Question: Calculate the term structure of default probabilities (i.e. default probabilities for each maturity) over three years using the following spot rates from the Treasury and

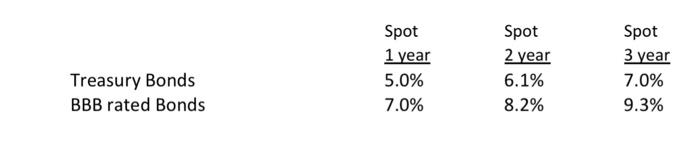

Calculate the term structure of default probabilities (i.e. default probabilities for each maturity) over three years using the following spot rates from the Treasury and corporate bond spot rate curves. Be sure to calculate both the annual marginal and the cumulative default probabilities. Assume a recovery rate of 0 in all cases of default. Also assume periodicity of 1 (i.e. annual compounding) for all rates.

TreasuryBondsBBBratedBondsSpot1year5.0%7.0%Spot2year6.1%8.2%Spot3year7.0%9.3%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock