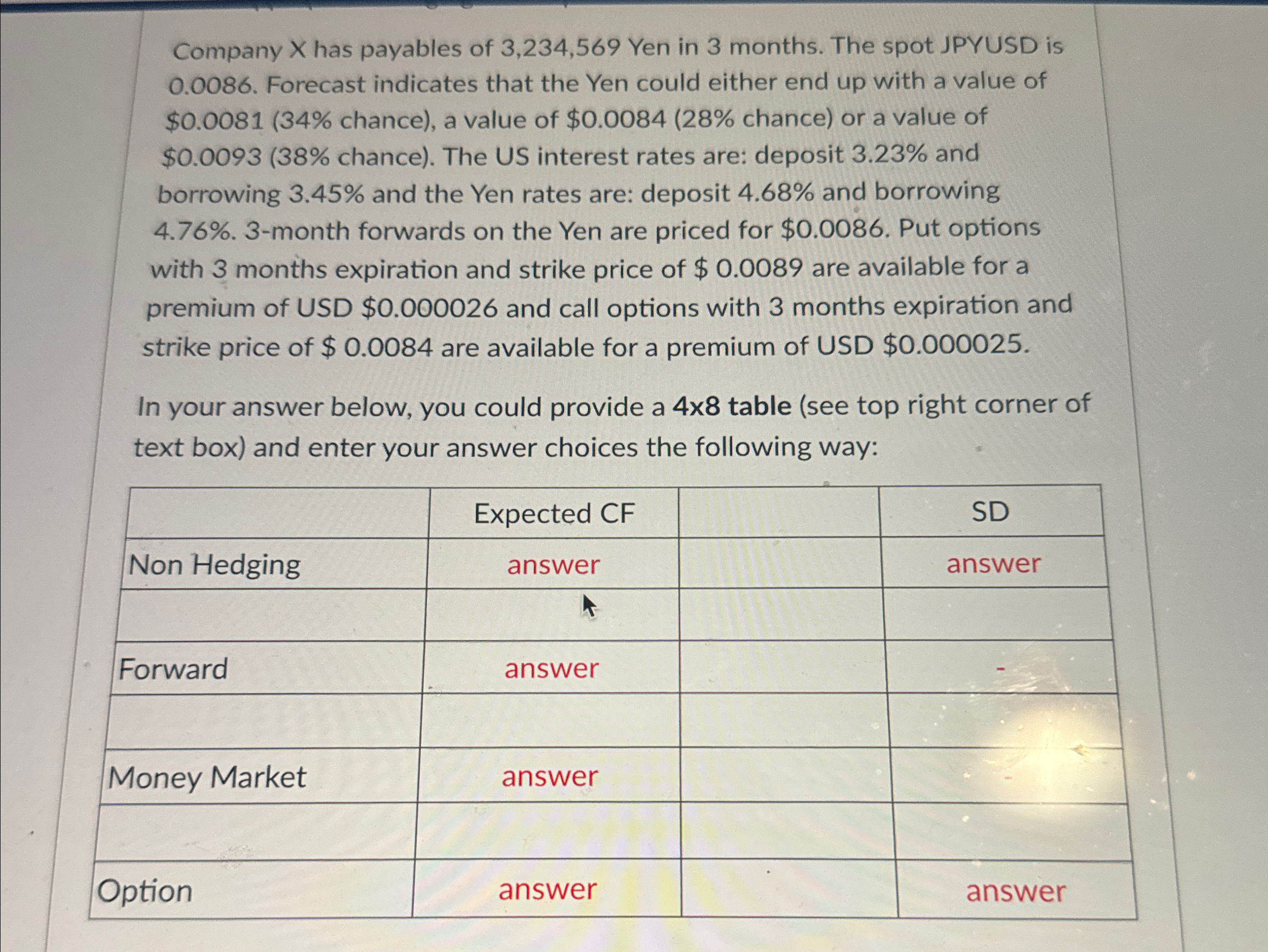

Question: Calculate the expected cash flows ( and standard deviation, where appropriate for all hedging possibilities Company x has payables of 3 , 2 3 4

Calculate the expected cash flows and standard deviation, where appropriate for all hedging possibilities

Company has payables of Yen in months. The spot JPYUSD is Forecast indicates that the Yen could either end up with a value of $ chance a value of $ chance or a value of $ chance The US interest rates are: deposit and borrowing and the Yen rates are: deposit and borrowing month forwards on the Yen are priced for $ Put options with months expiration and strike price of $ are available for a premium of USD $ and call options with months expiration and strike price of $ are available for a premium of USD $

In your answer below, you could provide a table see top right corner of text box and enter your answer choices the following way:

tableExpected CFSDNon Hedging,answer,,answerForwardanswer,,Money Market,answer,,Optionanswer,,answer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock