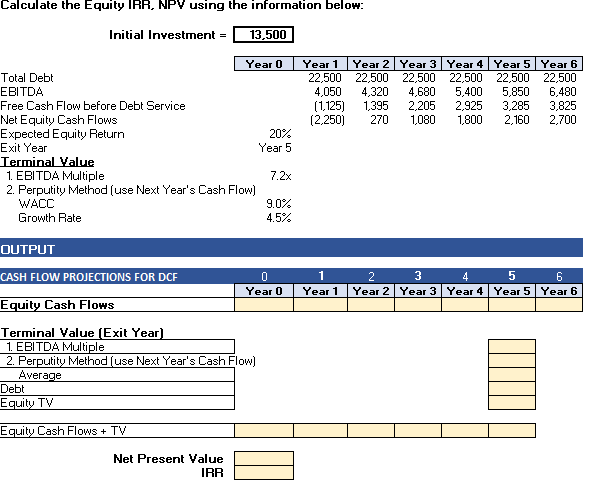

Question: Calculate the Equity IRR, NPV using the information below: Initial Investment = 13,500 Year 0 Total Debt EBITDA Free Cash Flow before Debt Service Net

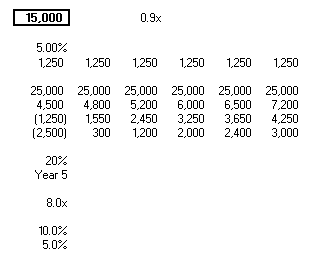

Calculate the Equity IRR, NPV using the information below: Initial Investment = 13,500 Year 0 Total Debt EBITDA Free Cash Flow before Debt Service Net Equity Cash Flows Expected Equity Return Exit Year Terminal Value 1. EBITDA Multiple 2. Perputity Method (use Next Year's Cash Flow) WACC Growth Rate OUTPUT CASH FLOW PROJECTIONS FOR DCF Equity Cash Flows Terminal Value (Exit Year) 1. EBITDA Multiple 2. Perputity Method (use Next Year's Cash Flow) Average Debt Equity TV Equity Cash Flows + TV Net Present Value IRR 20% Year 5 7.2x 9.0% 4.5% 0 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 22,500 22,500 22,500 22,500 22,500 22,500 4,050 4,320 4,680 5,400 5,850 6,480 (1.125) 1,395 3,825 2,205 2,925 3,285 1,800 (2,250) 270 1,080 2,160 2,700 2 3 4 5 6 Year 2 Year 3 Year 4 Year 5 Year 6 1 Year 1 15,000 0.9x 5.00% 1,250 1,250 1,250 1,250 1,250 1,250 25,000 25,000 25,000 25,000 25,000 25,000 4,500 4,800 5,200 6,000 (1,250) 1,550 2,450 3,250 6,500 7,200 3,650 4,250 (2,500) 300 1,200 2,000 2,400 3,000 20% Year 5 8.0x 10.0% 5.0% Calculate the Equity IRR, NPV using the information below: Initial Investment = 13,500 Year 0 Total Debt EBITDA Free Cash Flow before Debt Service Net Equity Cash Flows Expected Equity Return Exit Year Terminal Value 1. EBITDA Multiple 2. Perputity Method (use Next Year's Cash Flow) WACC Growth Rate OUTPUT CASH FLOW PROJECTIONS FOR DCF Equity Cash Flows Terminal Value (Exit Year) 1. EBITDA Multiple 2. Perputity Method (use Next Year's Cash Flow) Average Debt Equity TV Equity Cash Flows + TV Net Present Value IRR 20% Year 5 7.2x 9.0% 4.5% 0 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 22,500 22,500 22,500 22,500 22,500 22,500 4,050 4,320 4,680 5,400 5,850 6,480 (1.125) 1,395 3,825 2,205 2,925 3,285 1,800 (2,250) 270 1,080 2,160 2,700 2 3 4 5 6 Year 2 Year 3 Year 4 Year 5 Year 6 1 Year 1 15,000 0.9x 5.00% 1,250 1,250 1,250 1,250 1,250 1,250 25,000 25,000 25,000 25,000 25,000 25,000 4,500 4,800 5,200 6,000 (1,250) 1,550 2,450 3,250 6,500 7,200 3,650 4,250 (2,500) 300 1,200 2,000 2,400 3,000 20% Year 5 8.0x 10.0% 5.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts