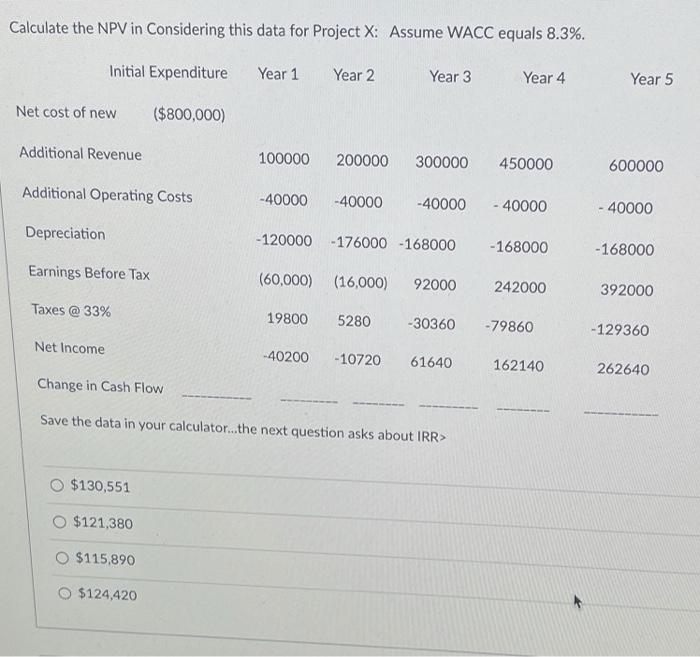

Question: Calculate the NPV in Considering this data for Project X: Assume WACC equals 8.3%. Initial Expenditure Year 1 Year 2 Year 3 Year 4 Year

Calculate the NPV in Considering this data for Project X: Assume WACC equals 8.3%. Initial Expenditure Year 1 Year 2 Year 3 Year 4 Year 5 Net cost of new ($800,000) Additional Revenue 100000 200000 300000 450000 600000 Additional Operating Costs -40000 -40000 -40000 - 40000 - 40000 Depreciation -120000 - 176000 -168000 -168000 -168000 Earnings Before Tax (60,000) (16,000) 92000 242000 392000 Taxes @33% 19800 5280 -30360 -79860 -129360 Net Income -40200 -10720 61640 162140 262640 Change in Cash Flow Save the data in your calculator...the next question asks about IRR> $130,551 O $121,380 O $115,890 O $124,420

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts