Question: Uncle Ray's Catering is a small food catering business with annual sales of $2.2 million, all of which on credit terms of net 30.

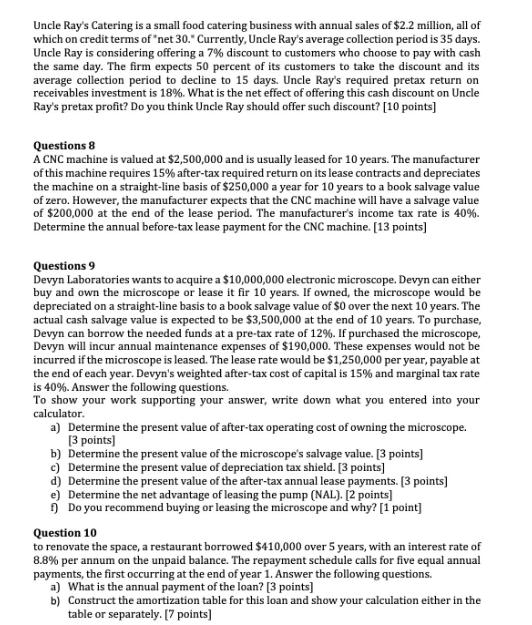

Uncle Ray's Catering is a small food catering business with annual sales of $2.2 million, all of which on credit terms of "net 30." Currently, Uncle Ray's average collection period is 35 days. Uncle Ray is considering offering a 7% discount to customers who choose to pay with cash the same day. The firm expects 50 percent of its customers to take the discount and its average collection period to decline to 15 days. Uncle Ray's required pretax return on receivables investment is 18%. What is the net effect of offering this cash discount on Uncle Ray's pretax profit? Do you think Uncle Ray should offer such discount? [10 points] Questions 8 A CNC machine is valued at $2,500,000 and is usually leased for 10 years. The manufacturer of this machine requires 15% after-tax required return on its lease contracts and depreciates the machine on a straight-line basis of $250,000 a year for 10 years to a book salvage value of zero. However, the manufacturer expects that the CNC machine will have a salvage value of $200,000 at the end of the lease period. The manufacturer's income tax rate is 40%. Determine the annual before-tax lease payment for the CNC machine. [13 points] Questions 9 Devyn Laboratories wants to acquire a $10,000,000 electronic microscope. Devyn can either buy and own the microscope or lease it fir 10 years. If owned, the microscope would be depreciated on a straight-line basis to a book salvage value of $0 over the next 10 years. The actual cash salvage value is expected to be $3,500,000 at the end of 10 years. To purchase, Devyn can borrow the needed funds at a pre-tax rate of 12%. If purchased the microscope, Devyn will incur annual maintenance expenses of $190,000. These expenses would not be incurred if the microscope is leased. The lease rate would be $1,250,000 per year, payable at the end of each year. Devyn's weighted after-tax cost of capital is 15% and marginal tax rate is 40%. Answer the following questions. To show your work supporting your answer, write down what you entered into your calculator. a) Determine the present value of after-tax operating cost of owning the microscope. [3 points] b) Determine the present value of the microscope's salvage value. [3 points] c) Determine the present value of depreciation tax shield. [3 points] d) Determine the present value of the after-tax annual lease payments. [3 points] e) Determine the net advantage of leasing the pump (NAL). [2 points] f) Do you recommend buying or leasing the microscope and why? [1 point] Question 10 to renovate the space, a restaurant borrowed $410,000 over 5 years, with an interest rate of 8.8% per annum on the unpaid balance. The repayment schedule calls for five equal annual payments, the first occurring at the end of year 1. Answer the following questions. a) What is the annual payment of the loan? [3 points] b) Construct the amortization table for this loan and show your calculation either in the table or separately. [7 points]

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

G1876 1854 1855 1856 STEP 1 1857 1858 STEP 2 1859 1860 1861 1862 ... View full answer

Get step-by-step solutions from verified subject matter experts