Question: Calculate the required return and the present value for both shares would you place on each share Furthermore, assume that Sharp Ltd's dividend has grown

Calculate the required return and the present value for both shares would you place on each share Furthermore, assume that Sharp Ltd's dividend has grown from $0.50 to $0.58 in the last 5-years and Blunt Ltd's dividend has increased from $1.10 to $1.34 over the last 5-years. The last observed 10-year government bond yield was 2%. What concerns does the research raise in regards to dividend valuation models?

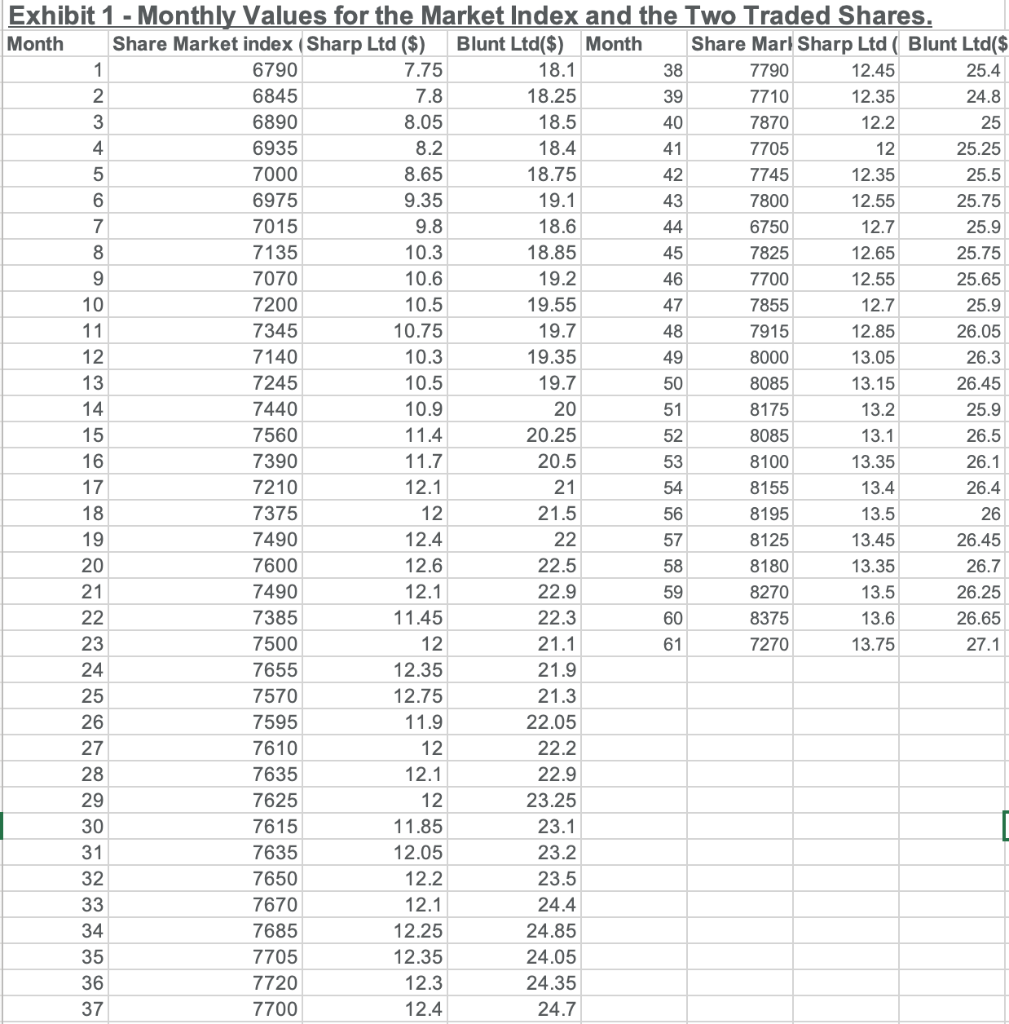

Exhibit 1 - Monthly Values for the Market Index and the Two Traded Shares. Month Share Market index (Sharp Ltd ($) Blunt Ltd($) Month Share Marl Sharp Ltd (Blunt Ltd($ 1 6790 7.75 18.1 38 7790 12.45 25.4 2 6845 7.8 18.25 39 7710 12.35 24.8 3 6890 8.05 18.5 40 7870 12.2 25 4 6935 8.2 18.4 41 7705 12 25.25 5 7000 8.65 18.75 42 7745 12.35 25.5 6 6975 9.35 19.1 43 7800 12.55 25.75 7 7015 9.8 18.6 44 6750 12.7 25.9 8 7135 10.3 18.85 45 7825 12.65 25.75 9 7070 10.6 19.2 46 7700 12.55 25.65 10 7200 10.5 19.55 47 7855 12.7 25.9 11 7345 10.75 19.7 48 7915 12.85 26.05 12 7140 10.3 19.35 49 8000 13.05 26.3 13 7245 10.5 19.7 50 8085 13.15 26.45 14 7440 10.9 20 51 8175 13.2 25.9 15 7560 11.4 20.25 52 8085 13.1 26.5 16 7390 11.7 20.5 53 8100 13.35 26.1 17 7210 12.1 21 54 8155 13.4 26.4 18 7375 12 21.5 56 8195 13.5 26 19 7490 12.4 22 57 8125 13.45 26.45 20 7600 12.6 22.5 58 8180 13.35 26.7 21 7490 12.1 22.9 59 8270 13.5 26.25 22 7385 11.45 22.3 60 8375 13.6 26.65 23 7500 12 21.1 61 7270 13.75 27.1 24 7655 12.35 21.9 25 7570 12.75 21.3 26 7595 11.9 22.05 27 7610 12 22.2 28 7635 12.1 22.9 29 7625 12 23.25 30 7615 11.85 23.1 31 7635 12.05 32 7650 12.2 23.5 33 7670 12.1 24.4 34 7685 12.25 24.85 35 7705 12.35 24.05 36 7720 12.3 24.35 37 7700 12.4 24.7 23.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts