Question: Calculate the proposed projects IRR. Explain the rationale for using the IRR to evaluate capital investment projects. Could the IRR for this project differ for

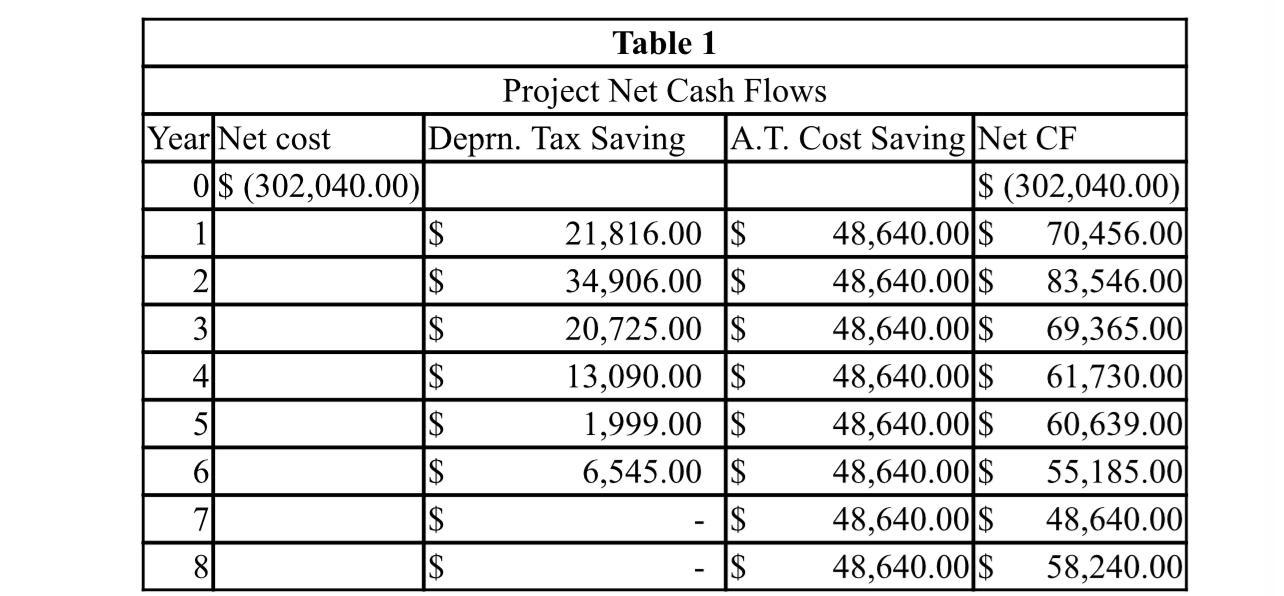

Calculate the proposed project’s IRR. Explain the rationale for using the IRR to evaluate capital investment projects. Could the IRR for this project differ for GP Manufacturing versus for another customer? What is the project’s MIRR? What is the difference between the IRR and the MIRR? Which is better?

Year Net cost 0$ (302,040.00) 1 2 3 5 6 7 8 Table 1 Project Net Cash Flows Deprn. Tax Saving A.T. Cost Saving Net CF $ $ $ $ $ $ $ $ 21,816.00 $ 34,906.00 $ 20,725.00 $ 13,090.00 $ 1,999.00 $ 6,545.00 $ $ $ $ (302,040.00)| 70,456.00 83,546.00 69,365.00 61,730.00 60,639.00 55,185.00 48,640.00 58,240.00 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts