Question: Please don't answer in excel, use a paper to answer so I can see the method of doing it..TQ b) A project requires the purchase

Please don't answer in excel, use a paper to answer so I can see the method of doing it..TQ

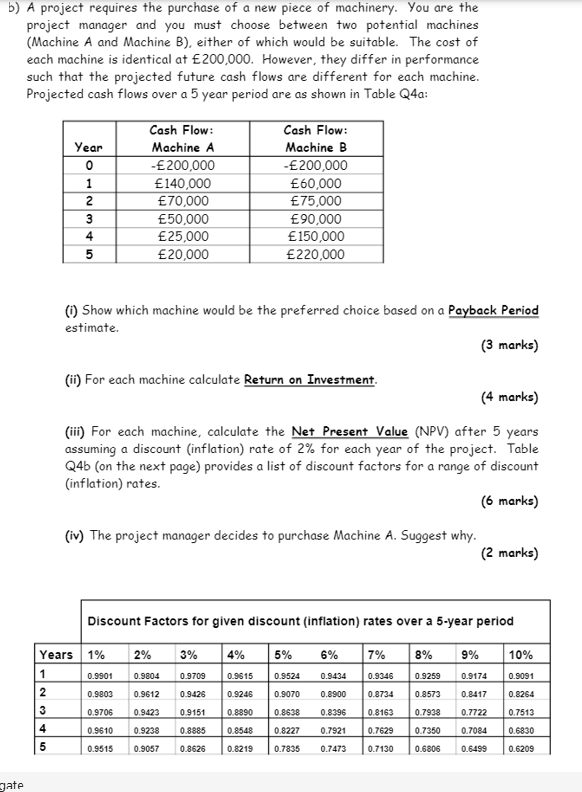

b) A project requires the purchase of a new piece of machinery. You are the project manager and you must choose between two potential machines (Machine A and Machine B), either of which would be suitable. The cost of each machine is identical at 200,000. However, they differ in performance such that the projected future cash flows are different for each machine. Projected cash flows over a 5 year period are as shown in Table Q4a: Year 0 1 2 3 4 5 Cash Flow: Machine A -200,000 140,000 70,000 50,000 25,000 20,000 Cash Flow: Machine B -200,000 60,000 75,000 90,000 150,000 220,000 (1) Show which machine would be the preferred choice based on a Payback Period estimate. (3 marks) (ii) For each machine calculate Return on Investment. (4 marks) (ii) For each machine, calculate the Net Present Value (NPV) after 5 years assuming a discount (inflation) rate of 2% for each year of the project. Table Q4b (on the next page) provides a list of discount factors for a range of discount (inflation) rates. (6 marks) (iv) The project manager decides to purchase Machine A. Suggest why. (2 marks) Discount Factors for given discount (inflation) rates over a 5-year period 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.92.46 0.8734 0.8264 Years 1% 1 0.9901 2 0.9803 3 0.9706 4 0.9610 5 0.9515 0.9612 0.9423 0.9426 0.9151 0.8885 0.8890 0.9070 0.8638 0.8227 0.8900 0.8396 0.7921 0.8573 0.7938 0.8163 0.7629 0.8417 0.7722 0.7084 0.7513 0.6830 0.8548 0.7350 0.9238 0.9057 0.8628 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 gateStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock