Question: Calculate the expected return and return standard deviation for Stock B on p.5 in your handout4 in the module. It is Example 3. I would

Calculate the expected return and return standard deviation for Stock B on p.5 in your handout4 in the module. It is Example 3. I would like you to work on your own before you check the answers in the notes.

Download historical month-end price from Jan. 2010 to Jan. 2022 for your favorite stock from finance.yahoo.com and save them in an Excel file. After you download the Excel, you only need to keep adjusted closing price. This is the price adjusted for dividend and stock splits. Calculate its risk and expected return. Remember to label your answers.

Following video 12, download historical month-end price from Jan. 2010 to Jan. 2023 SP500 index (Ticker: ^GSPC) finance.yahoo.com and save them in an Excel file. Keep adjusted closing price. calculate SP500, the market portfolio's risk and return. Label your answers.

The "download" button is not available on finance.yahoo. anymore. Here is how to download the data.

Highlight the data including the header for each column on finance.yahoo. page

Open Excel worksheet, click cell "A1" ==> right click your mouse, choose "paste special" ==> choose "Text"

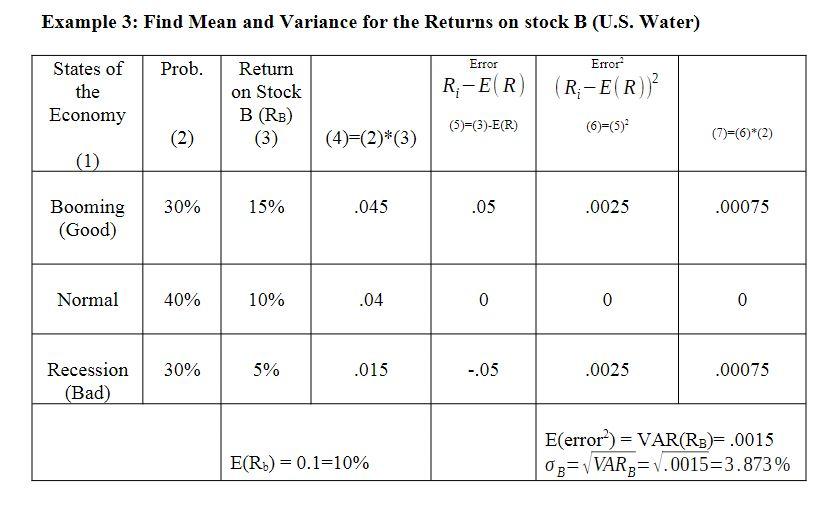

Example 3: Find Mean and Variance for the Returns on stock B (U.S. Water)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts