Question: Meat Enterprises Limited (MEL) is considering the acquisition of Gobabis Abattoirs Limited (GAL). MEL has a current EPS of N$2.30 and has a total

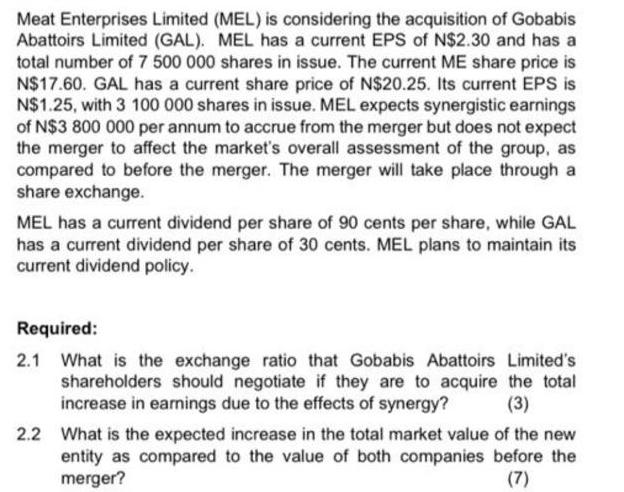

Meat Enterprises Limited (MEL) is considering the acquisition of Gobabis Abattoirs Limited (GAL). MEL has a current EPS of N$2.30 and has a total number of 7 500 000 shares in issue. The current ME share price is N$17.60. GAL has a current share price of N$20.25. Its current EPS is N$1.25, with 3 100 000 shares in issue. MEL expects synergistic earnings of N$3 800 000 per annum to accrue from the merger but does not expect the merger to affect the market's overall assessment of the group, as compared to before the merger. The merger will take place through a share exchange. MEL has a current dividend per share of 90 cents per share, while GAL has a current dividend per share of 30 cents. MEL plans to maintain its current dividend policy. Required: 2.1 What is the exchange ratio that Gobabis Abattoirs Limited's shareholders should negotiate if they are to acquire the total increase in earnings due to the effects of synergy? (3) 2.2 What is the expected increase in the total market value of the new entity as compared to the value of both companies before the merger?

Step by Step Solution

3.56 Rating (163 Votes )

There are 3 Steps involved in it

21 To calculate the exchange ratio we need to divide the expected synergisti... View full answer

Get step-by-step solutions from verified subject matter experts