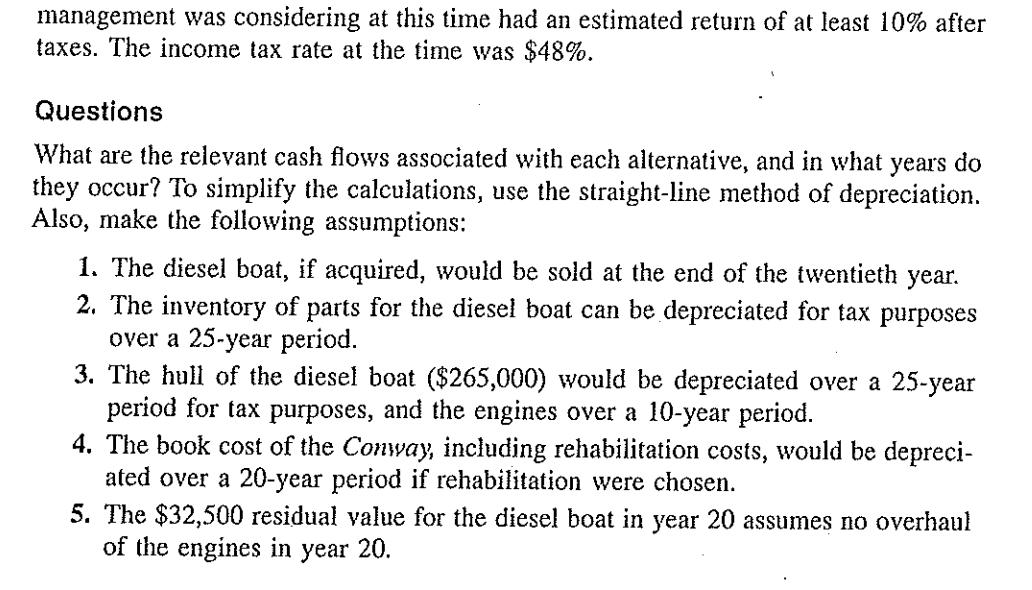

Calculate the additional initial outlay associated with purchasing the new diesel boat. (In other words, calculate the incremental difference in the cash flows between the initial outlay associated with purchasing the diesel boat and the initial outlay associated with renovating the Conway.)

Calculate the additional depreciation associated with purchasing the new diesel boat. (In other words, calculate the incremental difference in the depreciation associated with purchasing the diesel boat and the depreciation associated with renovating the Conway.)

Calculate the additional operating cash flows (i.e., cost savings) associated with purchasing the new diesel boat (which will occur in all years except Year 10). In other words, calculate the incremental difference between the annual operating cash flows associated with purchasing the diesel boat and the annual operating cash flows associated with renovating the Conway.

Calculate the additional terminal cash flows associated with purchasing the new diesel boat. (In other words, calculate the incremental difference in the cash flows between the terminal cash flows associated with purchasing the diesel boat and the terminal cash flows associated with renovating the Conway.)

Calculate the NPV for the project of purchasing the new diesel boat.

Based on your NPV calculation, what should be the conclusion about purchasing the new diesel boat?

Select one:

a. Accept

b. Reject

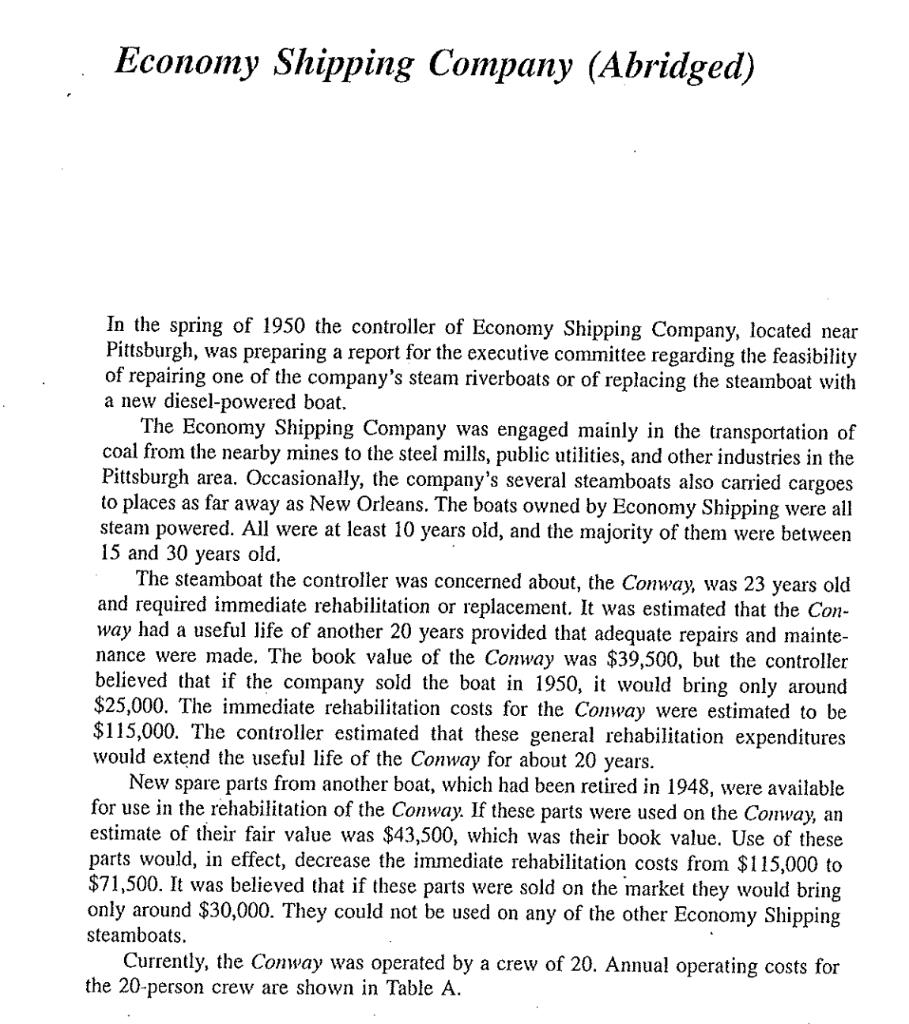

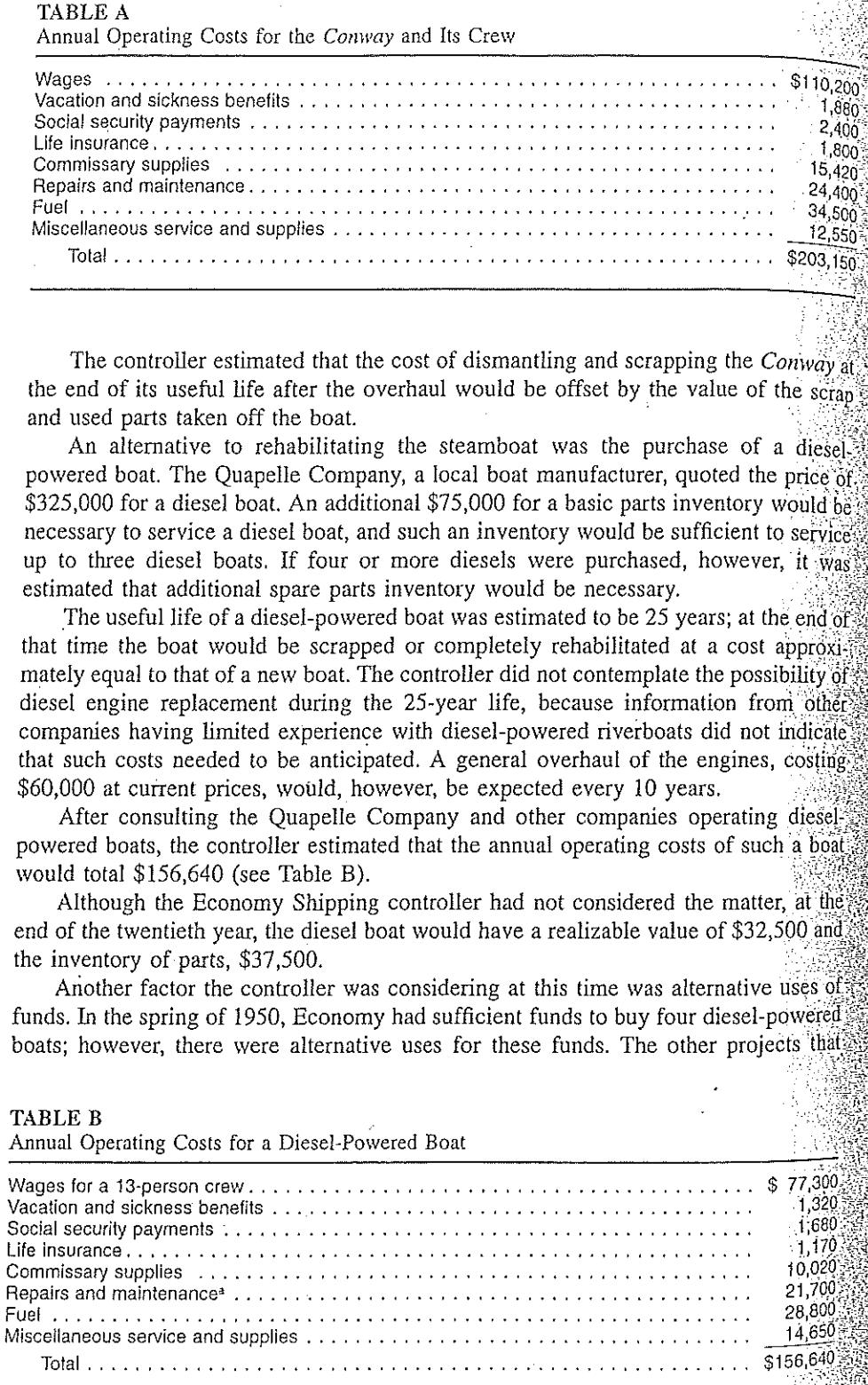

Economy Shipping Company (Abridged) In the spring of 1950 the controller of Economy Shipping Company, located near Pittsburgh, was preparing a report for the executive committee regarding the feasibility of repairing one of the company's steam riverboats or of replacing the steamboat with a new diesel-powered boat. The Economy Shipping Company was engaged mainly in the transportation of coal from the nearby mines to the steel mills, public utilities, and other industries in the Pittsburgh area. Occasionally, the company's several steamboats also carried cargoes to places as far away as New Orleans. The boats owned by Economy Shipping were all steam powered. All were at least 10 years old, and the majority of them were between 15 and 30 years old. The steamboat the controller was concerned about, the Conway, was 23 years old and required immediate rehabilitation or replacement. It was estimated that the Con- way had a useful life of another 20 years provided that adequate repairs and mainte- nance were made. The book value of the Conway was $39,500, but the controller believed that if the company sold the boat in 1950, it would bring only around $25,000. The immediate rehabilitation costs for the Conway were estimated to be $115,000. The controller estimated that these general rehabilitation expenditures would extend the useful life of the Conway for about 20 years. New spare parts from another boat, which had been retired in 1948, were available for use in the rehabilitation of the Conway. If these parts were used on the Conway, an estimate of their fair value was $43,500, which was their book value. Use of these parts would, in effect, decrease the immediate rehabilitation costs from $115,000 to $71,500. It was believed that if these parts were sold on the market they would bring only around $30,000. They could not be used on any of the other Economy Shipping steamboats. Currently, the Conway was operated by a crew of 20. Annual operating costs for the 20-person crew are shown in Table A.

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

SOLUTION The relevant cash flows associated with each alternative are Option A Renovating the Conway ... View full answer

Get step-by-step solutions from verified subject matter experts