Question: Calculate the leverage adjusted duration gap. Interpret it. Suppose interest rates on both assets and liabilities rise from 8 to 10 percent. What would happen

Calculate the leverage adjusted duration gap. Interpret it.

Suppose interest rates on both assets and liabilities rise from 8 to 10 percent. What would happen to the value of the banks net worth?

Suppose interest rates on both assets and liabilities fall from 8 to 6 percent. What would happen to the value of the banks net worth?

Suppose the leverage adjusted duration gap is zero. If the average duration of assets is 3.047 years, what must be the average duration? (Note that total assets and total liabilities equal 300 and 275 million, respectively).

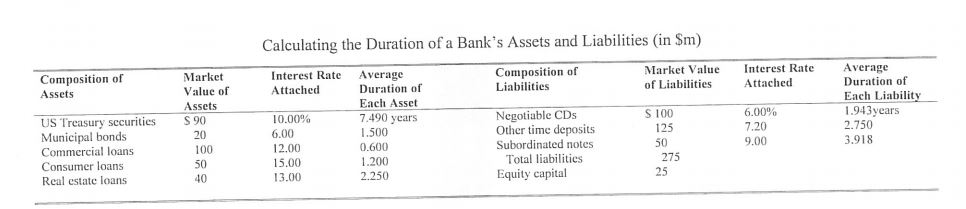

Calculating the Duration of a Bank's Assets and Liabilities (in Sm) Average Duration of Each Liability 1.943years 2.750 3.918 Interest Rate Average Attached Composition of Liabilities Market Value of Liabilities Interest Rate Attached Market Composition of Assets Duration of Each Asset 7.490 years 1.500 0.600 1.200 2.250 Value of Assets 6.00% 7.20 9.00 S 100 10.00% 6.00 12.00 15.00 13.00 Negotiable CDs Other time deposits Subordinated notes S90 US Treasury sccurities Municipal bonds Commercial loans Consumer loans Real estate loans 125 50 20 100 50 40 Total liabilities Equity capital 275 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts