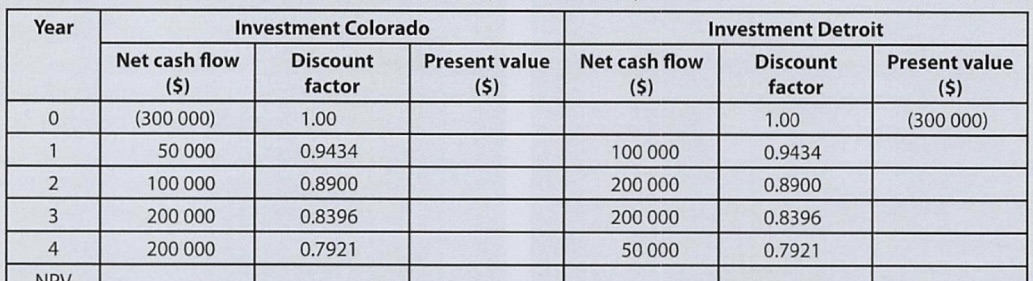

Question: Calculate the net present value (NPV) by completing the table below. Discount factors for 6% are given to 4 d.p. Both projects cost $300 000.

Calculate the net present value (NPV) by completing the table below. Discount factors for 6% are given to 4 d.p. Both projects cost $300 000. Explain which of the two projects should be pursued.Suggest what other information should be considered before deciding which investment project to pursue.

Year Net cash flow ($) Investment Colorado Present value Net cash flow ($) ($) Investment Detroit Discount factor 0 (300 000) 1.00 1 50 000 0.9434 2 100 000 0.8900 3 200 000 0.8396 4 200 000 0.7921 NDV Discount Present value factor ($) 1.00 (300 000) 100 000 0.9434 200 000 0.8900 200 000 0.8396 50 000 0.7921

Step by Step Solution

There are 3 Steps involved in it

Answer calculate the Net Present Value NPV for both Investment Colorado and Invest... View full answer

Get step-by-step solutions from verified subject matter experts