Question: Calculate the expected monetary value for each option (a,b,c) please, And show which option will the management undertake? Q1: A property owner is faced with

Calculate the expected monetary value for each option (a,b,c) please, And show which option will the management undertake?

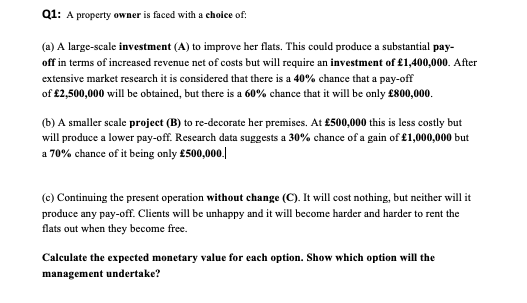

Q1: A property owner is faced with a choice of: (a) A large-scale investment (A) to improve her flats. This could produce a substantial pay- off in terms of increased revenue net of costs but will require an investment of 1,400,000. After extensive market research it is considered that there is a 40% chance that a pay-off of 2,500,000 will be obtained, but there is a 60% chance that it will be only 800,000. (b) A smaller scale project (B) to re-decorate her premises. At 500,000 this is less costly but will produce a lower pay-off. Research data suggests a 30% chance of a gain of 1,000,000 but a 70% chance of it being only 500,000./ (c) Continuing the present operation without change (C). It will cost nothing, but neither will it produce any pay-off. Clients will be unhappy and it will become harder and harder to rent the flats out when they become free. Calculate the expected monetary value for each option. Show which option will the management undertake

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts