Question: Calculate the company's stock average return, standard deviation, and coefficient of variation for the period 2005-2015. Use the closing price for the last day of

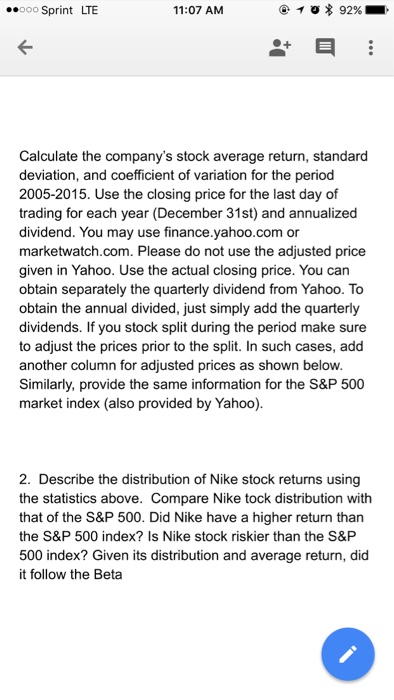

Calculate the company's stock average return, standard deviation, and coefficient of variation for the period 2005-2015. Use the closing price for the last day of trading for each year (December 31st) and annualized dividend. You may Use finance.yahoo.com or marketwatch.com. Please do not Use the adjusted price given in Yahoo. Use the actual closing price. You can obtain separately the quarterly dividend from Yahoo. To obtain the annual divided, just simply add the quarterly dividends. If you stock split during the period make sure to adjust the prices prior to the split. In such cases, add another column for adjusted prices as shown below. Similarly, provide the same information for the S&P 500 market index (also provided by Yahoo). Describe the distribution of Nike stock returns using the statistics above. Compare Nike tock distribution with that of the S&P 500. Did Nike have a higher return than the S&P 500 index? Is Nike stock riskier than the S&P 500 index? Given its distribution and average return, did it follow the Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts