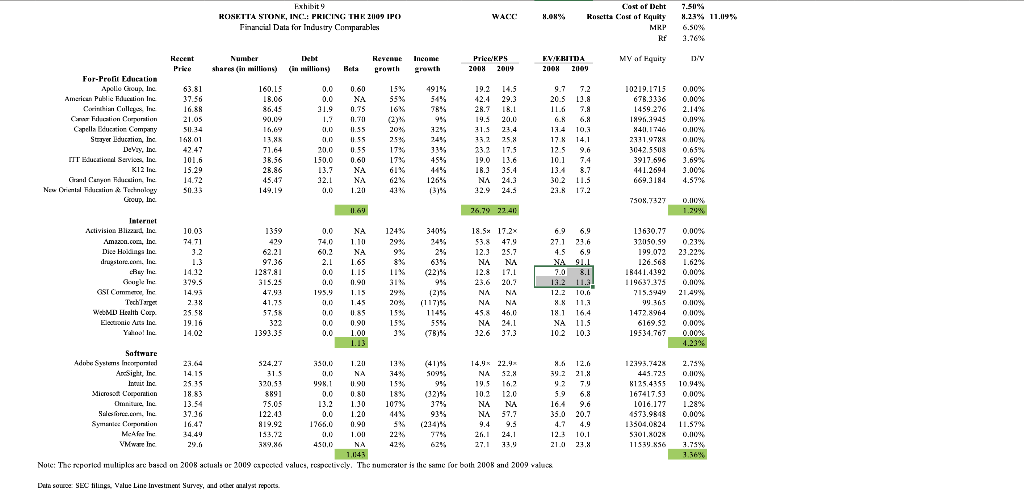

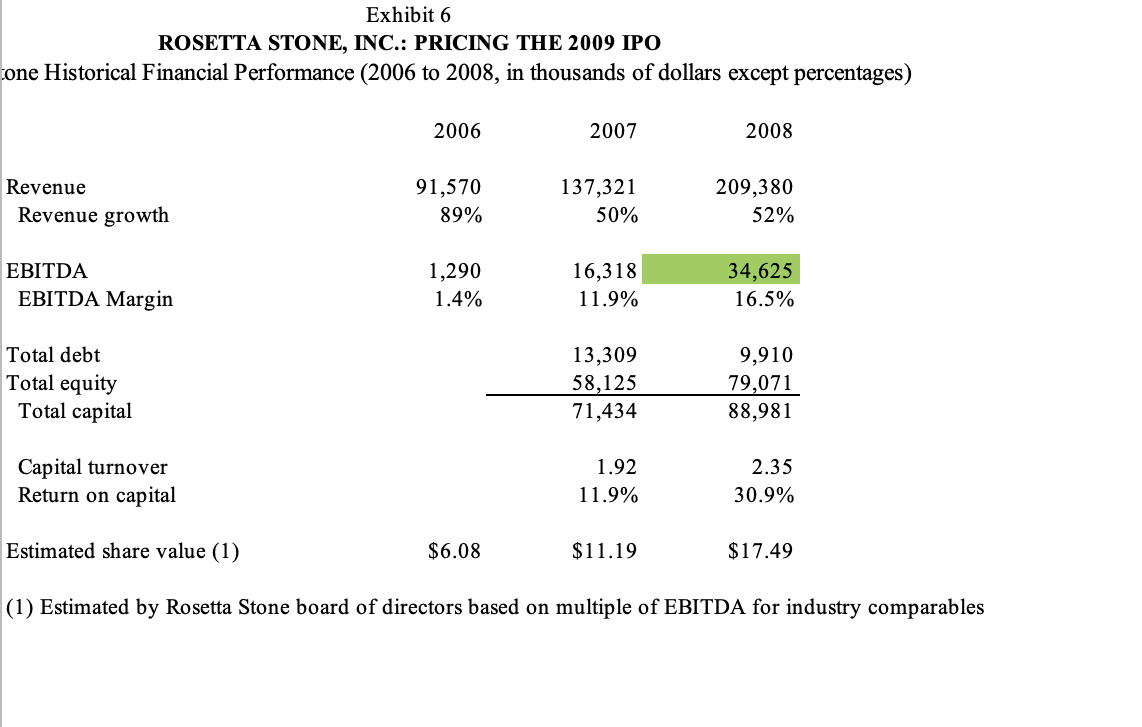

Question: Calculate the implied enterprise value of Rosetta Stone using the average EV/EBITDA multiple for all three categories of comparable firms provided in Exhibit 9 and

Calculate the implied enterprise value of Rosetta Stone using the average EV/EBITDA multiple for all three categories of comparable firms provided in Exhibit 9 and Rosetta Stone EBITDA provided in Exhibit 6, a total of three multiples. Interpret what these numbers suggest regarding the value of Rosetta Stone. The market-multiples approach seems easy. What are the some pros and cons of using a market-multiples approach in valuation?

ROSETTA STONE, INCH PRICING THE 2009 IPO Financial Data for Industry Comparables kerar Revenue Income growth growth EVERITA 9.7 7. 384 18 14 95.0 N 18:49 site for both 2008 and 2000 value Exhibit 6 ROSETTA STONE, INC.: PRICING THE 2009 IPO one Historical Financial Performance (2006 to 2008, in thousands of dollars except percentages) 2006 2007 2008 91,570 Revenue Revenue growth 137,321 50% 209,380 52% 89% EBITDA EBITDA Margin 1,290 1.4% 16,318 11.9% 34,625 16.5% Total debt Total equity Total capital 13,309 58,125 71,434 9,910 79,071 88,981 Capital turnover Return on capital 1.92 11.9% 2.35 30.9% Estimated share value (1) $6.08 $11.19 $17.49 (1) Estimated by Rosetta Stone board of directors based on multiple of EBITDA for industry comparables ROSETTA STONE, INCH PRICING THE 2009 IPO Financial Data for Industry Comparables kerar Revenue Income growth growth EVERITA 9.7 7. 384 18 14 95.0 N 18:49 site for both 2008 and 2000 value Exhibit 6 ROSETTA STONE, INC.: PRICING THE 2009 IPO one Historical Financial Performance (2006 to 2008, in thousands of dollars except percentages) 2006 2007 2008 91,570 Revenue Revenue growth 137,321 50% 209,380 52% 89% EBITDA EBITDA Margin 1,290 1.4% 16,318 11.9% 34,625 16.5% Total debt Total equity Total capital 13,309 58,125 71,434 9,910 79,071 88,981 Capital turnover Return on capital 1.92 11.9% 2.35 30.9% Estimated share value (1) $6.08 $11.19 $17.49 (1) Estimated by Rosetta Stone board of directors based on multiple of EBITDA for industry comparables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts