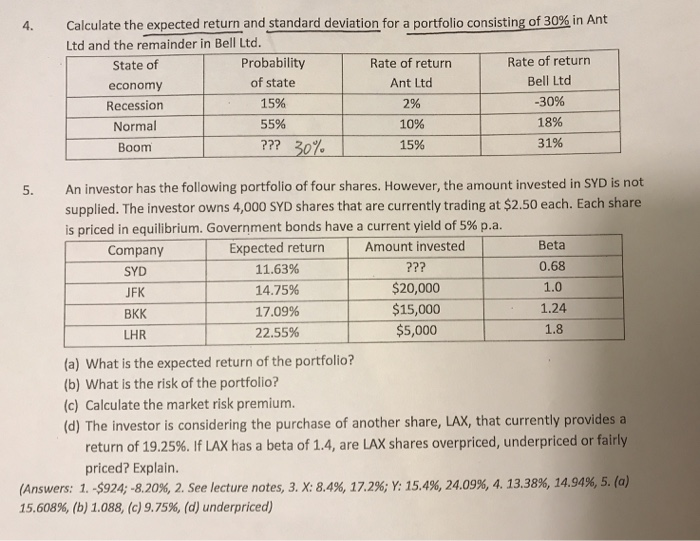

Question: Calculate the expected return and standard deviation for a portfolio consisting of 30% in Ant Ltd and the remainder in Bell Ltd 4. State of

Calculate the expected return and standard deviation for a portfolio consisting of 30% in Ant Ltd and the remainder in Bell Ltd 4. State of economy Recession Normal Boom Probability of state 15% 55% Rate of return Ant Ltd 2% 10% 15% Rate of return Bell Ltd -30% 18% 31% 2?? 307 5. An investor has the following portfolio of four shares. However, the amount invested in SYD is not supplied. The investor owns 4,000 SYD shares that are currently trading at $2.50 each. Each share is priced in equilibrium. Government bonds have a current yield of 5% pa. Expected return 11.63% 14.75% 17.09% 22.55% Beta 0.68 1.0 1.24 1.8 Amount invested Company SYD JFK BKK LHR $20,000 $15,000 $5,000 (a) What is the expected return of the portfolio? (b) What is the risk of the portfolio? (c) Calculate the market risk premium. (d) The investor is considering the purchase of another share, LAX, that currently provides a shares overpriced, underpriced or fairly return of 19.25%. If LAX has a beta of 1.4, are priced? Explain. (Answers: 1-S924;-8.20%, 2. See lecture notes, 3. X: 8.4%, 17.2%; Y: 15.4%, 24.09%, 4, 13.38%, 14.94%, 5. (a) 15.608%, (b) 1.088, (c) 9.75%, (d) underpriced)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts