Question: Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios

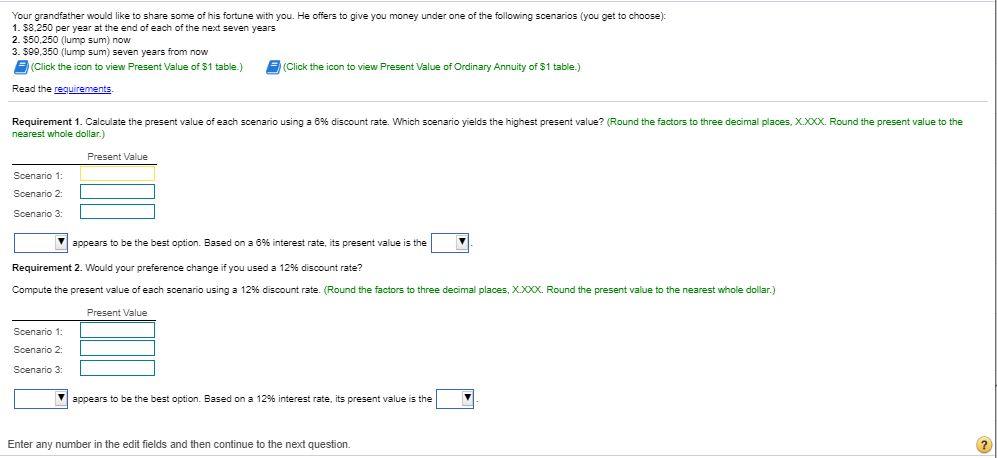

Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose): 1. $8,250 per year at the end of each of the next seven years 2. $50,250 (lump sum) now 3. $99,350 (lump sum) seven years from now (Click the icon to view Present Value of $1 table.) Read the requirements Requirement 1. Calculate the present value of each scenario using a 6% discount rate. Which scenario yields the highest present value? (Round the factors to three decimal places, X.XXX. Round the present value to the nearest whole dollar.) Scenario 1: Scenario 2: Scenario 3: Present Value Scenario 1: Scenario 2: Scenario 3: (Click the icon to view Present Value of Ordinary Annuity of $1 table.). appears to be the best option. Based on a 6% interest rate, its present value is the Requirement 2. Would your preference change if you used a 12% discount rate? Compute the present value of each scenario using a 12% discount rate. (Round the factors to three decimal places, XXXX. Round the present value to the nearest whole dollar.) Present Value appears to be the best option. Based on a 12% interest rate, its present value is the Enter any number in the edit fields and then continue to the next question. ?

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Requirement 1 Present Value at 6 Discount Rate Scenario 1 8250 per yea... View full answer

Get step-by-step solutions from verified subject matter experts