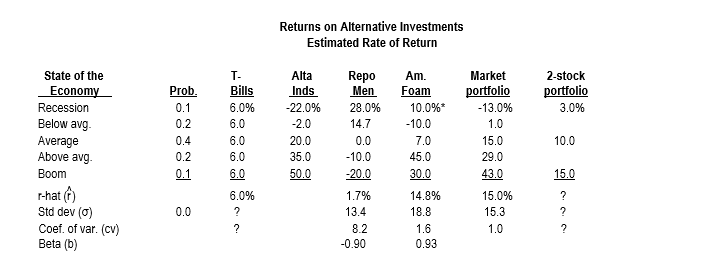

Question: Calculate the expected return (), the standard deviation (? p ), and the coefficient of variation (CV p ) for the portfolio profiled in Table

Calculate the expected return (), the standard deviation (?p), and the coefficient of variation (CVp) for the portfolio profiled in Table 1. Provide your answers with calculations.

Returns on Alternative Investments Estimated Rate of Return Market portfolio 13.0% State of the 2-stock ortfolio 3.0% T. Repo Am. Alta Prob BillInds Me Foam 0.1 0.2 6.0% 6.0 Recession Below avg Average Above avg Boom r-hat r Std dev (o) Coef. of var. (cv) Beta (b) 22.0% 2.0 20.0 28.0% 14.7 10.0%" 10.0 15.0 29.0 43.0 15.0% 15.3 10.0 0.0 10.0 50.0 -20.0 1.7% 13.4 7.0 45.0 30.0 14.8% 18.8 1.6 0.93 0.2 0.1 35.0 15.0 6.0 6.0% 0.0 0.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts